Given the roller-coaster ride which 2020 has turned into, an interval of quieter markets might be welcomed by many. With the next major news event not due until Wednesday, volatility has dropped out of the markets. That might not be the end of the ride, just a pause before the next series of peaks and troughs.

Putting the Fed announcement into context

The COVID pandemic, the vaccine to treat it and the US presidential election have driven market moves this year. For some, it might be a strain to recall that the US Fed’s update is in more normal times, arguably the most critical diarised market event.

The question is whether the announcement on the 16th of the month will have an impact in line with previous announcements.

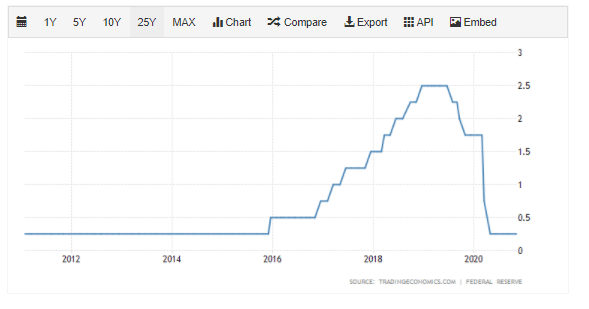

Source: Trading Economics

The US Fed meets eight times a year which equates to about every six weeks. In normal times, when interest policy is more stable, this can lead to a series of non-events. Between 2011 and 2015 each meeting was a monotone ‘UNCH’ affair.

That time interval appears too wide for a body which is responsible for managing an economy which can currently go into a tail-spin in a matter of days, not weeks. To put it another way, does the Fed have the agility and firepower to manage COVID?

The Christmas holiday break is an obvious potential catalyst for the disease surging once more and bringing with it extensive lockdowns. Bill Gates, the co-founder of Microsoft, is certainly pessimistic about the near future. Speaking with CNN, he said:

‘Sadly, the next four to six months could be the worst of the pandemic. The IHME forecast shows over 200,000 additional deaths.”

Source: Market Watch

Source: Tickmill

In economic and social terms, the potential risk appears to be to the downside which might not be such bad news for asset markets. With six weeks until their next shot at getting policy right, the suggestion is that if they are going to over-shoot it any direction, it will be in terms of greater relaxation of monetary policy.

As a result, equity markets are holding ground at levels in line with last week’s highs. They’re also trading in a tight range suggesting it is indeed the mid-week announcement they are awaiting.

How will markets react to the US Fed’s announcement?

The US Fed’s easiest route to managing the markets is through its asset purchase plan. The details of their quantitative easing are more of a mouthful for Fed Chairman Jerome Powell to get out at his press conference than just announcing a cut or rise in rates. There is a lot of detail to work through and analysts will be number-crunching the permutations as he speaks.

The granular detail could come down to buying more of one long-dated bond and less of another. If people don’t understand the change in the asset purchasing programme, then prices could start to whipsaw to reflect the time-lag between the announcement being made, and a shared understanding being gained.

Related Articles

- Forex vs Crypto: What’s Better For Beginner Traders?

- Three Great Technical Analysis Tools for Forex Trading

- What Does Binance Being Kicked Out of Belgium Mean for Crypto Prices?

- Crypto Traders and Coin Prices Face New Challenge as Binance Gives up its FCA Licence

- Interpol Declares Investment Scams “Serious and Imminent Threat”

- Annual UK Fraud Audit Reveals Scam Hot-Spots

Forex vs Crypto: What’s Better For Beginner Traders?

Three Great Technical Analysis Tools for Forex Trading

Safest Forex Brokers 2025

| Broker | Info | Best In | Customer Satisfaction Score | ||

|---|---|---|---|---|---|

| #1 |

|

Global Forex Broker |

BEST SPREADS

Visit broker

|

||

| #2 |

|

Globally regulated broker |

BEST CUSTOMER SUPPORT

Visit broker

|

||

| #3 |

|

Global CFD Provider |

Best Trading App

Visit broker

|

||

| #4 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #5 |

|

Global CFD & FX Broker (*Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more) |

ALL-INCLUSIVE TRADING PLATFORM

Visit broker

|

||

| #6 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #7 |

|

CFD and Cryptocurrency Broker |

CFD and Cryptocurrency

Visit broker

|

||

|

|

|||||

Forex Fraud Certified Brokers

Stay up to date with the latest Forex scam alerts

Sign up to receive our up-to-date broker reviews, new fraud warnings and special offers direct to your inbox