Charles Ponzi’s legacy lives on, in both the UK, as well as across the globe. As long as ordinary investors willingly hand over their savings to anyone that appears to be a professional fund manager, without even so much as a review or due diligence, then this type of fraud will continue to prevail on the investment landscape. Unfortunately, many Ponzi schemes start out as legitimate enterprises, typically hedge funds, but morph into fraud once the fund manager is unable to meet investor expectations.

This type of investment fraud has been around for hundreds of years, but it fastened upon its recent name when Charles Ponzi became famous for his international postage arbitrage proposition in 1920. He promised high returns, using his proprietary, but complex, technique. This ruse requires complexity to lure in the uniformed and make them believe that outrageous returns can be had. When the expected returns do not materialize, then future investors must be sought out. The new funds will pay for returns and withdrawals of earlier investors, along with the manager’s rather sizeable cut for himself.

Happy investors tend to spread the word, and as long as monthly reports look favorable and the total fund liability keeps expanding, then these deceptions can perpetuate themselves for lengthy periods of time before they unravel. The problem is that law enforcement authorities cannot uncover these operations early unless there are ample complaints from investors that lead to fruitful investigations. If the promoter is clever, he will pride himself on customer service, never allowing a client to become disgruntled.

If the law does not detect the fraud in process, then these Ponzi schemes usually end in one of three ways. First, when the conman has had enough, he will vanish with any remaining funds. The disappearing act can make big headlines, as worried investors cannot believe the reality that unfolds. In the second case, the fraudster just runs out of money. It happens. If he cannot convince and avalanche of new investors to jump onboard and he has already blown the bulk of the proceeds on paying for his extravagant lifestyle, then the party is over. Lastly, when market conditions take a turn for the worse, investor withdrawal requests can swamp a promoter. The resulting liquidity crunch forces a spotlight on his nefarious operation, large enough for the law to take immediate action.

The largest Ponzi scheme on record goes to Bernie MaDoff, topping out at nearly $20 billion, while more aggressive estimates have actually hit multiples of that figure. Bernie started out as a legitimate investment firm in the sixties, but came crashing down in 2008 after the Great Recession caused a run on his fund. His deception was a playbook of the typical characteristics: continuous higher than market returns, fraudulent monthly accounting statements, expansion spurred on by word-of-mouth, funding early investors with funds from new investors, and a lavish lifestyle for himself and his family. Court documents revealed that Bernie’s scam may have lasted forty years before detection.

Unfortunately, this one major triumph in the annals of crime has now convinced every high and low level hoodlum in the universe that the best risk/reward ratio for a fraudulent enterprise has to be that for a Ponzi scheme. Over the last seven years, regulators and the law have shut down a multitude of this type of investment scam. Post-MaDoff, analyst estimates for total Ponzi scheme fraud in the Americas has been in excess of $50 billion. If you include Europe and Asia, you could easily treble that number. Ponzi schemes are definitely on the rise, and, due to the complexity of foreign exchange trading, our industry offers just the right formula for Ponzi to work at all levels.

Do investors ever get any of their money back? Unfortunately, as we reported in an article a year ago, “After fines and court costs, investors rarely see as much as 20 cents on the dollar, but hope does spring eternal. The sad part for investors, however, is when they receive a notification from the bankruptcy judge that many of the Ponzi-type interest and principal payments must be returned to the court, a process referred to as “clawbacks”. Ironically, you instantly become a defendant in a case where you had been victimized.”

Many of today’s Ponzi promoters appear to be content with quick hit-and-run schemes, especially when it comes to forex fraud. Yes, there are still the larger operations that target millions and more, but the degree of Ponzi uptake has spread across all spectrums of capital loss, from a few thousand up to several million Dollars, Pounds, or Euros, take your pick.

Alex Hope and Joe Lewis are just two names that will live in infamy in this area. Both individuals got their starts in London and took off from there. The former set his sights on £5.5million, while the latter is said to have been a currency trader that vanished with over £130 million in investors’ cash. Perhaps, these two stories will make you think twice before allowing any fund manager to have total control over your investment capital.

Alex Hope, a 25-yearold whiz kid, simply said, “Currency is my passion!”

Formerly a caterer at Wembley Stadium events, Alex Hope was going nowhere fast on the London scene. He quickly glommed onto forex trading as a worthy pursuit, after reading two books on the topic during his morning and afternoon commutes. He switched jobs to a local Forex Academy training company and launched a PR campaign that proclaimed himself to be a boy wonder. In his own words, “In two to three months, I managed to teach myself what I would have learnt from a three-year course. Who would have thought I would become a trader in the City? Certainly not me. In a year or two, I’d like to set up my own mini hedge fund.”

His publicity campaign and website worked. Money soon came flowing in, enough to now finance a short film about Master Hope’s trading prowess. Court papers disclosed that, while the film was being made in 2012, Hope actually recorded losses in excess of £500,000. Withdrawals also followed to fund his already extravagant lifestyle. According to the trial prosecutor, “He promised investors and potential investors huge returns. In truth this was not a real trading scheme at all. It was a classic Ponzi fraud. He used their funds as his personal piggybank. A massive amount was spent on himself. The investors who put in the money in good faith had no idea this was happening.”

Evidence in court demonstrated that Hope had “spent over £1million in a casino, over £200,000 on designer watches and shoes, £60,000 on foreign travel and £600,000 in bars and nightclubs in London, Miami and New York.” On one occasion, he earned the title of “King Popper” after popping the cork on a £125,000 a bottle of champagne – a Nebuchadnezzar, which held 15 liters. If Hope did have a talent, it was in finding ways to blow a large amount of money in a short period of time. He was arrested in 2012 after running through an estimated £2 million in one year.

What little money Hope did trade only amounted to more losses. He is currently serving out a seven-year jail sentence. According to officials at the Financial Conduct Authority (FCA), “Hope’s sentence is the joint longest ever imposed as a result of a prosecution by the FCA.” Even at this stage, Hope denies any wrongdoing, except that he never obtained the necessary licenses required to do business in this arena. He will most likely be greeted with hefty fines when he gets out of prison, as well. The lesson for all is to Validate your manager’s certifications and be wary of marketing spiels from inexperienced managers.

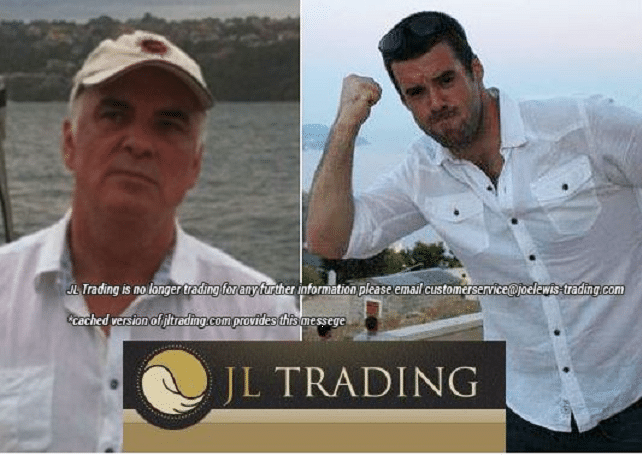

Joe Lewis and JL Trading – How a name can bilk investors out of £130 million

If there is a British version of Bernie MaDoff, then it would have to be Joe Lewis and his JL Trading empire gone bust. There is another Joe Lewis, a famous forex trader and multi-billionaire that resides in the Bahamas and acts through the Tavistock Group, and who also owns the Tottenham Hotspur FC. The other Joe Lewis and JL Trading are not affiliated with the former in any way. He operates out of Istanbul, until his recent arrest. As reported in April 2015, “The 60-year-old was arrested in East Yorkshire by detectives on suspicion of fraud by false representation and money laundering and is currently being questioned in a local police station.”

Mr. Lewis of JL Trading is reputed to have recorded foreign exchange trading losses approaching £100 million by 2009 and then went about attempting to recover his losses via a private investment club. He primarily solicited high-net-worth individuals, starting in 2011. The minimum investment amount was £16,000 or $25,000. These investors were promised annual returns of up to 36 percent, a dead giveaway that something nefarious was afoot. It now appears that all of these funds were lost, as well, but the source of the losses is not understood. Mr. Lewis has admitted his inability at making his investment strategies pay off, but at the end of the day, the assets are gone and there is very little to speak of.

In a message to nearly 1,000 investors, eerily MaDoff-esque in its delivery, Lewis wrote that, “Whilst I regret some of the things I have done, I will do my best to remedy this situation. Please note, I have covered up my mistakes from everyone including my staff, no one else knew what was happening.” Mr. Lewis’s son, James, is just one of people that is confused by the entire affair: “He didn’t live extravagantly. I don’t know where the money’s gone. I am happy to share information with the legal entities. Everything he had is ruined. There are no assets at all that I am aware of.”

The wheels of justice are moving slowly on this matter, but jail terms and fines will certainly be the long-awaited outcome. As for Mr. Lewis, he has no way “to remedy this situation.” Where the money went is still a mystery. The lesson: Be sure you know whom you are dealing with before handing over your life’s savings!

Concluding Remarks

Yes, Ponzi schemes are alive and proliferating across the planet. If you have not been approached or told by someone you trust that they have the greatest forex trader known to mankind, then keep a watchful eye. Ponzi schemes are bilking investors everyday. To be forewarned is to be forearmed!

Related Articles

- Forex vs Crypto: What’s Better For Beginner Traders?

- Three Great Technical Analysis Tools for Forex Trading

- What Does Binance Being Kicked Out of Belgium Mean for Crypto Prices?

- Crypto Traders and Coin Prices Face New Challenge as Binance Gives up its FCA Licence

- Interpol Declares Investment Scams “Serious and Imminent Threat”

- Annual UK Fraud Audit Reveals Scam Hot-Spots

Forex vs Crypto: What’s Better For Beginner Traders?

Three Great Technical Analysis Tools for Forex Trading

Safest Forex Brokers 2025

| Broker | Info | Best In | Customer Satisfaction Score | ||

|---|---|---|---|---|---|

| #1 |

|

Global Forex Broker |

BEST SPREADS

Visit broker

|

||

| #2 |

|

Globally regulated broker |

BEST CUSTOMER SUPPORT

Visit broker

|

||

| #3 |

|

Global CFD Provider |

Best Trading App

Visit broker

|

||

| #4 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #5 |

|

Global CFD & FX Broker (*Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more) |

ALL-INCLUSIVE TRADING PLATFORM

Visit broker

|

||

| #6 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #7 |

|

CFD and Cryptocurrency Broker |

CFD and Cryptocurrency

Visit broker

|

||

|

|

|||||

Forex Fraud Certified Brokers

Stay up to date with the latest Forex scam alerts

Sign up to receive our up-to-date broker reviews, new fraud warnings and special offers direct to your inbox