The trick to profitable trading is making decisions off what you see rather than what you want to see. Those looking for a continuation of the recent price momentum might want to recalibrate, if not to trade sideways markets at least to be ready to accept they might be about to come about.

The US Thanksgiving holiday on Thursday the 26th of November is the most significant break for the markets in the entire year. M&A activity, IPOs and the rolling out of new strategies will all be put on hold as the US shuts down.

With most market participants taking the Friday off, the markets look set to be run by junior staff with a mandate to monitor rather than manage trading positions.

This is a week when the Economic Calendar can help you keep out of trouble.

- Sideways markets

- Markets which might have additional volatility

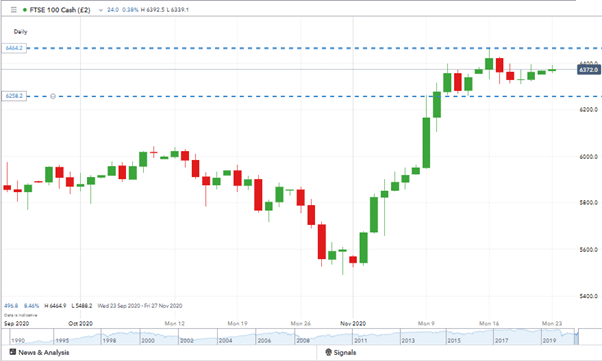

Sideways markets

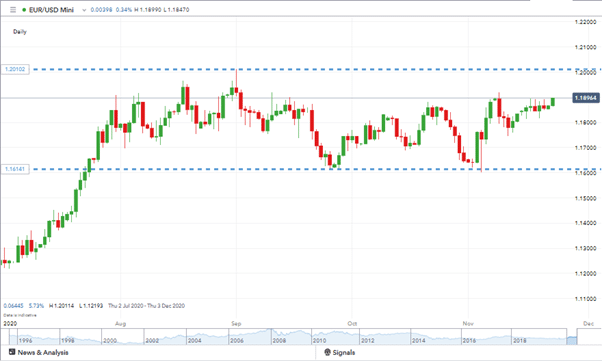

The countdown to Thanksgiving might explain the sideways price action in a few key markets. The long-weekend doesn’t just impact the US; instead, it casts a shadow over all the global markets.

Source: IG

If past years are anything to go by, we can expect the big firms to engage in some profit-taking and gentle realignment of positions. For independent traders, the trick might be not to get caught in a position they can’t readily extricate themselves from.

Anyone who is running strategies that require one or two days to come good might be feeling the squeeze if they’re still waiting for an exit position on Wednesday afternoon.

Source: IG

Nothing is ever certain; however, the Thanksgiving break looks set to offer a ‘drinks-break’ at a time when the markets are looking for one. All things being considered it could be hard to find enough volatility to support short-term trading strategies which don’t involve a degree of scalping.

Markets which might have additional volatility

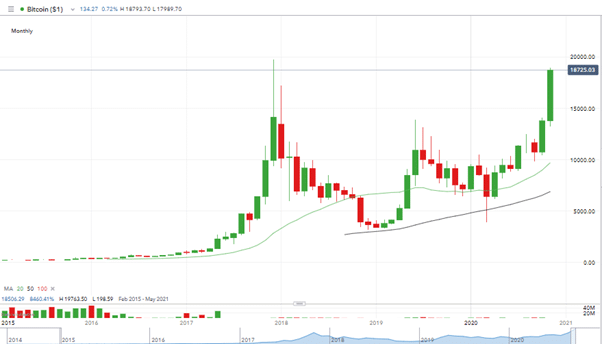

If you want a market which is holiday-resistant, then Bitcoin might be suitable. The price of the crypto continues to sky-rocket with the magic $20,000 price level now within touching distance.

The ability of BTC to set its course while other markets splutter is potentially a good sign for the crypto’s long-term prospects. If your unique selling point is a revolutionary shake-up of the establishment, then demonstrating an ability to do your own thing is a good start.

Source: IG

The questions for holders of Bitcoin are all to do with the $20,000 level. Despite the crypto having a following of hardcore fans, many others who took long positions in the last six months may be looking to take profits.

The all-time high of $19,763 posted in December 2017 is another possible target/resistance level.

Does the recent price spike represent another bubble? Or are the crypto-bugs reflecting concerns about the world’s central banks printing money at unprecedented rates?

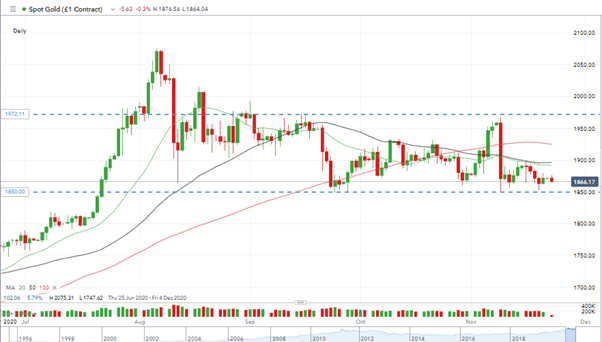

Source: IG

The questions about when Bitcoin’s price rally ends might not be answered during this shortened working week. A cross-check to gold shows that another hedge against central bank profligacy has not followed the crypto and actually belongs firmly in the sideways group of assets.

Related Articles

- Forex vs Crypto: What’s Better For Beginner Traders?

- Three Great Technical Analysis Tools for Forex Trading

- What Does Binance Being Kicked Out of Belgium Mean for Crypto Prices?

- Crypto Traders and Coin Prices Face New Challenge as Binance Gives up its FCA Licence

- Interpol Declares Investment Scams “Serious and Imminent Threat”

- Annual UK Fraud Audit Reveals Scam Hot-Spots

Forex vs Crypto: What’s Better For Beginner Traders?

Three Great Technical Analysis Tools for Forex Trading

Safest Forex Brokers 2025

| Broker | Info | Best In | Customer Satisfaction Score | ||

|---|---|---|---|---|---|

| #1 |

|

Global Forex Broker |

BEST SPREADS

Visit broker

|

||

| #2 |

|

Globally regulated broker |

BEST CUSTOMER SUPPORT

Visit broker

|

||

| #3 |

|

Global CFD Provider |

Best Trading App

Visit broker

|

||

| #4 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #5 |

|

Global CFD & FX Broker (*Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more) |

ALL-INCLUSIVE TRADING PLATFORM

Visit broker

|

||

| #6 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #7 |

|

CFD and Cryptocurrency Broker |

CFD and Cryptocurrency

Visit broker

|

||

|

|

|||||

Forex Fraud Certified Brokers

Stay up to date with the latest Forex scam alerts

Sign up to receive our up-to-date broker reviews, new fraud warnings and special offers direct to your inbox