At the start of the month Analysts at LPL Financial reported that the S&P 500 index has in 15 of the last 16 years posted a positive return in April. With two trading sessions left in April 2020 and the NASDAQ 100 index showing a month-to-date return of -10.8% next year’s statistic looks nailed on to be referencing 15 out of 17. The question for many is whether now is the time to buy the dips? We look at some of the key elements to consider and the pros and cons of trying to bottom-fish the market, and more importantly, when.

What Went Wrong in April?

The multi-month slide in stock prices was given added momentum in April thanks to severe Covid lockdowns in China reminding investors that the virus hasn’t gone away, and some horrible earnings releases from previous market darlings such as Netflix. These came on the back of Q1 being dominated by concerns about supply-side logistics, inflation, interest rate rises, the Ukraine conflict and record oil prices.

With so many shock events battering the markets it’s almost possible to have forgotten that one of the few potential banana skins to have not appeared so far, is unemployment. That could be about to change.

Trading the Week Ahead

With the US Non-Farm Payroll numbers coming out on the first Thursday of every month the 6th of May is a day to add to the diary. Unless market sentiment changes before the NFP announcement this could be set up to be a lose-lose situation. Even positive news on employment levels could spook the markets as it would suggest there is room for wage-driven inflation to come into play thanks to employees negotiating pay rises to cope with rising living costs.

Before the NFP announcement comes out there are two potential catalysts in play that if they pan out correctly could trigger a bounce.

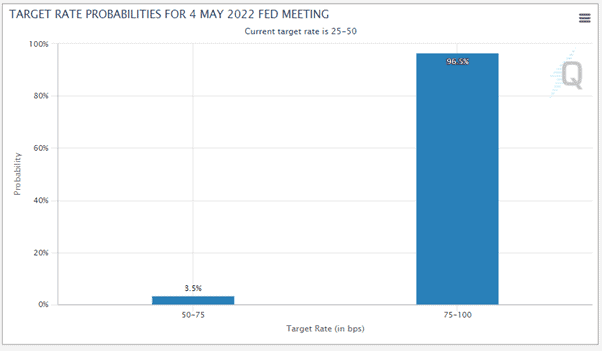

CME FedWatch Chart – 28th April 2022

Source: CME

The most important event is the meeting of the US Federal Reserve on 3-4th May. Traders will have to contend with the increasingly likely risk of a 0.50% hike in US interest rates but that is now priced in. According to CME Group’s FedWatch analysis, those trading in interest rate futures currently put the chances of a 50 basis point rise at 96.5%.

Added to the mix is that earnings season has only just got into full swing. For example, on Thursday 28th April updates to investors will be provided by Intel, Ford, Merck, Unilever, McDonald’s, Barclays, and the largest firm in the world by market cap, Apple Inc.

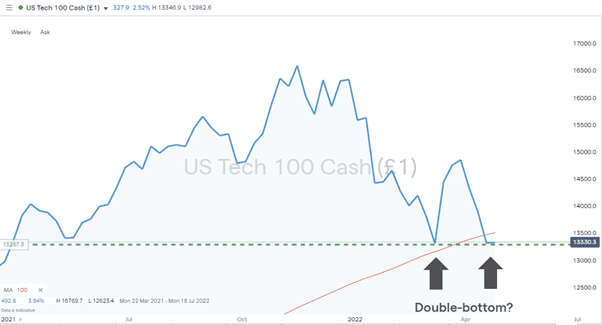

NASDAQ 100 – Weekly Chart – Trading near 100 SMA and forming a double-bottom

Source: IG

There is always a dip and buying into the resulting bounce can generate significant returns, the question is how to time trade entry points. If the potential catalysts which are on the horizon are activated there is potential for a double-bottom price pattern to be confirmed. If Apple’s numbers beat expectations markets can be expected to rally, an interest rate hike of ‘only’ 0.25% could send them sky-high. The temptation to trade the current price slide is very real but it’s worth recalling the trading floor adage that sometimes the best trades you do … are the ones you don’t do.

Crowdsourcing information about scam brokers can help others avoid falling into the traps set by disreputable brokers and you can share your experiences here. If you would like to know more about this particular topic or have been scammed by a fraudulent broker, you can also contact us at [email protected]

Related Articles

- Forex vs Crypto: What’s Better For Beginner Traders?

- Three Great Technical Analysis Tools for Forex Trading

- What Does Binance Being Kicked Out of Belgium Mean for Crypto Prices?

- Crypto Traders and Coin Prices Face New Challenge as Binance Gives up its FCA Licence

- Interpol Declares Investment Scams “Serious and Imminent Threat”

- Annual UK Fraud Audit Reveals Scam Hot-Spots

Forex vs Crypto: What’s Better For Beginner Traders?

Three Great Technical Analysis Tools for Forex Trading

Safest Forex Brokers 2025

| Broker | Info | Best In | Customer Satisfaction Score | ||

|---|---|---|---|---|---|

| #1 |

|

Global Forex Broker |

BEST SPREADS

Visit broker

|

||

| #2 |

|

Globally regulated broker |

BEST CUSTOMER SUPPORT

Visit broker

|

||

| #3 |

|

Global CFD Provider |

Best Trading App

Visit broker

|

||

| #4 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #5 |

|

Global CFD & FX Broker (*Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more) |

ALL-INCLUSIVE TRADING PLATFORM

Visit broker

|

||

| #6 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #7 |

|

CFD and Cryptocurrency Broker |

CFD and Cryptocurrency

Visit broker

|

||

|

|

|||||

Forex Fraud Certified Brokers

Stay up to date with the latest Forex scam alerts

Sign up to receive our up-to-date broker reviews, new fraud warnings and special offers direct to your inbox