- The USDCAD and USDJPY Forex rate moved significantly lower into latter June last week, primarily a reflection of US Dollar weakness.

- This has been driven by the more dovish tone from the Federal Reserve at their 19th June Meeting.

- Strong market expectations are now for a July rate cut, with even market chatter for a 50bp move lower.

- The USDJPY currency pair broke out from the June range that had dominated for two weeks, through 107.79 and a longer-term support from January 2019 at 107.74, aiming lower into late June.

- The USDCAD FX rate also suffered significant losses last week, back down from resistance in the 1.3450/60 area (down from 1.3432) to plunge below 1.3222 and resume short- and intermediate-term bear themes.

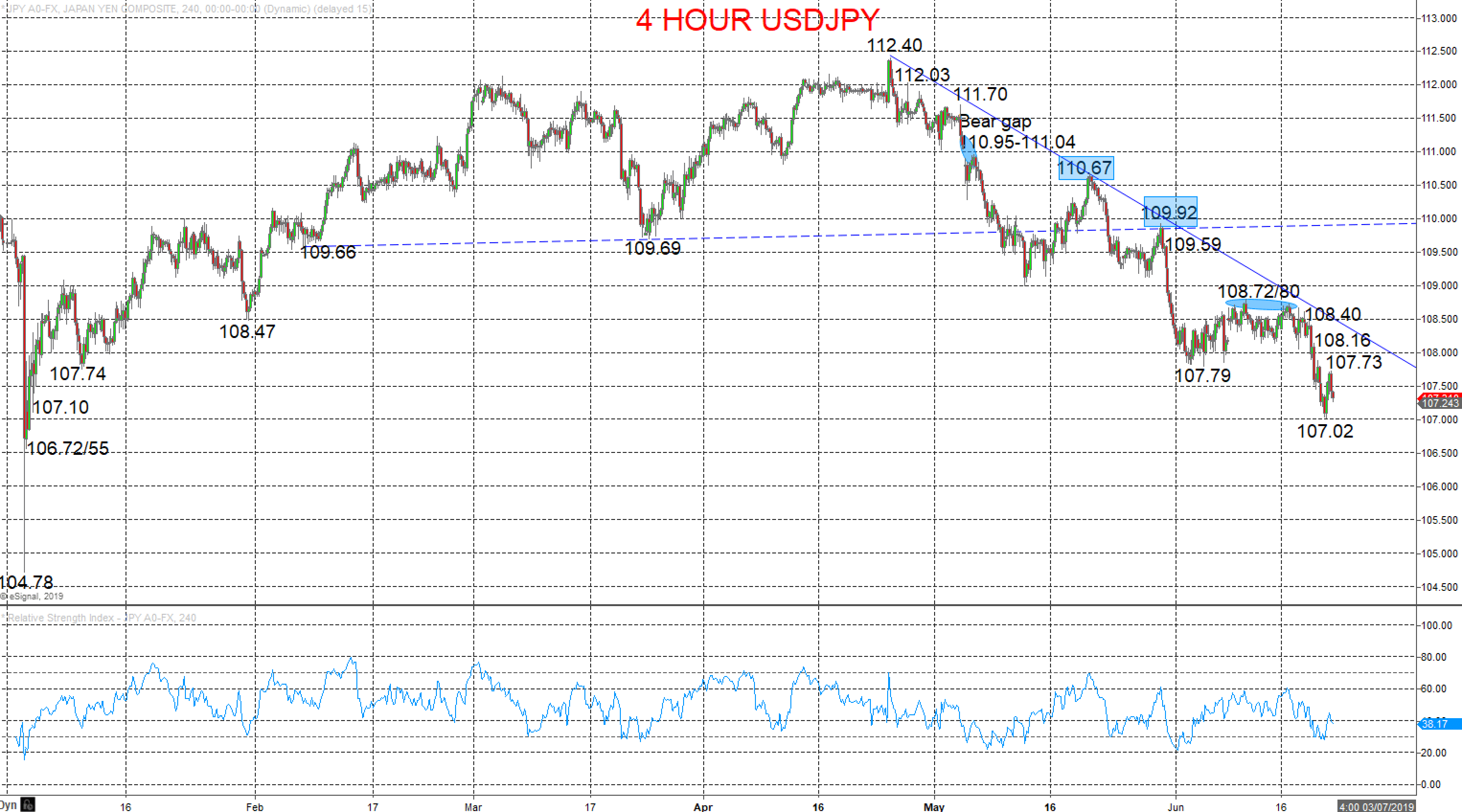

USDJPY

Bear trend intact, despite bounce

A corrective rebound Friday but to stall below our 107.88 resistance (at new resistance 107.73) to leave pressures from Thursday’s plunge through 107.79/74 supports and Wednesday’s post-Fed selloff, down from below the bear trend line from April, keeping the risks lower into Monday.

The May surrender of 109.66 set an intermediate-term bear trend

For Today:

- We see a downside bias for 107.02; break here aims for 106.72/55.

- But above 107.73 opens risk up towards 108.16, maybe 108.40.

Intermediate-term Outlook – Downside Risks: We see a downside risk for 107.74, 106.72/55 and 105.00/104.78

- What Changes This? Above the resistance gap at 109.92 shifts the outlook back to neutral; above 110.67 is needed for a bull theme.

Resistance and Support:

| 107.73 | 108.16 | 108.40* | 108.72/80* | 109.59* |

| 107.02 | 106.72/55** | 106.00 | 105.69 | 105.00 |

4 Hour Chart

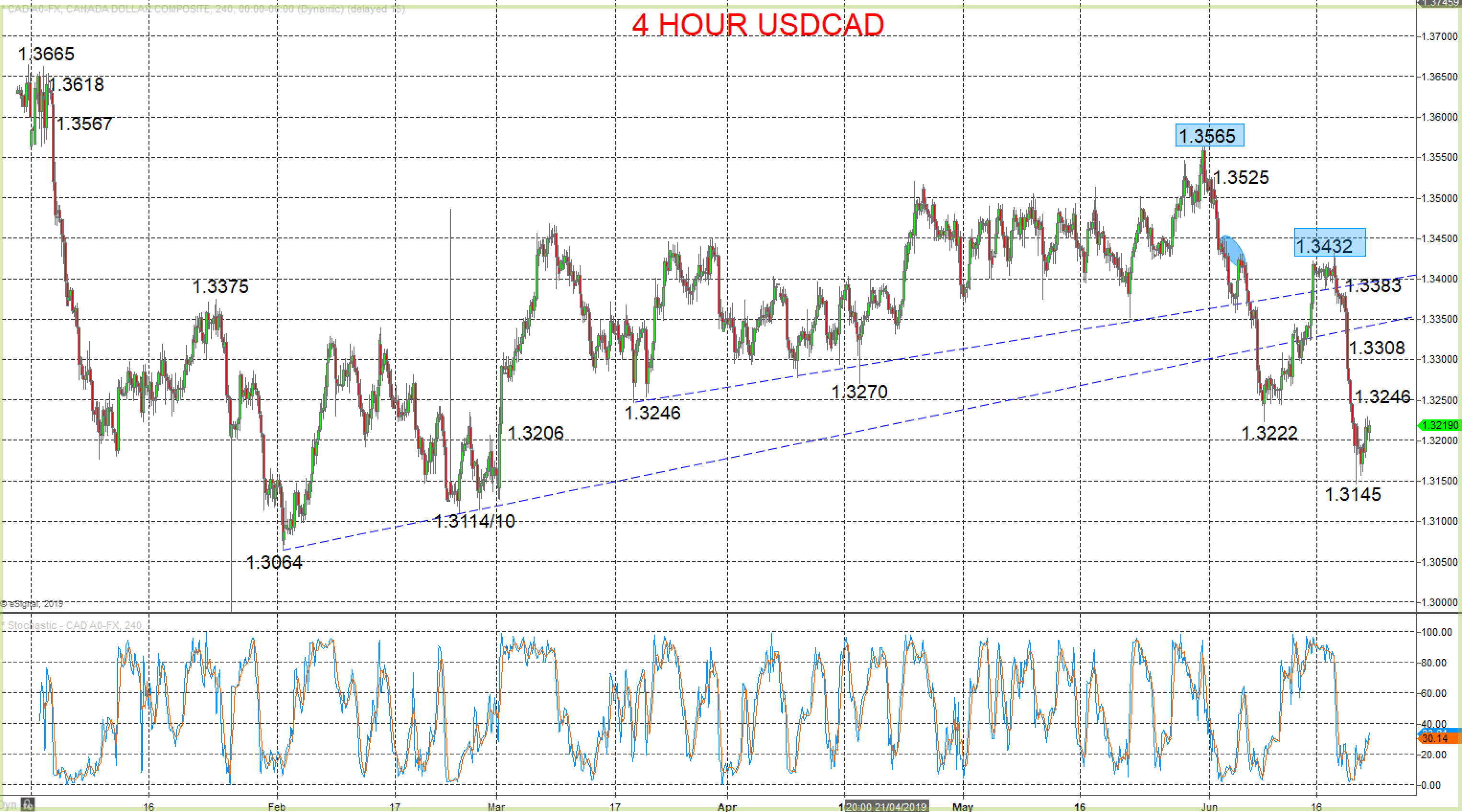

USDCAD

Bear forces intact (despite bounce)

A bounce Friday but whilst contained below 1.3246 resistance we still see bear forces from the aggressive Wednesday-Thursday plunge after the Fed Meeting to wipe out multiple June support, retaining both short- and intermediate-term bear threats, keeping risks lower for Monday.

The June plunge through 1.3270 set an intermediate-term bearish trend.

For Today:

- We see a downside bias for 1.3145; break here aims for 1.3114/10 and then 1.3064.

- But above 1.3246 opens risk up to 1.3308.

Intermediate-term Outlook – Downside Risks: We see a downside risk for 1.3114/10, 1.3064 and 1.3000.

What Changes This? Above key 1.3430/49 shifts the intermediate-term outlook back to neutral; above 1.3565 is needed for an intermediate-term bull theme.

Resistance and Support:

| 1.3246 | 1.3308 | 1.3383 | 1.3432*** | 1.3525 |

| 1.3145 | 1.3114/10** | 1.3064*** | 1.3000 | 1.2961 |

4 Hour Chart