The surprising change in tone by the US Federal Reserve last Wednesday has been followed by a very slow-motion, minor market correction. On Thursday, the Forex Fraud analysts picked out that statements from the US central bank could “change the landscape” for investors, and it looks like after extended deliberation, some doubt has crept into investor sentiment.

Most of the questions at this stage relate to the timing of the move. A reaction to the FOMC stating that interest rates would rise sooner than expected would be naturally followed by a shift away from risk assets. But why did it take days to filter through into price action, and what does it say about whether the loss of confidence is momentary or more serious than that?

Source: IG

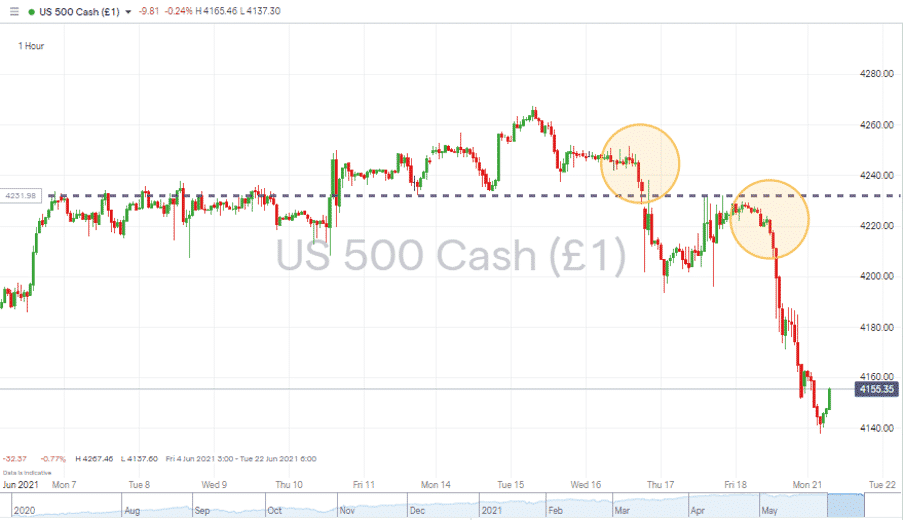

S&P 500 – A car crash, or just a minor case of travel sickness?

In its statement presented on Wednesday, the US Fed raised its expectations for inflation and brought forward the timeline for interest rate hikes. The threat to equities was real and apparent, but price fell away a minor amount and then rebounded. By the close of European markets at 5 pm Friday, the S&P 500 index was back within touching distance of the key 4232 resistance/support level.

It wasn’t until the final hours of the last trading session of the week that price corrected. The run into the Wall Street close was associated with broad selling. That then spooked Asian markets, which posted some alarming headline falls in the opening session of the following week.

- Japan’s Nikkei 225 index plunged 4% intra-day Monday

- Hong Kong’s Hang Seng index – down 1.34%

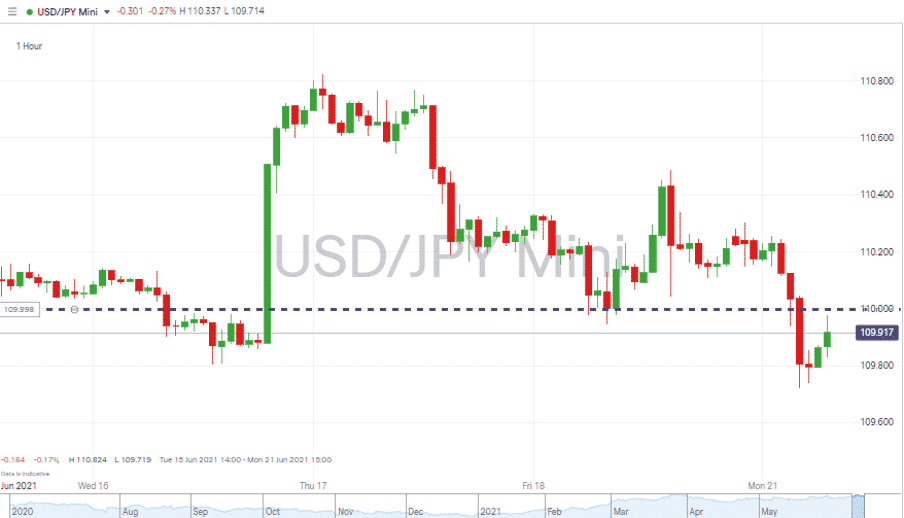

- USDJPY broke the 110 support-level and trading sub 109.90 at the end of Asian trading

Source: IG

Will the markets bounce from here?

A much-trodden path for the markets and risk appetite is for US traders to hit the panic button and cause a sell-off in Asia, but by the time Wall Street opens again, investors are likely to adopt a more bullish stance. The scenario can’t be dismissed, and the US open will be eagerly awaited today.

- Those talked about interest rate rises are still months and years away. The Fed’s statement brought rate rises forward from 2024 to 2023.

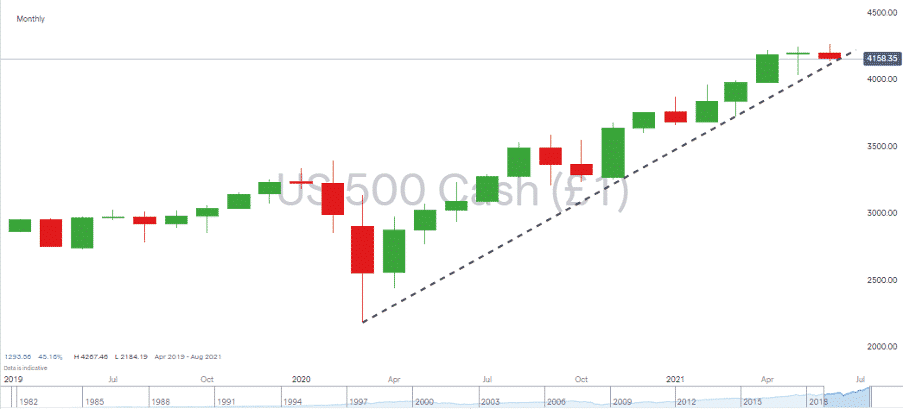

- The monthly price chart for the S&P is still holding its long-term supporting trend-line.

A 5-10% correction in equities can’t be discounted, but the markets have for 14 months pretty much gone up in a straight line. Until the supporting line breaks, then the path of least resistance appears to be upwards. It will break at some point, but is the suggestion of interest rate moves in two rather than three years going to be the catalyst for a major sell-off?

Source: IG

The delayed reaction to the Fed’s news could give the bulls some hope. For the die-hards and those with nowhere else to put their cash, the minor adjustment in the markets is just a shake-down of the less committed traders.

If you want to know more about this topic or have been scammed by a fraudulent broker, please contact us at [email protected].

Related Articles

- Forex vs Crypto: What’s Better For Beginner Traders?

- Three Great Technical Analysis Tools for Forex Trading

- What Does Binance Being Kicked Out of Belgium Mean for Crypto Prices?

- Crypto Traders and Coin Prices Face New Challenge as Binance Gives up its FCA Licence

- Interpol Declares Investment Scams “Serious and Imminent Threat”

- Annual UK Fraud Audit Reveals Scam Hot-Spots

Forex vs Crypto: What’s Better For Beginner Traders?

Three Great Technical Analysis Tools for Forex Trading

Safest Forex Brokers 2025

| Broker | Info | Best In | Customer Satisfaction Score | ||

|---|---|---|---|---|---|

| #1 |

|

Global Forex Broker |

BEST SPREADS

Visit broker

|

||

| #2 |

|

Globally regulated broker |

BEST CUSTOMER SUPPORT

Visit broker

|

||

| #3 |

|

Global CFD Provider |

Best Trading App

Visit broker

|

||

| #4 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #5 |

|

Global CFD & FX Broker (*Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more) |

ALL-INCLUSIVE TRADING PLATFORM

Visit broker

|

||

| #6 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #7 |

|

CFD and Cryptocurrency Broker |

CFD and Cryptocurrency

Visit broker

|

||

|

|

|||||

Forex Fraud Certified Brokers

Stay up to date with the latest Forex scam alerts

Sign up to receive our up-to-date broker reviews, new fraud warnings and special offers direct to your inbox