Bearish price moves across the board have left many traders taking a refresher course in risk management and recalling the adage of how the US dollar can blow the markets apart.

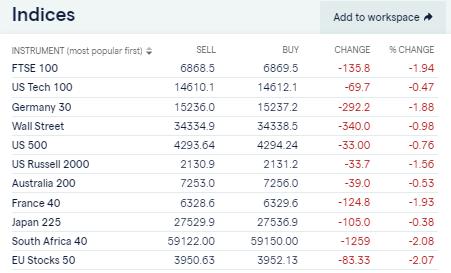

Global Equity Indices 10.30 BST

Source: IG

Risk-Off

Monday’s trading sessions in Asia and Europe inflicted a hammer blow on complacent investors. Futures in all the major global indices are in the red with substantial moves of over 2% in South African and European stocks. The former can be partly explained by the political unrest and the latter by the flooding in economically important areas of Northern Europe. However, that’s to some extent fitting a convenient explanation to the price move rather than examining what’s really happening. The Russell 2000 index is down more than 1.56% from Friday’s close, and the France 40 CAC index is down more than the German DAX.

Role of the US Dollar in the Recent Price Moves

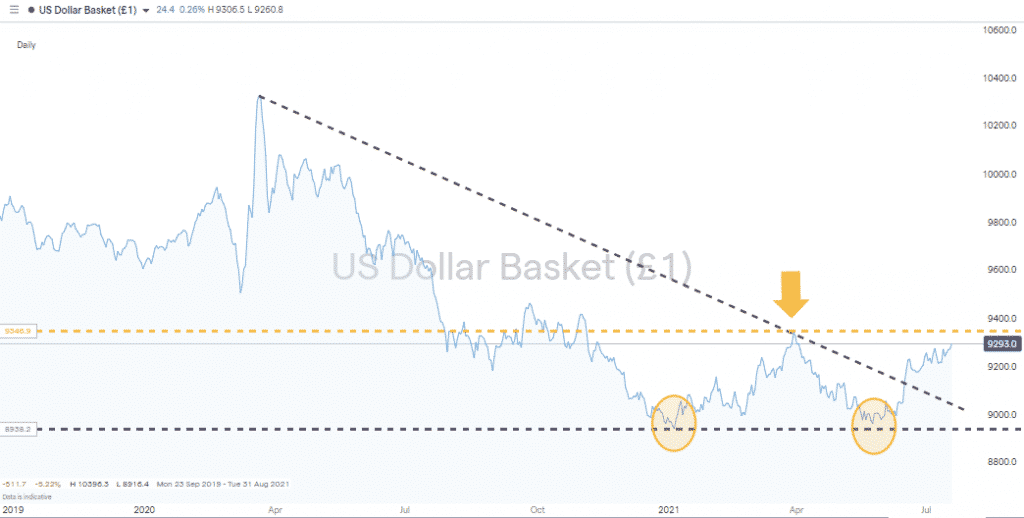

A check of the US dollar basket index is always worthwhile and is more so today. The potential double-bottom pattern identified by Forex Fraud analysts on the 29th of June could be coming into play.

USD Basket Index – 2019 – 21 Double Bottom?

Source: IG

If you want to give the recent dollar move greater significance, extending the price chart back to February 2018 brings in the low of 88.74. It’s not a perfect fit to the lows of 2021, which were at 89.40 and 89.52, but if you’re willing to squint while looking at the chart, you could be seeing a move in the US dollar that could flip the financial markets upside down. Is this a multi-year change in the direction of travel for the markets? Are inflation concerns and interest rate hikes the new game in town?

USD Basket Index – 2017 – 21 Double Bottom?

Source: IG

Timing trades in a market like this is challenging but getting it right could generate considerable returns. There’s no need to scale up in size and emotion and applying appropriate risk management will be vital.

It’s All about 93.46

One major price test appears to be on the cards. It’s found in the US Dollar Basket index, where 93.46 marks the year-to-date high of the 30th of March. If the dollar maintains its current run and breaches that level, then it could mark a move into a prolonged period of bearish uncertainty for other asset groups. The multi-year bull run has been fuelled by dollar weakness; if that ends, so could the rally.

USD Basket Index – 2020 – 21

Source: IG

Could the dollar take out such a critical resistance level at the first attempt? The Daily RSI is still below 70, and price has consolidated since the 17th of June, which makes that possible. With so much at stake, a rebound from 93.46 would buy equity investors a chance to reassess if they want to stay in or get out of positions.

USD Basket Index – 2020 – 21 with RSI

Source: IG

Crowdsourcing information about scam brokers can help others avoid falling into the traps set by disreputable brokers. You can share your experiences here. If you want to know more about this topic or have been scammed by a fraudulent broker, you can also contact us at [email protected]

Related Articles

- Forex vs Crypto: What’s Better For Beginner Traders?

- Three Great Technical Analysis Tools for Forex Trading

- What Does Binance Being Kicked Out of Belgium Mean for Crypto Prices?

- Crypto Traders and Coin Prices Face New Challenge as Binance Gives up its FCA Licence

- Interpol Declares Investment Scams “Serious and Imminent Threat”

- Annual UK Fraud Audit Reveals Scam Hot-Spots

Forex vs Crypto: What’s Better For Beginner Traders?

Three Great Technical Analysis Tools for Forex Trading

Safest Forex Brokers 2025

| Broker | Info | Best In | Customer Satisfaction Score | ||

|---|---|---|---|---|---|

| #1 |

|

Global Forex Broker |

BEST SPREADS

Visit broker

|

||

| #2 |

|

Globally regulated broker |

BEST CUSTOMER SUPPORT

Visit broker

|

||

| #3 |

|

Global CFD Provider |

Best Trading App

Visit broker

|

||

| #4 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #5 |

|

Global CFD & FX Broker (*Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more) |

ALL-INCLUSIVE TRADING PLATFORM

Visit broker

|

||

| #6 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #7 |

|

CFD and Cryptocurrency Broker |

CFD and Cryptocurrency

Visit broker

|

||

|

|

|||||

Forex Fraud Certified Brokers

Stay up to date with the latest Forex scam alerts

Sign up to receive our up-to-date broker reviews, new fraud warnings and special offers direct to your inbox