Given the amount of technical and fundamental analysis which goes into running a successful investment strategy, it’s often surprising how many traders skip analysing the health of their broker. With some of the big-name brokers recently sharing performance updates, we’ve run the rule over some of them to assess which are currently looking strong enough to justify investors holding accounts with them. One of the most dynamic brokers in the sector is BlackBull Markets, and this review outlines how that broker continues to push the boundaries of what account holders can expect from the platform.

Source: BlackBull Markets

BlackBull Markets

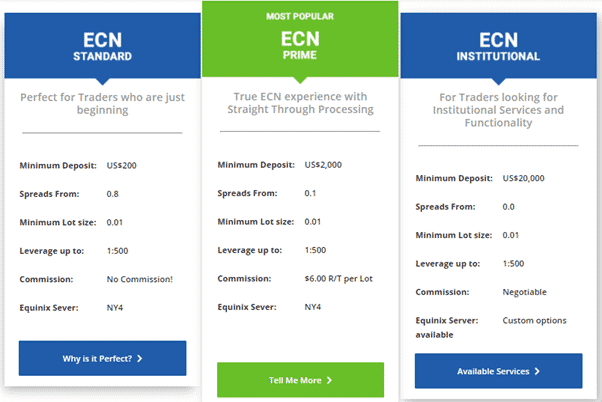

New Zealand based broker BlackBull continues to forge a unique position for itself in the broker sector. It’s been a busy few months for the firm, and recent upgrades to its operations continue to build on its unique and innovative approach. The proposition is a simple one; to provide institutional-grade technology to retail investors, with the fintech approach backed up by their team of highly trained staff who offer dedicated account manager style customer support.

Improved Leverage Terms

If your knowledge of the New Zealand regulatory environment isn’t what it could be, then the headline fact is that only about 20 firms operate under the licence of the Financial Markets Authority (FMA). It’s an exclusive club that includes top-tier names such as Credit Suisse and Deutsche Bank, and it now also includes BlackBull Markets. This is important news for traders who are looking for the best leverage terms. It is, of course, easy to find more aggressive leverage at offshore brokers that are regulated by Tier-2 authorities, but the FMA registration permits traders to scale up to 1:500. At the same time, client accounts are protected by the FMA’s Tier-1 grade protocols, and funds are segregated at the AA rated ANZ Bank.

BlackBull Markets Chairman Michael Walker was speaking with LeapRate when he explained:

“Being regulated by the FMA and its minimum capital requirements of $1 million or 10% of client funds also gives transparent solvency assurance to our clients when markets move in unpredictable ways.”

Source: LeapRate

Even the Standard Account, with a minimum deposit requirement of $200, now offers leverage of up to 1:300

Source: BlackBull Markets

Ready to Expand

Changes in the C-suite management team suggest the firm is looking to expand its client base by getting the basics right. In July, Benjamin Boulter, who helped turn Australian broker Pepperstone into a global force, was appointed Chief Operating Officer. Boulter’s promotion demonstrates the firm is putting one of its best resources in charge of the nuts and bolts of the operation. Given that security of funds is the number one priority for any trader, the move offers some reassurance. The recent addition of MetaTrader’s MT5 platform to the range of available platforms is another notable upgrade. In short, BlackBull is looking to develop market share, and they’re going about it the right way.

Next Steps?

We at Forex Traders do, unfortunately, continue to receive messages from traders who have been scammed. Given the health of the broker sector, anyone considering signing up with a broker or switching broker could do worse than check out the full review of BlackBull Markets found here or explore other safe options using this report on trusted brokers.

Crowdsourcing information about scam brokers can help others avoid falling into the traps set by disreputable brokers, and you can share your experiences here. If you want to know more about this particular topic, or have been scammed by a fraudulent broker, you can also contact us at [email protected].

Related Articles

- Forex vs Crypto: What’s Better For Beginner Traders?

- Three Great Technical Analysis Tools for Forex Trading

- What Does Binance Being Kicked Out of Belgium Mean for Crypto Prices?

- Crypto Traders and Coin Prices Face New Challenge as Binance Gives up its FCA Licence

- Interpol Declares Investment Scams “Serious and Imminent Threat”

- Annual UK Fraud Audit Reveals Scam Hot-Spots

Forex vs Crypto: What’s Better For Beginner Traders?

Three Great Technical Analysis Tools for Forex Trading

Safest Forex Brokers 2025

| Broker | Info | Best In | Customer Satisfaction Score | ||

|---|---|---|---|---|---|

| #1 |

|

Global Forex Broker |

BEST SPREADS

Visit broker

|

||

| #2 |

|

Globally regulated broker |

BEST CUSTOMER SUPPORT

Visit broker

|

||

| #3 |

|

Global CFD Provider |

Best Trading App

Visit broker

|

||

| #4 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #5 |

|

Global CFD & FX Broker (*Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more) |

ALL-INCLUSIVE TRADING PLATFORM

Visit broker

|

||

| #6 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #7 |

|

CFD and Cryptocurrency Broker |

CFD and Cryptocurrency

Visit broker

|

||

|

|

|||||

Forex Fraud Certified Brokers

Stay up to date with the latest Forex scam alerts

Sign up to receive our up-to-date broker reviews, new fraud warnings and special offers direct to your inbox