- The US Dollar has strengthened against G10 currencies since mid-April, a response to growing US inflationary apprehensions, PLUS the view of a more hawkish Federal reserve position, which has led to higher US Treasury yields, with the US 10yr Note pushing above the much watched 3% level.

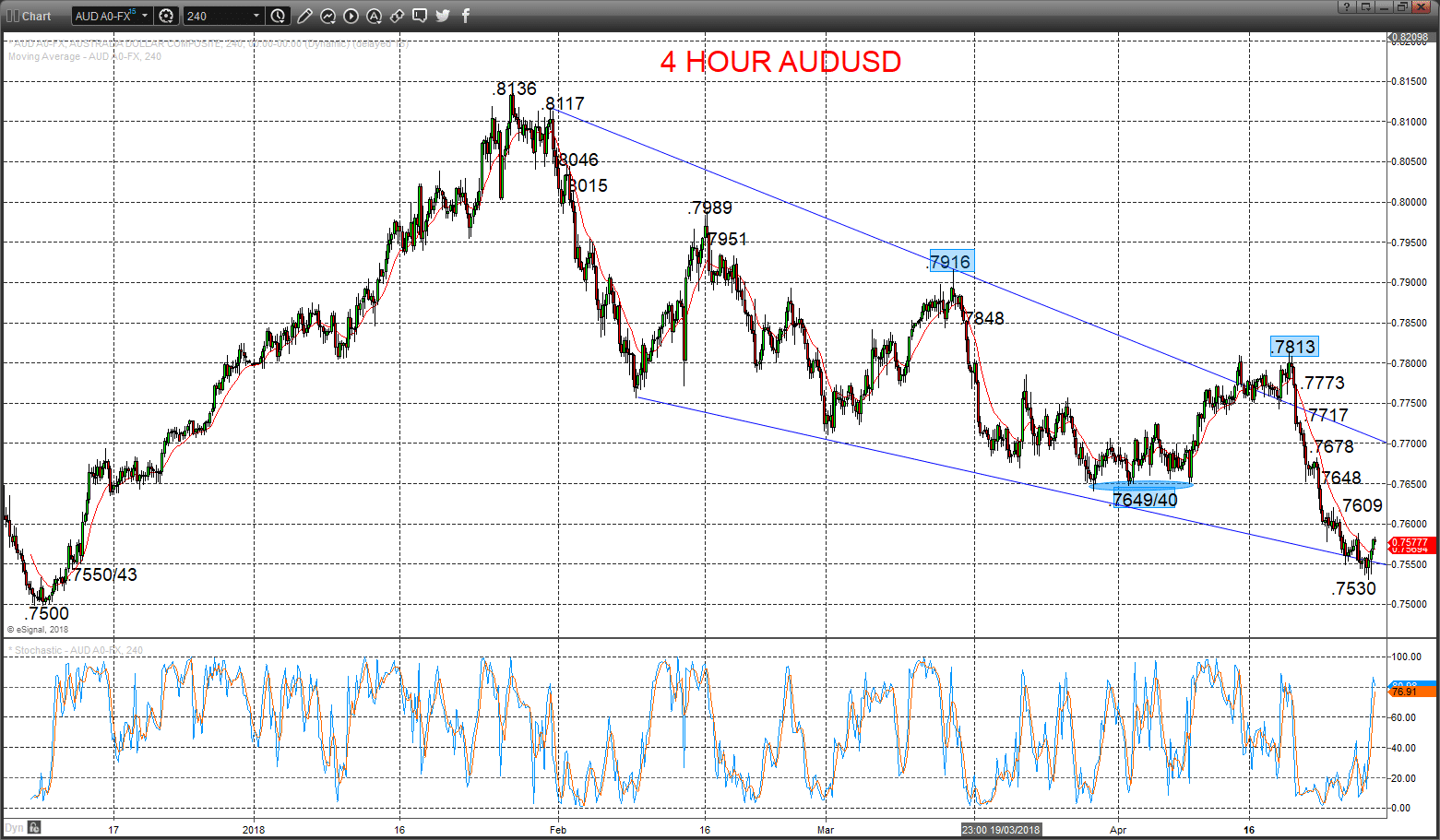

- AUDUSD has plunged below the key .7640 level, to resume the intermediate-term bear trend from earlier in 2018 and to aim still lower into May.

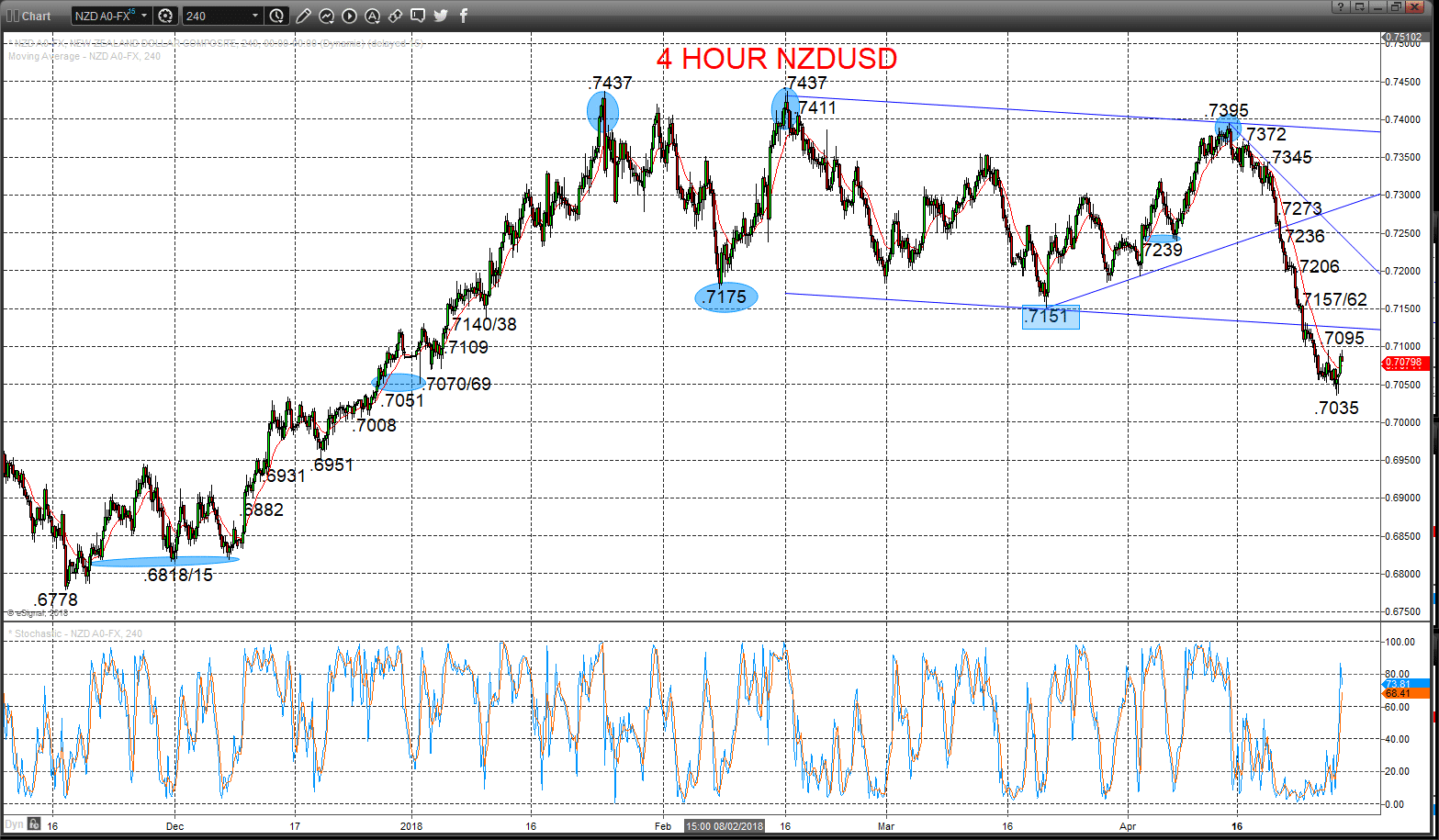

- For the NZDUSD currency rate, the plunge through key .7151 signalled a large topping pattern (Triple Top) and shifted the intermediate-term outlook from bullish to bearish.

See all forex articles.

AUDUSD Mini bounce, but downside risks

Another lacklustre rebound effort Friday from another new bear move low for 2018 through the .7549/43 support area and again probing bottom of the February-April Wedge pattern, after Thursday’s correction failure from below our .7609 initial resistance, to leave the bias lower again Monday.

The latter April surrender of key .7640 support set an intermediate-term bear trend again.

For Today:

- We see a downside bias for .7530; below targets .7500 and even .7457.

- But above .7609 aims at .7648 and maybe targets .7678.

Intermediate-term Outlook – Downside Risks: We see a downside risk for .7500.

- Lower targets would be .7368/31 and .7155/41.

- What Changes This? Above .7813 shifts the outlook back to neutral; above .7916 is needed for a bull theme.

Resistance and Support:

| .7609 | .7648 | .7678** | .7717* | .7773 |

| .7530 | .7500** | .7457 | .7418* | .7400 |

4 Hour AUDUSD Chart

NZDUSD Bear trend reinforced

A push lower Friday to another new April low through .7051 support and despite a minor rebound effort, we still see negative pressures from Thursday’s rebound failure (capped below our first resistance now at .7095), PLUS the latter April surrender of the key .7151 level, keeping risks lower Monday.

The latter April plunge through key .7151 signalled a large topping pattern (Triple Top) and shifted the intermediate-term outlook from bullish to bearish.

For Today:

- We see a downside bias for .7035; below here targets .7008 and maybe closer to .6951.

- But above .7095 opens risk up to the .7157/62 area.

Intermediate-term Outlook – Downside Risks: We see a downside risk for .7070/69.

- Lower targets would be .6951 and .6778

- What Changes This? Above .7395 shifts the outlook straight to bullish.

Resistance and Support:

| .7095* | .7157/62 | .87206* | .7236 | .7273* |

| .7035 | .7008* | .6951** | .6931 | .6900 |

4 Hour NZDUSD Chart