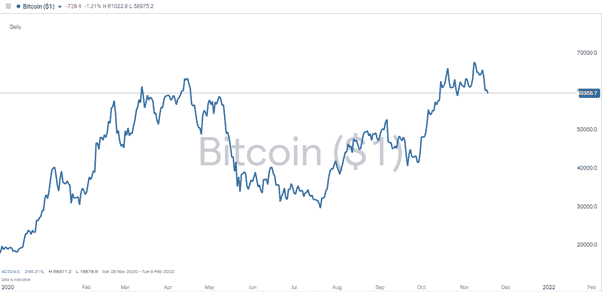

Crypto price moves continue to provide a white-knuckle ride for holders of coins, but recent price weakness is causing some sufferers of FOMO to consider stepping into the market.

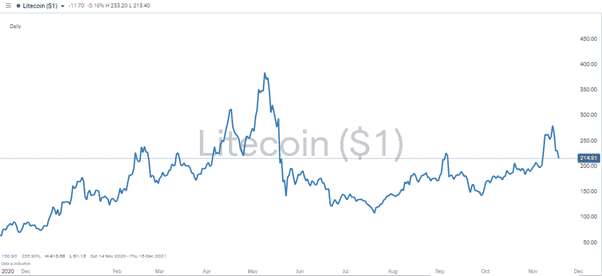

In 21 days in October, Bitcoin went on one of its trademark runs and rose by 60% in value. Ether, a fellow front-runner in terms of total market capitalisation, matched the BTC price rise. Litecoin, between the end of September and the 15th of November, almost doubled in value, with the price rocketing by +96%. Other smaller Altcoins also surged in price; however, as is the way with crypto, the sudden spike has been followed by an equally sudden fall.

Source: IG

Source: IG

Source: IG

The cause of the mini price crash could be down to technical factors or that the buying pressure just dried up. With everyone getting into long positions so quickly, there was only one way for price to head when the queue of buyers came to an end. Most analysts are pointing at fundamental reasons to explain the fall.

China’s most recent clampdown on crypto involves declarations that trading in all cryptos is illegal. That baseline bearish sentiment has been added to by statements from high profile figures on the viability of the coins. On Tuesday of this week, it was reported that Twitter CFO Ned Segal said investing in cryptocurrencies “doesn’t make sense right now”.

The slump in prices has been painful for those holding positions. Litecoin, for example, has shed 23% of its value from Friday’s close. Those who have been suffering FOMO as they watched the price shoot up are approaching the price move from a different direction.

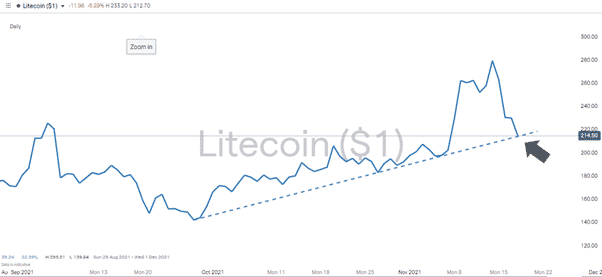

Crypto trading has a Wild-West feel, and traditional trade indicators may not be as reliable as they are in other markets, but some of the most straightforward trading tools can pay off.

The supporting trend-line on the daily price chart of Litecoin shows price touching a key support level. All bets are off if it breaks through to the downside, but traditional charting methodologies suggest this could be a trade entry point.

Source: IG

In the case of Bitcoin, the price has yet to fall back to the longest dated supporting trend-line.

Source: IG

Getting into new positions at these levels does require buyers to trade an amount of cash they can afford to lose. Market risk can’t be avoided, but there are some insider tips on how to help tilt the scales in a trader’s favour.

One tip is to use a regulated broker rather than an unregulated exchange. This brings a greater degree of client protection and can be a lot more convenient as there isn’t any need to set up a special wallet. Buying crypto dips is a high risk-return proposition, so managing operational risk as much as possible is strongly recommended.

Crowdsourcing information about scam brokers can help others avoid falling into the traps set by disreputable brokers and you can share your experiences here. If you want to know more about this particular topic, or have been scammed by a fraudulent broker, you can also contact us at [email protected]

Related Articles

- Forex vs Crypto: What’s Better For Beginner Traders?

- Three Great Technical Analysis Tools for Forex Trading

- What Does Binance Being Kicked Out of Belgium Mean for Crypto Prices?

- Crypto Traders and Coin Prices Face New Challenge as Binance Gives up its FCA Licence

- Interpol Declares Investment Scams “Serious and Imminent Threat”

- Annual UK Fraud Audit Reveals Scam Hot-Spots

Forex vs Crypto: What’s Better For Beginner Traders?

Three Great Technical Analysis Tools for Forex Trading

Safest Forex Brokers 2025

| Broker | Info | Best In | Customer Satisfaction Score | ||

|---|---|---|---|---|---|

| #1 |

|

Global Forex Broker |

BEST SPREADS

Visit broker

|

||

| #2 |

|

Globally regulated broker |

BEST CUSTOMER SUPPORT

Visit broker

|

||

| #3 |

|

Global CFD Provider |

Best Trading App

Visit broker

|

||

| #4 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #5 |

|

Global CFD & FX Broker (*Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more) |

ALL-INCLUSIVE TRADING PLATFORM

Visit broker

|

||

| #6 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #7 |

|

CFD and Cryptocurrency Broker |

CFD and Cryptocurrency

Visit broker

|

||

|

|

|||||

Forex Fraud Certified Brokers

Stay up to date with the latest Forex scam alerts

Sign up to receive our up-to-date broker reviews, new fraud warnings and special offers direct to your inbox