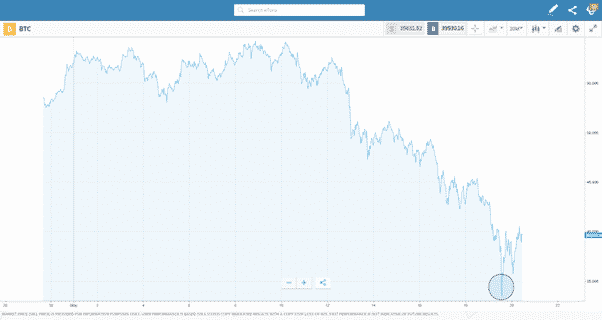

Wednesday will go down as a significant milestone in the crypto markets. The unprecedented price falls in Bitcoin, Ether and Dogecoin wiped billions off the valuation of the crypto markets. The obvious temptation at this point is to “buy the dips”.

The recent events confirm nothing can be guaranteed and trading crypto is a high-risk return operation even during quieter spells. Those who endured severe pangs of FOMO during the recent multi-month crypto bull run and are convinced the market has finally bottomed out, also need to consider risks other than the fact that price might move against them.

The Dos and Don’ts of Crypto Trading?

The main risk to avoid is opening an account with a scam broker. During times of market stress, it’s also important to avoid signing up with a weak broker, one which might not survive the market turmoil. That is even more important than timing your buy trade correctly. The worst-case scenario would be you make the right call, buy the dip, think you’ve made a profit, to ultimately find your broker won’t even return your initial stake, let alone any profits.

The Crypto Price Crash Could Have Been Even Worse

The crypto price crash on Wednesday was dramatic enough, but it could have been even worse. Some regulators, most notably the Financial Conduct Authority (FCA) in the UK recently brought in new regulations designed to reduce the risk in the crypto market. Since January of this year, UK traders have not been able to trade cryptos in CFD (Contract for Difference) form. Buyers could only buy ‘outright’ and not use leverage. Some brokers even stopped offering markets in crypto because upgrading their systems to support the new protocols was unviable.

It’s hard to imagine how things would have panned out on Wednesday if more people had been borrowing money to take positions. That would be the time for panic!

How to Buy the Dips in Crypto?

With all things considered, if you’re still looking to buy the recent dip, the best option is to head to a regulated broker such as eToro which still offers a market in a variety of coins. While the crypto market itself is unregulated, eToro as an entity is regulated by the FCA, which marks it out as one of the few FCA regulated brokers still offering crypto trading to UK clients. FCA regulated brokers stand out from the crypto exchanges. Those exchanges might appear to be crypto specialists because they only offer crypto markets. The truth is that exchanges don’t cover forex, stocks and commodities because those are regulated markets and to do so would mean they’d have to beef up their client protection protocols, which is an expensive exercise.

Funds placed with exchanges don’t have the same degree of protection as they do at a regulated broker like eToro. Being FCA regulated means a broker is required to hold excess amounts of working capital to ensure it can operate in extreme circumstances, it has to provide financial reports to the regulator to demonstrate good practice and its operations are audited by an independent body. Those kinds of protective measures are designed to make sure firms are equipped to survive times of extreme market stress – just like the one being seen now. The Forex Fraud team haven’t seen any rumours of specialist crypto exchanges going under because of the price crash, but it’s something we’re looking out for.

Buying Bitcoin, Ethereum or Doge now could be the deal of the year, or it could not. Market risk is something for each individual to consider. The real killer would be to make that call, ride out the storm and after being proven right to find your profit is only a paper one. If you can’t get your funds back out of an exchange then it will all have been for nothing.

Where Will Crypto Prices Head Next?

The wild price swings in crypto are down to their design, part of their DNA. If any of them do become the global currency of the future their value will be exponentially higher than it is today, or even before the recent correction. The perceived wisdom is that it’s a winner takes all situation with also-rans likely to be worth nothing. The fact that Bitcoin has been the front-runner in the race doesn’t guarantee that coin will become the base of all global activity. It’s increasingly regarded as an effective store of wealth, but transactions still take many minutes to process, which leaves many questioning if it will ever be an effective means of exchange.

Source: eToro

It’s important to be open and honest about the potential gains, as they continue to draw people into the crypto markets. Those who bought into Bitcoin at the time of Wednesday’s lows, in the region of $30,000, will already be sitting on a percentage return above 30%. If you’re trading using funds that you can afford to lose, completely, then crypto might be for you. The carbon footprint of the sector, the wavering support from Elon Musk and the clamp-down on crypto trading by the People’s Bank of China have caused cryptos to lose more than half their value in the space of a few days. Those challenges remain. There are counter-arguments. Most notably the essence of crypto’s appeal is that it is decentralised and unregulated, making any coins generated by central banks and other authorities, an unwelcome alternative for crypto purists.

Regardless of which school of thought is ultimately proved right, the most important thing for experienced and new investors in the market to consider is the safety of funds. Choosing the right broker, and signing up for as much client protection as possible is step 1, 2 and 3.

A Bad Day for Crypto

Wednesday saw Bitcoin lose as much as 30% of its value. The momentary test of the key $30,000 price support level represented a more than 50% fall in value from the $64,862 price level reached as recently as the 14th of April.

Ether, the coin of the Ethereum network, has lost 57% of its value from its all-time heights which were recorded even more recently. Ether was trading at $4,379 on the 12th of May.

If you want to know more about buying Bitcoin or crypto markets in general or have been scammed by a fraudulent broker, please contact us at [email protected]

Related Articles

- Forex vs Crypto: What’s Better For Beginner Traders?

- Three Great Technical Analysis Tools for Forex Trading

- What Does Binance Being Kicked Out of Belgium Mean for Crypto Prices?

- Crypto Traders and Coin Prices Face New Challenge as Binance Gives up its FCA Licence

- Interpol Declares Investment Scams “Serious and Imminent Threat”

- Annual UK Fraud Audit Reveals Scam Hot-Spots

Forex vs Crypto: What’s Better For Beginner Traders?

Three Great Technical Analysis Tools for Forex Trading

Safest Forex Brokers 2025

| Broker | Info | Best In | Customer Satisfaction Score | ||

|---|---|---|---|---|---|

| #1 |

|

Global Forex Broker |

BEST SPREADS

Visit broker

|

||

| #2 |

|

Globally regulated broker |

BEST CUSTOMER SUPPORT

Visit broker

|

||

| #3 |

|

Global CFD Provider |

Best Trading App

Visit broker

|

||

| #4 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #5 |

|

Global CFD & FX Broker (*Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more) |

ALL-INCLUSIVE TRADING PLATFORM

Visit broker

|

||

| #6 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #7 |

|

CFD and Cryptocurrency Broker |

CFD and Cryptocurrency

Visit broker

|

||

|

|

|||||

Forex Fraud Certified Brokers

Stay up to date with the latest Forex scam alerts

Sign up to receive our up-to-date broker reviews, new fraud warnings and special offers direct to your inbox