Bitcoin’s incredible price rise continued last week, with the crypto increasing in value by more than 19%. These double-digit gains keep stacking up and the usual arguments claiming the valuation is out of hand did nothing to halt the gravity defying price rush.

One factor, to date largely unrelated, could potentially do a lot of damage to the price of Bitcoin and other cryptos. It’s currently only a small part of the Bitcoin jigsaw and might not now be enough to shake bit-bugs out of positions, but it needs to be monitored.

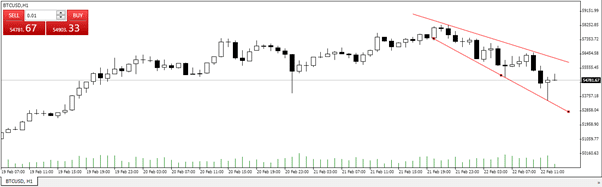

Bitcoin Price Chart – 1H

Source: Tickmill

Will Bitcoin be drowned in a green wave of eco and ethical concerns?

A large amount of new Bitcoin is mined in the Chinese province of Xinjiang. The Cambridge Bitcoin Electricity Consumption Index, as of April 2020, reported that China was responsible for 65% of all Bitcoin mining.

Digging down one more level, they concluded that 36% of total Chinese mining takes place in Xinjiang. The area has an abundant supply of cheap coal which is costly to transport, so the miners have set up their operations in the region.

The difficulty for Bitcoin fans is that it’s estimated that more than a million Uighur Muslims and other minorities have been imprisoned in concentration camps in the region. The plight of the Uighur is gaining momentum in the same way Bitcoin prices have been and the two trends are heading in opposite directions.

The act of mining is an energy-intensive process and cheap fuel is a competitive advantage. The miners who solve complex algorithmic problems to verify blockchain transactions operate on thin profit margins, so relocating would be costly and time-consuming.

If they remain in Xinjiang, then the whole Bitcoin industry would be a sitting duck for those concerned about ethical issues.

It’s hard to gauge to what extent Bitcoin traders’ factor in ethical production methods. At face value, the stereotypical crypto trader would not be automatically bracketed as an eco-warrior. Blindly following that assumption could be costly and BTC investors need to be ready for action.

- Big banks, hedge funds and corporations such as Tesla have expressed a desire to adopt the use of cryptos. They are now carrying considerable reputational risk should public sentiment focus on the plight of the Uighurs.

- Bitcoin was set up to challenge the establishment. Having your production based in such a contentious location is hardly “socking it to the man”.

- A lot of the upward price pressure stems from word of mouth. If boasting about Bitcoin entry price levels becomes taboo, the groundswell of retail support might drain away.

- Regulators and governments which have struggled to contain the boom in cryptos would finally have the moral high ground and greater justification for restricting crypto trading.

Where are we now?

Bitcoin’s Teflon resistance to orthodox valuations makes it immune to the comments of those who form part of the establishment. The more the likes of Warren Buffet and Janet Yellen highlight the potential risks involved in holding Bitcoin, the greater the coin’s kudos among the global community of crypto buyers.

Source: Twitter

The more significant potential threat comes from inside the Bitcoin fan club. One example is the comment made by Elon Musk at the weekend where one short Tweet saying the price of Bitcoin and Ethereum “seemed high” pulverised crypto prices.

Bitcoin Price Chart – 1H

Source: Tickmill

Between Sunday evening and Monday morning, BTC’s value plummeted by more than 8%

If you want to know more about this topic, or have been scammed by a fraudulent broker, please contact us at [email protected]

Related Articles

- Forex vs Crypto: What’s Better For Beginner Traders?

- Three Great Technical Analysis Tools for Forex Trading

- What Does Binance Being Kicked Out of Belgium Mean for Crypto Prices?

- Crypto Traders and Coin Prices Face New Challenge as Binance Gives up its FCA Licence

- Interpol Declares Investment Scams “Serious and Imminent Threat”

- Annual UK Fraud Audit Reveals Scam Hot-Spots

Forex vs Crypto: What’s Better For Beginner Traders?

Three Great Technical Analysis Tools for Forex Trading

Safest Forex Brokers 2025

| Broker | Info | Best In | Customer Satisfaction Score | ||

|---|---|---|---|---|---|

| #1 |

|

Global Forex Broker |

BEST SPREADS

Visit broker

|

||

| #2 |

|

Globally regulated broker |

BEST CUSTOMER SUPPORT

Visit broker

|

||

| #3 |

|

Global CFD Provider |

Best Trading App

Visit broker

|

||

| #4 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #5 |

|

Global CFD & FX Broker (*Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more) |

ALL-INCLUSIVE TRADING PLATFORM

Visit broker

|

||

| #6 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #7 |

|

CFD and Cryptocurrency Broker |

CFD and Cryptocurrency

Visit broker

|

||

|

|

|||||

Forex Fraud Certified Brokers

Stay up to date with the latest Forex scam alerts

Sign up to receive our up-to-date broker reviews, new fraud warnings and special offers direct to your inbox