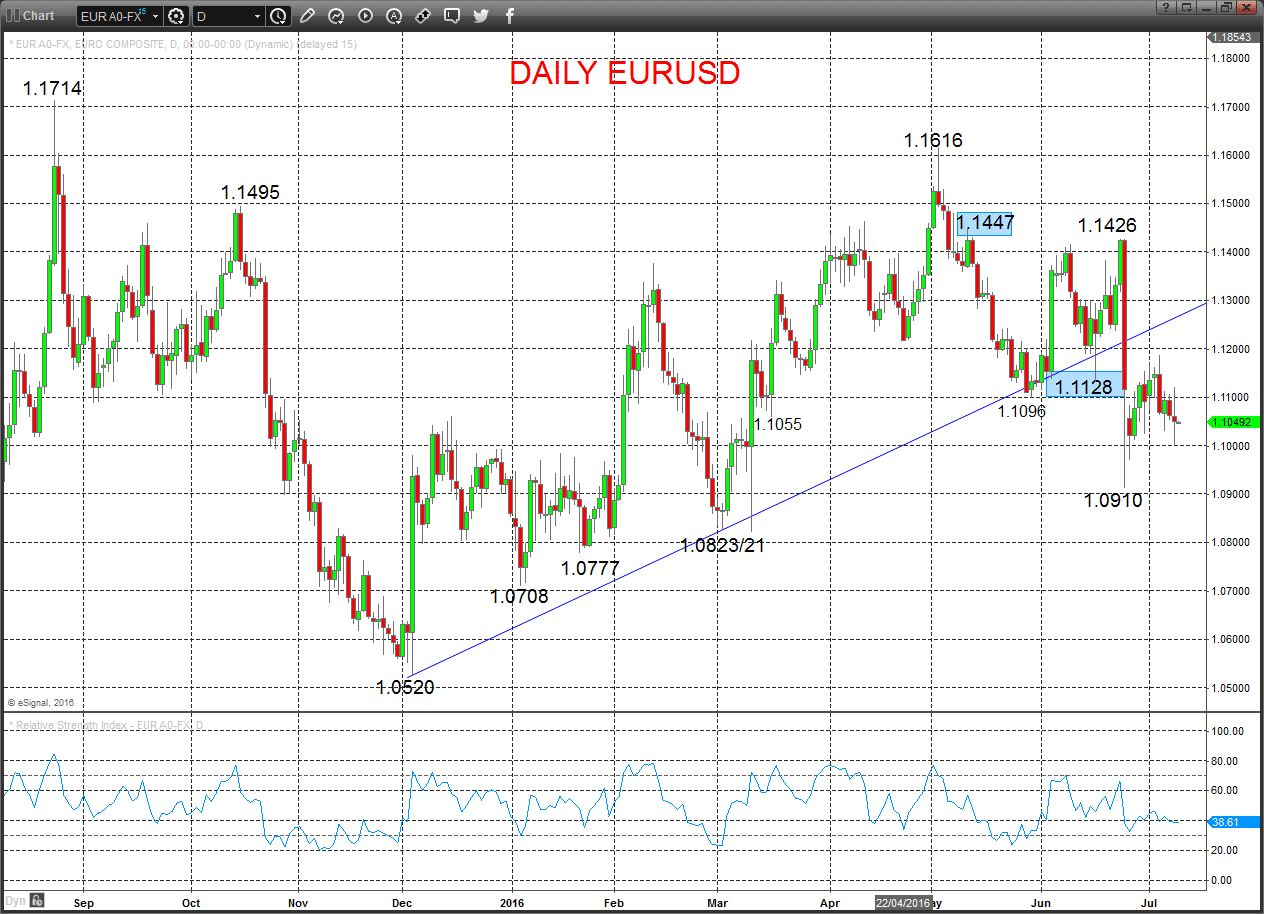

The Euro has maintained it’s very near term negative tone and also sees a bear bias versus the US Dollar into July.

The EURUSD sell off after the UK Brexit vote triggered a more bearish theme, which aims for lower targets into the summer.

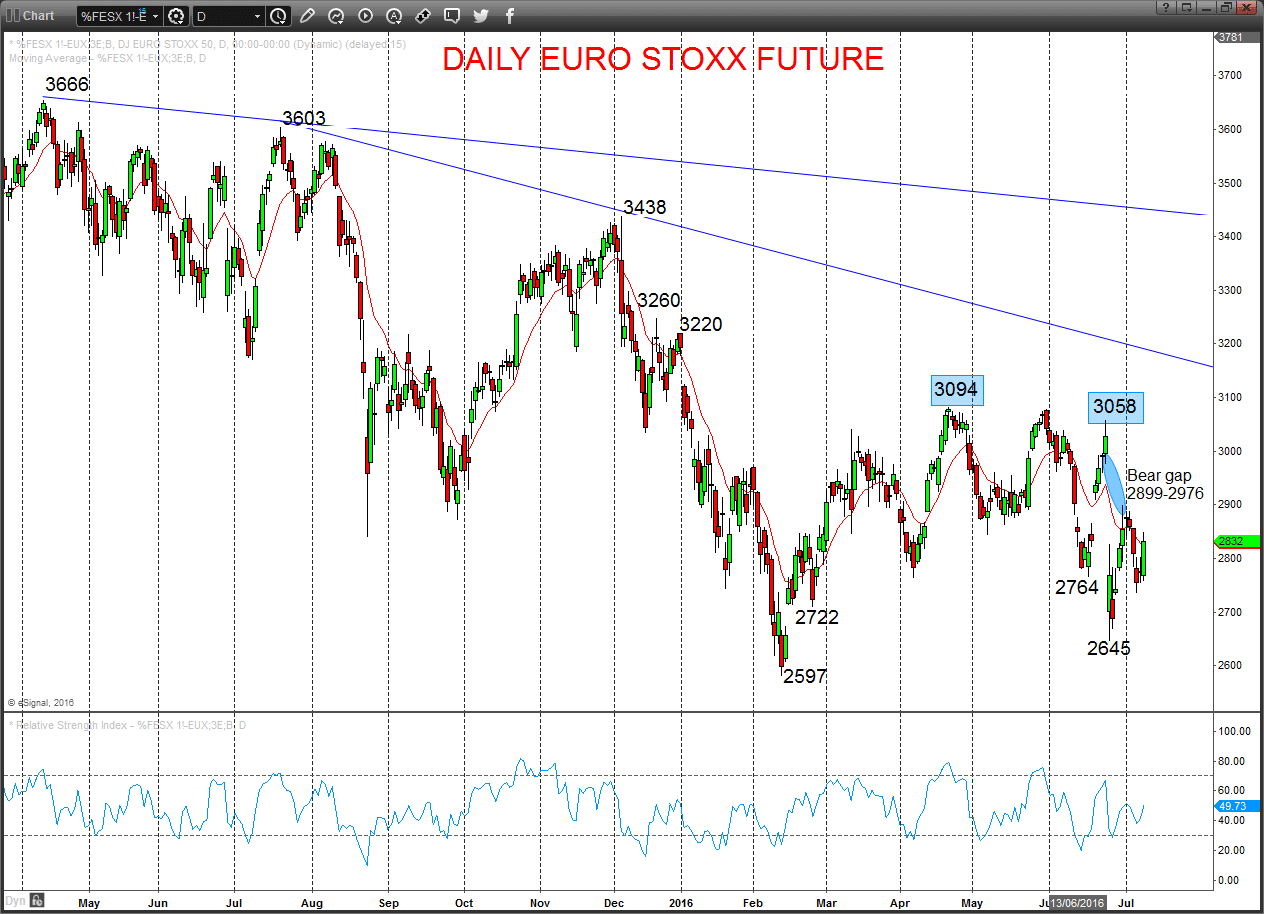

Furthermore, despite a Friday rebound by the Euro STOXX 50 future, the pan-European benchmark equity index, the sell off after the UK Referendum also leaves a bigger picture bearish threat into July, maybe August.

EURUSD

An indecisive long-legged doji pattern Friday, but another probe lower (below the 1.1032/23 support area) reinforces the push to the downside from midweek (from ahead of 1.1125/30 resistance, from 1.1111), to leave the bias lower Monday.

Furthermore, the aggressive plunge lower on Friday 24th June (after the UK Referendum result) leaves the intermediate-term bias lower.

For Monday:

- We see a downside bias for 1.1007 break here aims for 1.0970, then the 1.0910 cycle low.

- But above 1.1111/25/30 opens risk up to 1.1185/89.

Short/ Intermediate-term Outlook – Downside Risks:

- We see a negative tone with the bearish threat to 1.0823/21.

- Below here targets 1.0777/08 and maybe 1.0520.

Daily EURUSD Chart

NZDUSD

The aggressive Friday 24th June plunge through 2764 triggered an intermediate-term bear shift.

Short/ Intermediate-term Outlook – Downside Risks:

- We see a negative tone with the bearish threat to 2645.

- Below here targets 2597 and 2488/81.

What Changes This? Above 3058 signals a neutral tone, only shifting positive above 3094.

But a firm rebound Friday driven by the US NFP data, to push above 2802, 2820/25 resistances, shifts the bias higher Monday.

For Monday:

- We see an upside bias for 2848; break here aims quickly for 2856, then 2877, maybe 2899/2900.

- But below 2805/00 opens risk down to 2780/75, maybe 2758.

Daily Euro STOXX 50 future Chart