After market close on Wednesday, GameStop, king of the meme stocks, will release its Q1 earnings, and given the battle taking place between retail and institutional investors, some extreme price volatility can be expected. As exciting as that might be, basing trading decisions off historical earnings is a fundamental problem for stock pickers – it involves looking in the rear-view mirror. What they really need is intel on upcoming events. Fortunately, the AGM held earlier in the day provides a better opportunity to identify the catalysts for the next move. It’s even possible for shareholders to try to steer the firm in one direction or another. However, one problem is already rearing its head: voting rights. Here’s the latest in GameStop stock news.

The AGM will be open to investors only – the media are not allowed. This is a shame as it could get raucous as the ‘Diamond Hands’ Reddit buyers find themselves in the same room as hedge funds. Thankfully, COVID-19 regulations will require them to maintain a distance between each other. The problem is that a group of smaller investors will find themselves fighting with one hand behind their back due to their brokers not allowing them to cast votes in accordance with their shareholding.

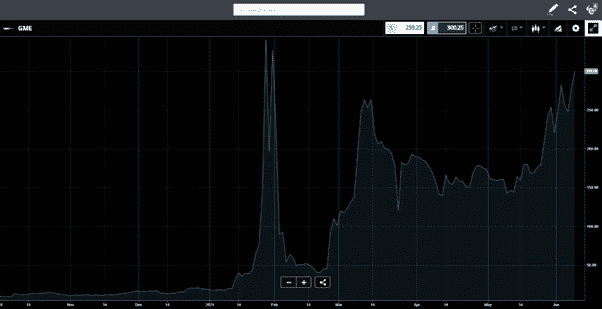

GME Stock Price at a Tipping Point

Source: eToro

The basic principle of AGMs is that votes are cast according to shareholding. In the case of GameStop, those votes could be crucial to determining its future plans. Industry reports and trader feedback have highlighted that some platforms are allowing retail investors to trade but not to vote.

Speaking with Investment Week, Cliff Weight, director of investor group ShareSoc, picked out the main culprits. His accusation was that industry heavyweights Hargreaves Lansdown and AJ Bell have been underinvesting in their technology and customer service.

Weight said: “Their platform is prehistoric, and they seem to treat customers as a source of profit rather than prioritising customer service.”

Source: Investment Week

Not all brokers are looking to take commissions but not offer voting services. eToro hasn’t been around as long as some of the established players, but is one platform that has put new procedures in place to facilitate its clients voting at the GME AGM. The pilot scheme is a welcome move and reflects the innovative approach of the second generation of brokers. GME shareholders were sent email links allowing them to cast their vote and have their say on the next steps for GME. Considering the amount of retail interest in the stock, it’s a shame that all brokers aren’t facilitating this approach.

The GameStop Annual Shareholders Meeting is scheduled for Wednesday, 9th June 2021 at 625 Westport Parkway, Grapevine, Texas. The meeting can only be accessed by shareholders who provide proof of ownership through legal proxy and valid identification. It is expected to kick off, quite literally, at 11:00am ET and conclude at 11:15am.

If you want to know more about this topic or have been scammed by a fraudulent broker, please contact us at [email protected].

Related Articles

- Forex vs Crypto: What’s Better For Beginner Traders?

- Three Great Technical Analysis Tools for Forex Trading

- What Does Binance Being Kicked Out of Belgium Mean for Crypto Prices?

- Crypto Traders and Coin Prices Face New Challenge as Binance Gives up its FCA Licence

- Interpol Declares Investment Scams “Serious and Imminent Threat”

- Annual UK Fraud Audit Reveals Scam Hot-Spots

Forex vs Crypto: What’s Better For Beginner Traders?

Three Great Technical Analysis Tools for Forex Trading

Safest Forex Brokers 2025

| Broker | Info | Best In | Customer Satisfaction Score | ||

|---|---|---|---|---|---|

| #1 |

|

Global Forex Broker |

BEST SPREADS

Visit broker

|

||

| #2 |

|

Globally regulated broker |

BEST CUSTOMER SUPPORT

Visit broker

|

||

| #3 |

|

Global CFD Provider |

Best Trading App

Visit broker

|

||

| #4 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #5 |

|

Global CFD & FX Broker (*Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more) |

ALL-INCLUSIVE TRADING PLATFORM

Visit broker

|

||

| #6 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #7 |

|

CFD and Cryptocurrency Broker |

CFD and Cryptocurrency

Visit broker

|

||

|

|

|||||

Forex Fraud Certified Brokers

Stay up to date with the latest Forex scam alerts

Sign up to receive our up-to-date broker reviews, new fraud warnings and special offers direct to your inbox