Every human activity has its own pacesetters, the ones that grab the headlines on a continual basis for good or bad reasons. These headline getters almost assume celebrity status, the products of our penchant for news and the latest reality show gone live. The forex industry is no different. Yes, the news is littered with the latest goings on, but our attention is often driven to the continuing saga of a long-running fraud story or a poor broker down on its luck, trying everything and anything to right its ship and survive.

Read all forex market news

Over the past few years, we have a few standouts that fall into the above categories, interesting tales of the good, the bad, and the ugly. In some cases, the stories are actually about success or the antics of a non-conforming billionaire. It is difficult to assume a low profile when you are throwing large amounts of cash around to willing M&A candidates. There are times when these celebs do seek anonymity, but they have a way of popping up in the news. In case you missed the latest chapter related to your favorite, we have prepared updates on where they are now, one each for IronFX, FXCM, Plus500, Playtech, and, of course, the exploits of its precocious founder, Teddy Sagi.

FXCM: Rags to riches, then riches to ruin – Where are they now?

Everyone loves a great success story, but, when it becomes known that the rise was built on unsound foundations, the vultures that see blood in the streets are quick to feast on the carrion. We last wrote about the travails of FXCM and its CEO, Drew Niv, a year ago to the day. The firm had been forced to exit the U.S. market, sell accounts to the highest bidder, pay fines for its misconduct, and then subsequently changed its name to Global Brokerage Inc. (GLBR). As one could expect, a rash of shareholder lawsuits has ensued, each attempting to secure damages from the surviving entities.

What had FXCM done? Per the CFTC complaint: “FXCM went so far as to write internal algorithms that routed trades to a controlled entity that shared 70% of its revenues with the firm, amounting to $77 million from 2010/2014. It also concealed its interest in the market maker and filed false statements with the NFA. FXCM, Adhout and Niv are permanently barred from NFA membership, FXCM can no longer operate in the U.S., and FXCM has agreed to pay a $7 million fine.”

FXCM was actually caught rigging its back office trading operations to its benefit, while using a marketing ruse to lure new customers to the firm. Their supposed “non-dealing desk” approach was an appealing innovation that gained immediate popularity amongst the trading community. As we reported: “FXCM had come a long way in a short period of time, and Drew Niv, its founder and CEO, was heralded as a miracle-maker in the foreign exchange industry.”

FXCM’s “ruse”, however, was exposed when Swiss authorities dropped the peg of the Swiss Franc to the Euro on January 15, 2015. The company lost $225 million, a loss that should not have been possible with its “riskless” non-dealing desk approach. To Niv’s credit, he arranged a $300 million loan from Leucadia, a publicly listed hedge fund that imposed draconian terms for its deal and subsequently took control of the enterprise.

As its savings grace, FXCM did have a lucrative international business. It did sell its U.S. book to GAIN Capital for $7 million, while the remaining 82% of its business racked up sales in July of 2017 of $197 million. FXCM was not dead, but a flurry of lawsuits threatened to bring it down. One such shareholder suit was recently dismissed in a New York court. The plaintiff, a pension fund, alleged that Niv and his cohorts had mislead, misrepresented the risk, and had full knowledge of their wrongdoings before committing acts of fraud. The court ruled in favor of the defendants, i.e., Niv and GLBR.

Are Niv and FXCM (GLBR) out of the woods yet? Not hardly. Leucadia (Now Jeffries – It re-branded, as well) has recovered more in principal, interest, and fees than its original $300 million deal, but it has lost considerable amounts on its stock purchases. It estimates its total loss on the deal at around $220 million. Oddly enough, FXCM shareholders are also suing Niv and a host of others, claiming the terms of the original Leucadia deal were “unfair” and that all parties had breached their fiduciary duties to FXCM. The road ahead will remain bumpy for quite some time.

IronFX: A tale of success, woe, aggressive marketing tactics, and angry clients

The tale of IronFX is another storyline that keeps on giving. July, a year ago, we wrote: “IronFX, mired in controversy, continues to be the poster child for how a high-flying forex broker can be brought to its knees by its own aggressive marketing tactics. But wait a minute. This broker has refused to throw in the towel. It may be late in the fight, but the management at IronFX battles on through the courts, while maintaining as low a profile in the press as is possible. The latter effort has been a challenge, as investigative reporters from around the globe have tried their best to zero in on the facts.”

In the case of IronFX, it had been a rollercoaster ride since the firm’s opening in 2010. It burst on the scene with an aggressive marketing scheme that included hefty welcoming bonuses and fat commissions for its burgeoning network of Introducing Brokers (IBs). Competitors cried foul, but IronFX was a success story in the retail forex trading industry that rose to stardom far too quickly, according to many business analysts. Trading volumes skyrocketed, but competition soon took its toll. Volume from Chinese traders rose quickly, too, but IronFX soon cried “foul”, claiming that a widespread group was gaming their bonus system, bringing into play “lock-down” provisions and major delays in honoring withdrawal requests. A figure of $176 million was bandied about as proof.

The lack of transparency and key facts in this case has cast a cloud over IronFX and its management team. An investigative study ensued, to be performed by an Ombudsman, appointed by CySEC, to resolve the matter concerning disgruntled traders and investors. The Ombudsman, having access to undisclosed information, ruled in favor of IronFX, summarily dismissing any claims by the plaintiff group, totaling some 1,500 individuals. CySEC found no evidence of wrongdoing, refused to suspend the license of IronFX, but did assess a fine of €335,000 in November of 2015 for other compliance infractions. Soon thereafter, IronFX was contemplating a very complicated reverse merger with Nukkleus on the NYSE, but the deal was unwound in December. A Middle Eastern Family Office had decided to invest $100 million. Cash flow problems were now mute.

A public outcry ensued, screaming that corruption at high levels of government were at play. CySEC merely reiterated that it was not a court of law. Claimants and their attorneys then went to the European Parliament for relief, but the wheels of justice can move slowly. All of 93 un-named Chinese claimants filed claims amounting to $300,000 with the court, which they promptly withdrew in mid-July of this year. In January of this year, the Hungarian high court ruled that thee claimants were also investors, not consumers, who would normally be covered by various protection schemes. As bad as the publicity was for IronFX, it appears that they may be winning.

Plus500: Freed from the clutches of Playtech, the firm has subsequently thrived

86% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Three years have passed in an instant. It seems as if it were just yesterday that Teddy Sagi and his flagship firm of Playtech had made a bid of $702 million to buy the beleaguered Plus500 franchise, having been beaten down by a host of regulatory rulings. Regulators would eventually nix the deal. Plus500 would come back into compliance, and then go about its merry way to renewed successes in the forex market. If ever there was an example of disaster and then recovery, the Plus500 tale is worthy of any textbook on the subject. It had faced the Grim Reaper, survived, and then achieved prosperity against all odds.

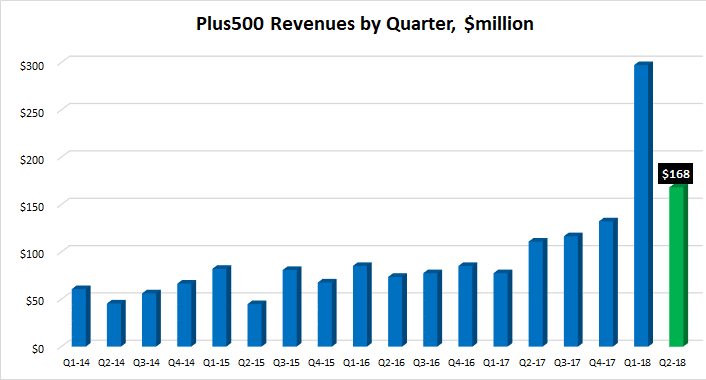

2016 became a rebuilding year. Revenues stabilized, and when second quarter revenues in 2017 were released, we reported a year ago that, “Plus500 is once again the “darling” of the analyst community in London. Per one stock reporter: “Plus500 is an incredibly attractive opportunity, but the full effects of the regulatory changes will be unknown for at least another 12 months.” Here we are one year later, and financial figures are way up again, although the second quarter fell due to new CFD rules issued by ESMA. In any event, Plus500 has momentum in 2018, based upon diversification.

86% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Playtech and Teddy Sagi: Parting can be such sweet sorrow in some cases

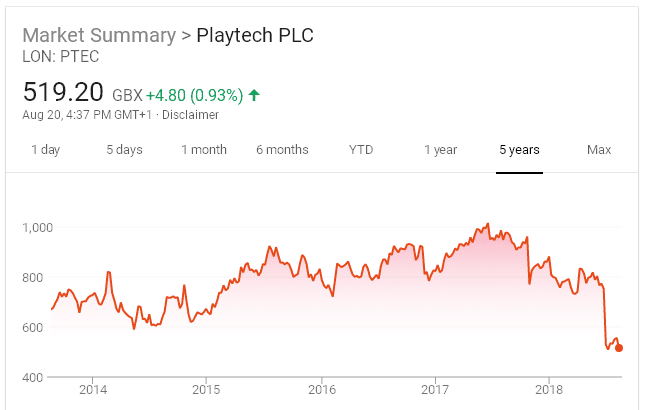

Who cannot resist a story about a large London gambling concern, an Israeli self-made billionaire, and their exploits, which include parting ways to some extent? When last we spoke on this topic back in August of last year, Playtech was flying high, sporting a share price over 1,000 pence, and Teddy Sagi was selling 36.5 million shares, thereby reducing his ownership from 17.8% down to 6.3% of the gambling juggernaut. He would move onto managing his real estate portfolio and private investments, which includes a jaunt into crypto-currencies. He remained Playtech’s largest stockholder, but he could no longer appoint directors. Mor Weizer remained the current CEO of Playtech, having served since 2007.

Teddy Sagi had many reasons to smile at this point, but some might regard it a smirk, following his timely private deal to institutional investors for $429 million. Since last year, Playtech has been hit with headwinds at every turn, necessitating earnings warnings on two separate occasions. As you might expect, the share price for Playtech has tanked:

Poor Mor Weizer. He was expecting a major bump in compensation for his able leadership from 2015 through 2017, only to be stymied by the Board due to recent events. Per one analyst, there may yet be hope: “Amid all the gloom and doom, there is a bright spot, however. The company reported that Playtech is set to work with some of its European clients to roll out online gaming and sportsbook opportunities for the emerging U.S. market, which has not had legal sportsbooks for more than 25 years.”

Concluding Remarks

Would you like to invest in these enterprises? Do you like rollercoaster rides? There will be more updates. Stay tuned!

Are you ready to trade?

Sign up with Your capital is at risk

Your capital is at risk

Related Articles

- Forex vs Crypto: What’s Better For Beginner Traders?

- Three Great Technical Analysis Tools for Forex Trading

- What Does Binance Being Kicked Out of Belgium Mean for Crypto Prices?

- Crypto Traders and Coin Prices Face New Challenge as Binance Gives up its FCA Licence

- Interpol Declares Investment Scams “Serious and Imminent Threat”

- Annual UK Fraud Audit Reveals Scam Hot-Spots

Forex vs Crypto: What’s Better For Beginner Traders?

Three Great Technical Analysis Tools for Forex Trading

Safest Forex Brokers 2025

| Broker | Info | Best In | Customer Satisfaction Score | ||

|---|---|---|---|---|---|

| #1 |

|

Global Forex Broker |

BEST SPREADS

Visit broker

|

||

| #2 |

|

Globally regulated broker |

BEST CUSTOMER SUPPORT

Visit broker

|

||

| #3 |

|

Global CFD Provider |

Best Trading App

Visit broker

|

||

| #4 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #5 |

|

Global CFD & FX Broker (*Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more) |

ALL-INCLUSIVE TRADING PLATFORM

Visit broker

|

||

| #6 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #7 |

|

CFD and Cryptocurrency Broker |

CFD and Cryptocurrency

Visit broker

|

||

|

|

|||||

Forex Fraud Certified Brokers

Stay up to date with the latest Forex scam alerts

Sign up to receive our up-to-date broker reviews, new fraud warnings and special offers direct to your inbox