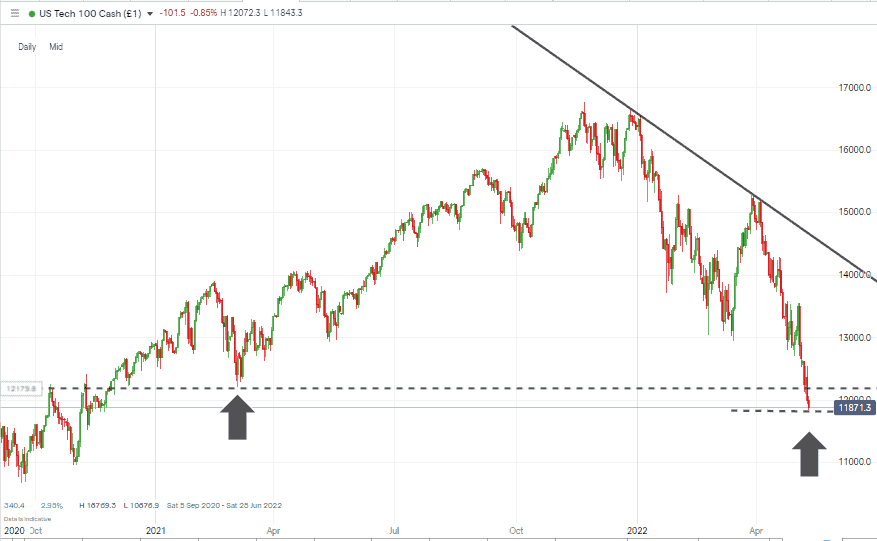

With the Nasdaq 100 index currently trading 28% lower than its January highs, the Q1 correction has transformed into a multi-month rout. The pessimistic market mood continues to be caused by worryingly strong inflation data, but all trends have a bend at the end. Much caution needs to be exercised when trying to pick the bottom of the market, but the seasoned professional Cathie Wood is currently buying these stocks.

Nasdaq 100 – Daily Price Chart –2021 – May 2022 – Breach of key support level

Source: IG

Cathie Wood & Ark ETF

The Ark ETF, managed by high-profile investor Cathie Wood, is a high-volatility rollercoaster ride which might offer more risk-return than most can stomach. It gained notoriety in 2020 when it posted an annual return above 150%. Cathie Wood is back in the market, picking up cheap stocks which have seen their prices hammered down by inflation fears.

Wood’s high beta strategy is designed to profit from markets overshooting as they are now. Extensive analysis is used to identify individual stocks. The below names are those being bought in May.

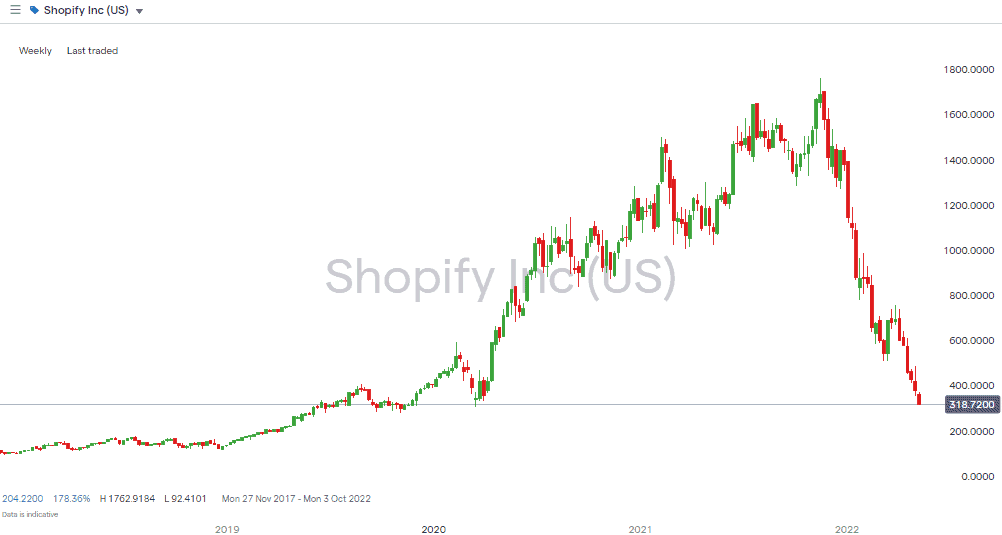

Shopify

Wood is a long-term fan of the online retailer Shopify. The social media angle of the firm’s operations has even led to Wood stating Shopify has the potential to be as big as Amazon. The Shopify stock price has cratered as part of the tech stock sell-off, so if Wood is correct, the current price could present the buying opportunity of a lifetime. Ark bought 44,024 shares of Shopify on 5th May 2022.

Shopify Weekly Share Price Chart

Source: IG

Zoom Inc

Video conferencing service Zoom has been caught up in the wider tech sell-off but has improving fundamentals. In 2021 it generated $4 billion in revenue, a 53% increase year-on-year, and its profit margin is an impressive 29.2%. It’s also worth remembering the popularity of the platform could return once initial post-lockdown meetings are carried out face-to-face. It’s pretty easy to perceive the convenience of online catch-ups becoming more appealing to overstretched business leaders, and that’s the kind of long-term trend Wood invests in. Ark bought 25,896 shares of Zoom on 5th May 2022.

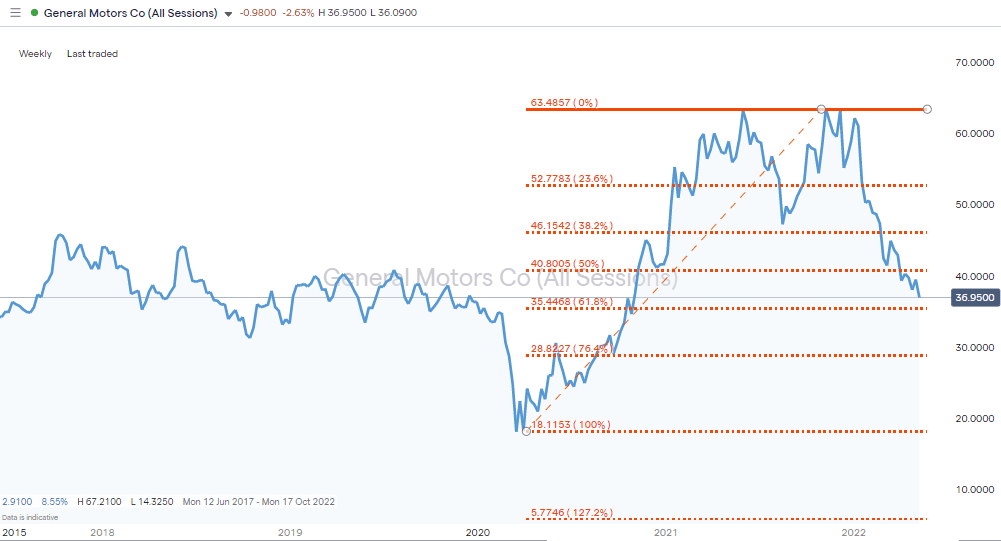

General Motors

This one is definitely a curveball for followers of Wood’s investment philosophy. Known for having a five-year view and a passion for Tesla stock, the purchase of 158,187 shares of the Detroit based motor company has raised eyebrows. With GM trading in the region of $36, it’s nearing the 61.8% Fibonacci retracement support level at $35.4, so it looks like a classic case of bottom-fishing.

General Motors Weekly Share Price Chart – Fib Support

Source: IG

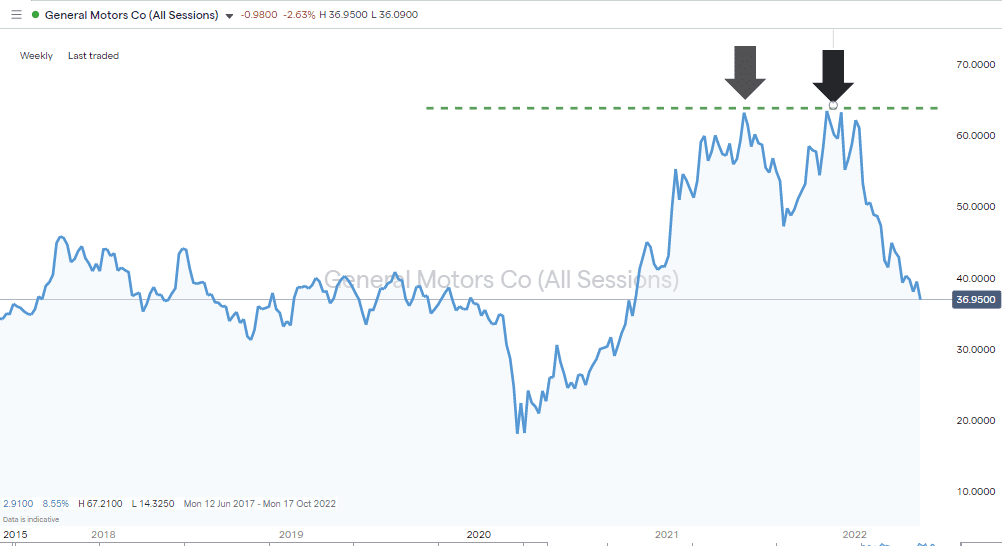

It’s the Ark fund’s first-ever investment in a traditional motor manufacturer and is a divergence from the tech bias the fund operates, so this one is a ‘watch this space’ situation, particularly as there is a concerning double-top pattern to deal with.

General Motors Weekly Share Price Chart – Double Top?

Source: IG

Crowdsourcing information about scam brokers can help others avoid falling into the traps set by disreputable brokers, and you can share your experiences here. If you would like to know more about this particular topic or have been scammed by a fraudulent broker, you can also contact us at [email protected]

Related Articles

- Forex vs Crypto: What’s Better For Beginner Traders?

- Three Great Technical Analysis Tools for Forex Trading

- What Does Binance Being Kicked Out of Belgium Mean for Crypto Prices?

- Crypto Traders and Coin Prices Face New Challenge as Binance Gives up its FCA Licence

- Interpol Declares Investment Scams “Serious and Imminent Threat”

- Annual UK Fraud Audit Reveals Scam Hot-Spots

Forex vs Crypto: What’s Better For Beginner Traders?

Three Great Technical Analysis Tools for Forex Trading

Safest Forex Brokers 2025

| Broker | Info | Best In | Customer Satisfaction Score | ||

|---|---|---|---|---|---|

| #1 |

|

Global Forex Broker |

BEST SPREADS

Visit broker

|

||

| #2 |

|

Globally regulated broker |

BEST CUSTOMER SUPPORT

Visit broker

|

||

| #3 |

|

Global CFD Provider |

Best Trading App

Visit broker

|

||

| #4 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #5 |

|

Global CFD & FX Broker (*Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more) |

ALL-INCLUSIVE TRADING PLATFORM

Visit broker

|

||

| #6 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #7 |

|

CFD and Cryptocurrency Broker |

CFD and Cryptocurrency

Visit broker

|

||

|

|

|||||

Forex Fraud Certified Brokers

Stay up to date with the latest Forex scam alerts

Sign up to receive our up-to-date broker reviews, new fraud warnings and special offers direct to your inbox