A Referendum in the UK on Thursday (23rd June) resulted in a vote to leave the European Union.

This lead to a destructive sell off in the British Pound on Friday, with GBPUSD collapsing down to the lowest level seen since 1985.

Furthermore, EURUSD also saw significant downside pressures, twitch a break below 1.1128 and 1.1000 setting a more bearish outlook into July.

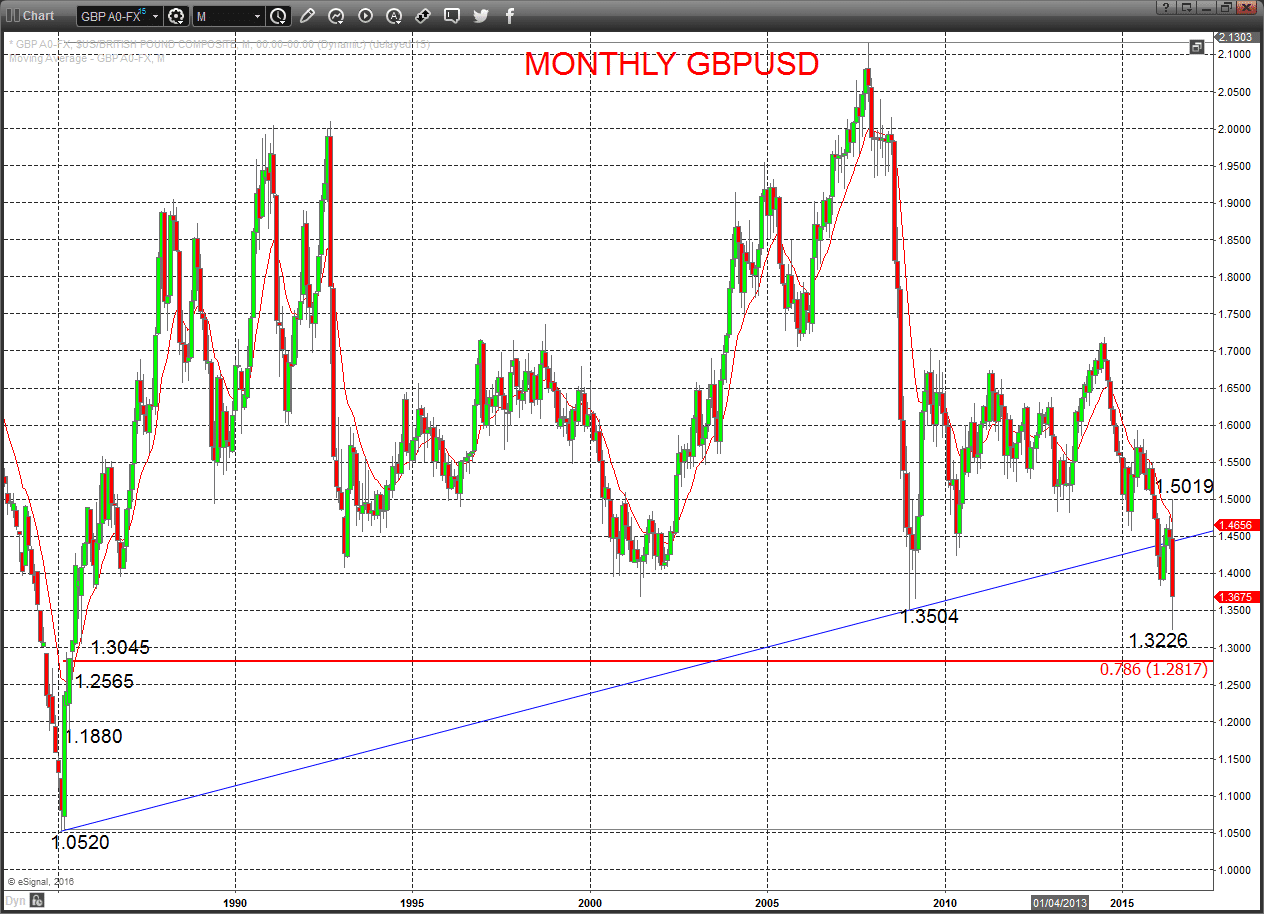

GBPUSD

A very aggressive sell off Friday after the UK voted to leave the EU, with a push through 1.4004 for an intermediate-term bear shift (also below 1.3834 and 1.3504) to keep the threat into July still lower.

Short/ Intermediate-term Outlook – Downside Risks:

- The negative tone leaves the bearish threat to 1.3226

- Below this level aims for 1.3045/1.3000, 1.2817, 1.2565, 1.2000 and 1.1880 (risk to 1.1000 and 1.0520?!?!)

What Changes This? A push above 1.4635 would signal a neutral tone, only moving bullish back through 1.5019.

Monthly GBPUSD Chart

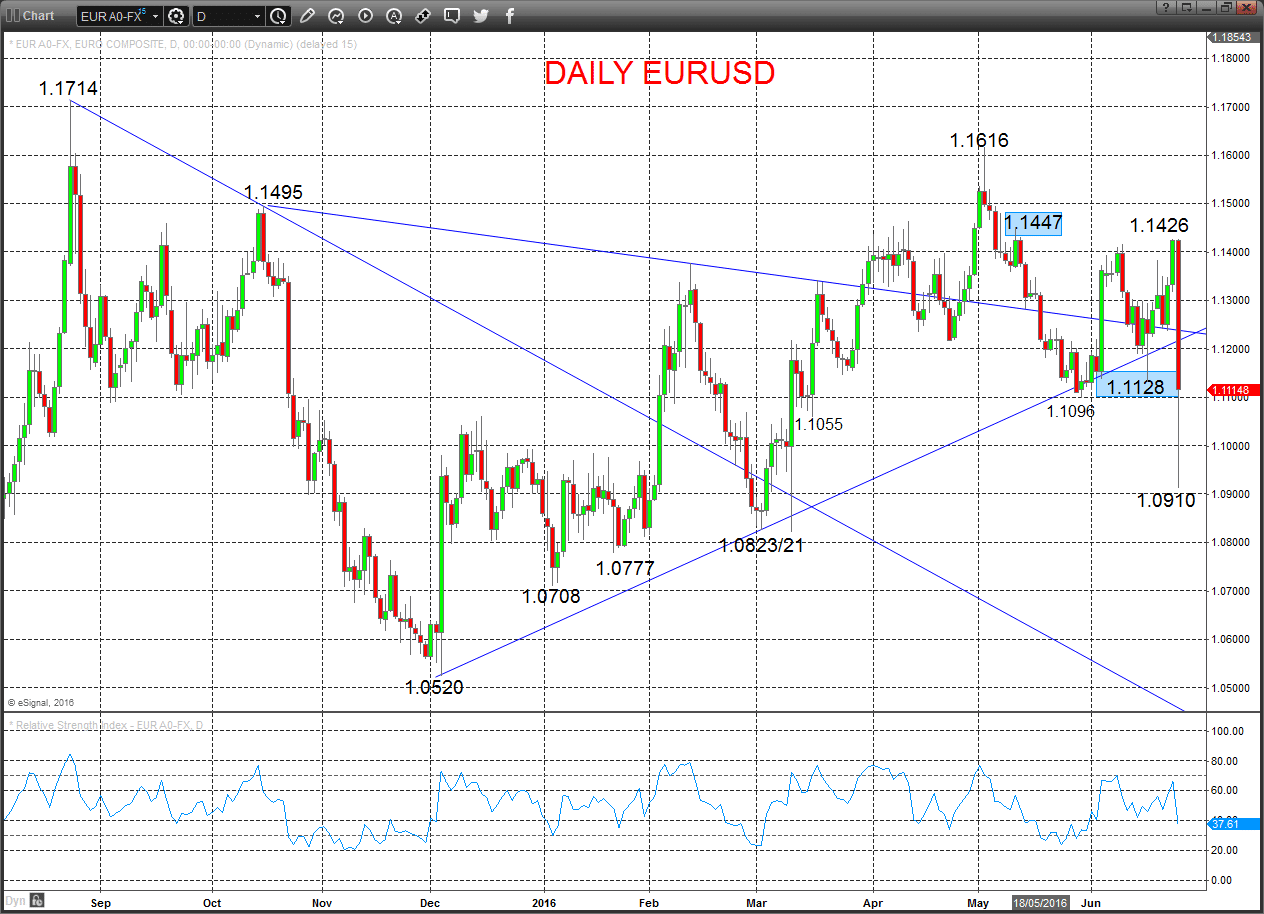

EURUSD

An aggressive plunge lower Friday through 1.1128 to trigger an intermediate-term bear shift (reinforced through 1.1096 and 1.1055) to leave the June/ July risks still lower.

Despite an intraday bounce Friday, we still see a bear tone for Monday.

For Today:

- We see a downside bias for 1.1034/29; break here aims for the Friday low at 1.0910, maybe 1.0870 then 1.0823/21.

- But above 1.1189 opens risk up to 1.1231 and 1.1318.

Short/ Intermediate-term Outlook – Downside Risks:

- We see a negative tone with the bearish threat to 1.0823/21.

- Below here targets 1.0777/08 and maybe 1.0520.

Daily EURUSD Chart