As ESMA implements it tighter restrictions on forex trading products and CFDs, while banning binary options altogether, regulators across the globe are also clamping down hard on these nefarious trading vehicles, where fraud is rampant and consumer loss ratios are said to exceed 90%. In the UK alone, the FCA has found that, “The majority of consumers who invest in binary options lose money and that investors lost an average of £87,410 per day over the course of 2017.” Following years of lethargy, the regulatory community appears to have gone on the attack, generating a new enforcement wave across the planet directed at the shady underbelly of the binary options industry.

The fact that binary options have developed an extremely poor reputation does not mean that all operators in this sector of the trading arena are fraud and scam artists. There are legitimate firms out there, but a CEO of one of these brokers offered these thoughts on the challenge the industry faces: “The binary options industry has been negatively affected in recent years by the emergence of numerous Israeli operators based in Cyprus, and who often ran their businesses in an unethical and immoral manner. This has led to the misconception that binary options and everyone who offers binary options trading services are fraudulent.”

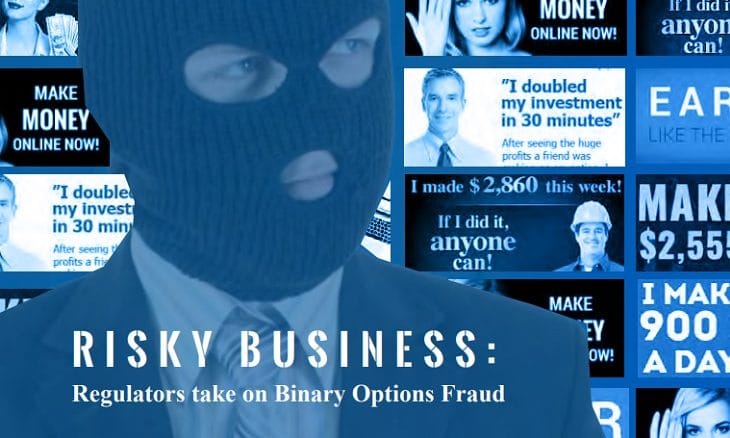

Binary options have had a remarkable history, but the popularity of this genre, coupled with the fact that the traditional brokerage community shunned the product from the start, led consumers down a dark path where only offshore brokers of questionable business practices with no regulatory oversight compliance were their only choice for a trading partner. It is no wonder that organized crime plunged headfirst into this medium in a major way, infiltrating every aspect of its value chain. The result was a massive fraudulent enterprise that fleeced investors of billions of dollars almost overnight.

Consumer complaints skyrocketed at regulatory establishments, which were taken by surprise and had no idea as to the source of the problem. In early 2016, however, Simona Weinglass, an investigative reporter for the Times of Israel, penned her compelling exposé about the binary options industry. We wrote, “Ms. Weinglass revealed the ugly underbelly of an industry that had disguised itself as a highly profitable investment vehicle, while running a rigged gambling casino in the back office.”

As regulators sifted through the avalanche of complaints, the nature of the scam became evident. The quantity of complaints regarding aggressive marketing tactics, bonus come-ons with onerous restrictions, tricking clients into thinking they have invested in company stocks when they were really gambling, the refusal to honor withdrawal requests, and deliberately misrepresenting expiration prices grew to monstrous proportions in every jurisdiction of the globe, especially in developed countries where forex trading had been flourishing for decades.

Subsequent articles by Ms. Weinglass also revealed how extensive and developed the criminal conspiracy had become: “Fraudulent binary options is a vast criminal enterprise, employing thousands of people in over 100 companies, many of them in Israel, but also in countries like Romania, Bulgaria, Ukraine and the Philippines. The industry is thought to earn hundreds of millions, if not billions of pounds a year, and victims worldwide are believed to number in the millions.”

The exposé went on to detail that, “Fraudulent Israeli binary options companies ostensibly offer customers worldwide a potentially profitable short-term investment. But in reality — through rigged trading platforms, refusal to pay out, and other ruses — these companies fleece the vast majority of customers of most or all of their money. The fraudulent salespeople routinely conceal where they are located, misrepresent what they are selling, and use false identities.”

Regulators subsequently ignited their printing presses, releasing a plethora of new regulations. ESMA put pressure on CySEC to clean up its act, and the FCA began plans for taking over responsibility for binary options from the local Gambling Commission, which had done little but monitor the general take of tax revenues from the genre. ESMA also published a new set of guidelines to take effect in July and August to nail down its compliance standards in the EU. The new rules banned binary options altogether within the EU market, due primarily to concerns laid out below.

What were the specific rules put in place by ESMA?

ESMA went through a long and painstaking deliberation period before announcing its final revised rules for the EU. As expected, an industry lobbying effort produced over 4,000 comments, asking for lenience in all areas. On the 1st of June, the regulatory body published its final say. Its Chair, Steven Maijoor, also stated that, “ESMA’s prohibition on the marketing, distribution or sale of binary options to retail investors addresses the significant investor protection concerns caused by the characteristics of this product.”

The staged implementation was defined as follows:

- Binary Options (from 2 July 2018) – a prohibition on the marketing, distribution or sale of binary options to retail investors;

- Contracts for Differences (from 1 August 2018) – a restriction on the marketing, distribution or sale of CFDs to retail investors. This restriction consists of: leverage limits on opening positions; a margin close out rule on a per account basis; a negative balance protection on a per account basis; preventing the use of incentives by a CFD provider; and a firm specific risk warning delivered in a standardised way.

- Leverage limits on the opening of a position by a retail client from 30:1 to 2:1, which vary according to the volatility of the underlying:

- 30:1 for major currency pairs;

- 20:1 for non-major currency pairs, gold and major indices;

- Leverage limits on the opening of a position by a retail client from 30:1 to 2:1, which vary according to the volatility of the underlying:

- 10:1 for commodities other than gold and non-major equity indices;

- 5:1 for individual equities and other reference values;

- 2:1 for cryptocurrencies;

- A margin close out rule on a per account basis. This will standardise the percentage of margin (at 50% of minimum required margin) at which providers are required to close out one or more retail client’s open CFDs;

- Negative balance protection on a per account basis. This will provide an overall guaranteed limit on retail client losses;

- A restriction on the incentives offered to trade CFDs; and

- A standardised risk warning, including the percentage of losses on a CFD provider’s retail investor accounts.

CySEC was quick to follow suit and re-emphasize the new rules for the benefit of the multitude of brokers that have set up shop on the island of Cyprus. Its Chairwoman, Demetra Kalogerou, also went a step further to provide guidance that these rules applied to all clients of its licensees, whether foreign or domestic via a simple answer and question route: “Do MiFID rules apply to customers who are not resident in the EEA? Answer: “Yes. MiFID does not distinguish the obligations of firms to their clients according to the location of the client.”

What has been the reaction by the FCA to these changing tides?

When it comes to regulatory oversight of binary options, the FCA is the “new kid on the block.” Responsibility transferred from the Gambling Commission in January of this year, and the folks at the FCA have made it known to all in the City and the UK that compliance with new ESMA rules is priority Number One. It has delayed banning binary options outright, choosing rather to police heavily in the space, warn consumers of illegal solicitations from offshore, and produce a blacklist of 94 firms that have been accused of committing fraud. Coincidentally, police, in cooperation with the FCA, recently “swooped in” on 20 binary option brokers to validate compliance and gather fraud related data.

Given the long lead time before new ESMA rules were to be effective, the FCA has been concerned that brokers would get creative and design new products that skirted the definition of a CFD in a blatant attempt to avoid new restrictions that became law on the 1st of August. Spreadbetting firms have been actively developing what they term “Turbo Certificates”, which look and smell like a CFD/Binary Option combo. FCA authorities have warned firms to “consider whether the product is offered on terms that act in the best interests of the client. We know that other products can create the same kinds of risks to consumers as CFDs, particularly where they expose the investor to significant leverage.”

Is there a new enforcement wave mounting in the U.S. Market by the CFTC?

The CFTC got the attention of the press and industry pundits when it recently lowered the boom on an enterprising “middle man” that had fed a number of binary scams with clients that he had deliberately duped in the process. The crook was even brazen enough to brag about his antics on social media. The agency is seeking $75 million in fines and penalties from a marketer by the name of Michael Shah, who, according to the CFTC, “worked in tandem with call centers in Israel and steered his American and other financial victims to numerous binary options websites based in Israel.”

Presently, investors in the U.S. market can only trade binary options through two separate regulated exchanges, but Shah and his company sought to funnel unsuspecting consumers by using fraudulent testimonial films, heavy handed marketing solicitations, and promises of immediate wealth from proprietary trading platforms. None of their claims were true, and no license was ever obtained to sell access to these instruments from the CFTC. Clients were handed off to sixteen or more firms in Israel that paid substantial commissions for the service, then scammed the clients for all that they were worth.

According to inside investigators, there are more than a dozen similar actions to the Shah case contemplated in the CFTC’s existing enforcement pipeline. As one industry’s recent headline espoused, “Exclusive: US Authorities to Launch Major Crackdown Against Binary Options.” Expect multiple indictments and a flurry of activity in the coming weeks and months, as prosecutors wreak havoc on their targets.

Concluding Remarks

A new enforcement wave to clean up the binary options space is in progress, but fraud is like a balloon — when you squeeze hard in one place, it pops out in another. Most shady binary option brokers have ignored bans or redefined their various product lines. Others have left Israel and set up operations in Russia, Ukraine, Philippines, Panama, Poland, Albania, Bulgaria, and Serbia. Crooks will never abandon such a lucrative business model. The affiliate marketing industry will follow, as well, if hefty commissions continue.

Be wary of unwanted solicitations touting the next great binary option “look-alike.” The easy path to riches beyond your wildest dreams is only a fiction. Don’t become a victim!

Related Articles

- Forex vs Crypto: What’s Better For Beginner Traders?

- Three Great Technical Analysis Tools for Forex Trading

- What Does Binance Being Kicked Out of Belgium Mean for Crypto Prices?

- Crypto Traders and Coin Prices Face New Challenge as Binance Gives up its FCA Licence

- Interpol Declares Investment Scams “Serious and Imminent Threat”

- Annual UK Fraud Audit Reveals Scam Hot-Spots

Forex vs Crypto: What’s Better For Beginner Traders?

Three Great Technical Analysis Tools for Forex Trading

Safest Forex Brokers 2025

| Broker | Info | Best In | Customer Satisfaction Score | ||

|---|---|---|---|---|---|

| #1 |

|

Global Forex Broker |

BEST SPREADS

Visit broker

|

||

| #2 |

|

Globally regulated broker |

BEST CUSTOMER SUPPORT

Visit broker

|

||

| #3 |

|

Global CFD Provider |

Best Trading App

Visit broker

|

||

| #4 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #5 |

|

Global CFD & FX Broker (*Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more) |

ALL-INCLUSIVE TRADING PLATFORM

Visit broker

|

||

| #6 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #7 |

|

CFD and Cryptocurrency Broker |

CFD and Cryptocurrency

Visit broker

|

||

|

|

|||||

Forex Fraud Certified Brokers

Stay up to date with the latest Forex scam alerts

Sign up to receive our up-to-date broker reviews, new fraud warnings and special offers direct to your inbox