Expert’s Summary

Expert’s Summary

Swiss Markets is an online brokerage founded under the corporate umbrella of BDSwiss Holding Group—a financial services group that has been in operation since 2012. As they were founded in 2016, Swiss Markets are one of the new entrants into the online forex trading scene.

Founded with a view to providing customers with a safe, transparent, and reliable service for STP transactions, Swiss Markets have found themselves trying to carve out space for themselves in an increasingly crowded space. Despite this, Swiss Markets have managed to build up a solid name for themselves, thanks, in part, to the prestige of the BDSwiss Holdings brand.

But how do they actually compare to the competition out there? Are they worth trading with, or are they simply one of the many mid-range brokers hoping to get in on the action?

Overall, the trading experience offered by Swiss Markets easily competes with the best of them, although it does fall down in certain respects—particularly when it comes to the pricing and fee structure.

Swiss Markets delivered some generally very favourable trading conditions, which is spread across a selection of financial assets that are ready to trade on the live markets. This includes major, minor, and exotic currency pairs, major precious metals, energy products, soft commodities, as well as CFDs on a range of high volume stock indices. Whilst not quite as extensive as some of the biggest players out there, the selection put out by Swiss Markets is very good for a broker of their size and should meet the needs of most intermediate and novice traders.

The straight-through processing—or STP—model means that Swiss Markets can offer customers extremely tight spreads on the majority of asset classes on offer. The average spread for the EUR/USD, for example, runs from 0.2 pips—although this is indicative only, with the final spreads offered varying across asset classes and subject to liquidity. Customers can trade lots from as small as 0.1 up to a maximum of 50 lots per currency trade, which suits the needs of both novice and intermediate traders. There is also plenty of leverage for those of you looking to margin trade.

It should be noted, however, that the fee Swiss Markets charge on trades is relatively high, which can reach as much as $11 depending on the asset class and volume traded. Whilst this might seem high, depending on what markets you trade, this might be balanced out by the competitive spreads they offer.

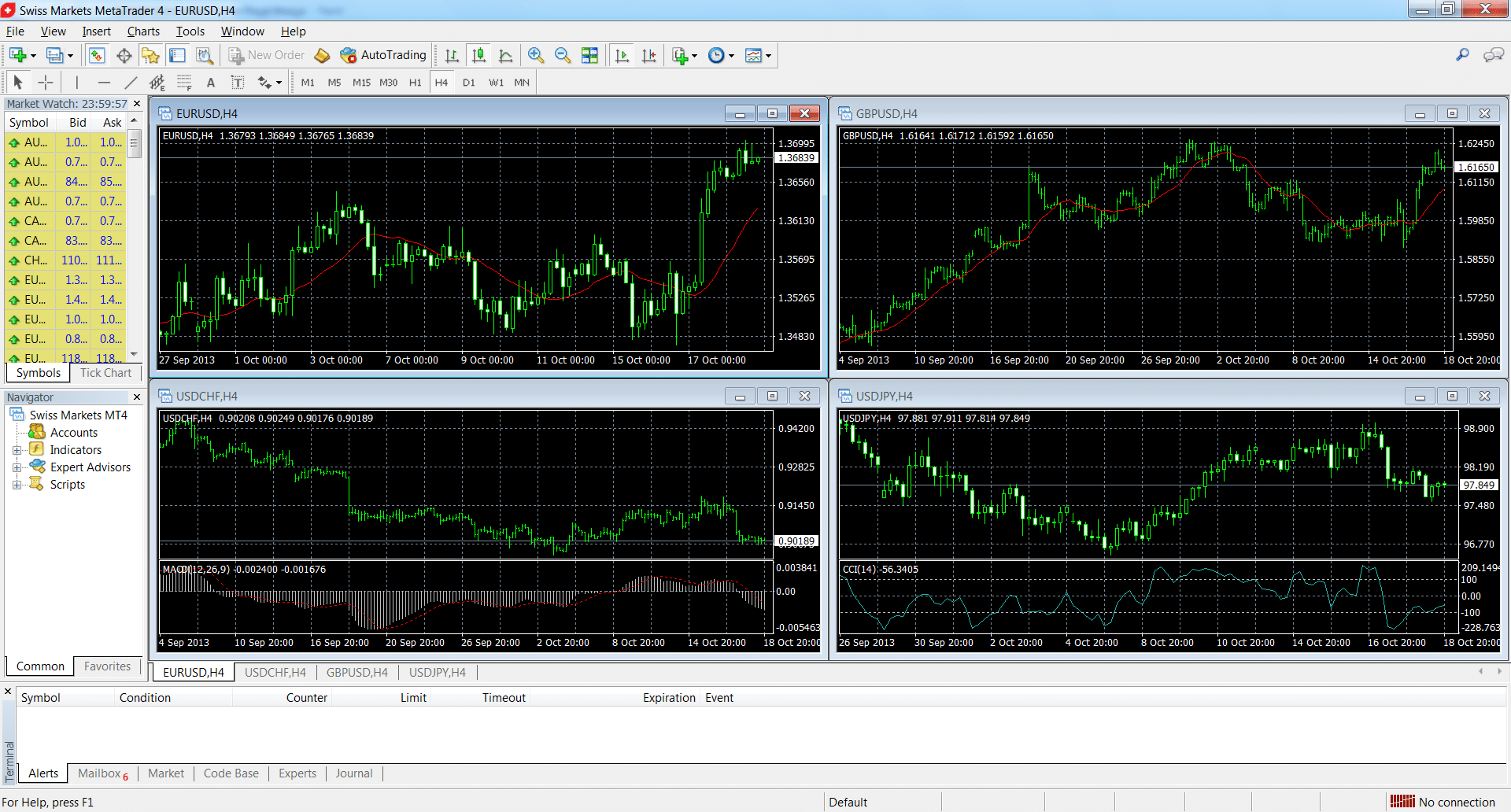

Trading is delivered through the classic MetaTrader 4 platform, which offers all the functionality and usability we have come to expect from it.

In terms of customer trust and safety, Swiss Markets also keep things above board—which definitely lives up to their founding aim of keeping things transparent. Furthermore, as they are established within the EU, this means users of the platform will benefit from both local law and EU wide financial services directives.

With all that said, despite their age, Swiss Markets have put together a really solid package that competes with the best of them in certain respects. Whilst the fees on trades was a bit off-putting at first, the conditions offered are generally competitive, particularly given the range of asset classes and markets you are given access to.

The Swiss Markets brand was established in 2016 and it makes up the trading division of the BDSwiss Holding PLC group that was founded in 2012. Swiss Markets is incorporated and registered in Cyprus with incorporation number HE300153, and the broker is regulated by CySec (the Cyprus Securities and Exchange Commission) under license number 199/13.

Swiss Markets is a forex and CFD broker that offers an STP or Straight Through Processing service and remains committed to providing a secure, transparent and reliable trading environment for its clients.

** Swiss Markets does NOT accept clients from the USA. **

Unique Features of Trading with Swiss Markets

Swiss Markets makes an extensive list of assets available to its clients for trading. These include 18 major pairs, 19 minor pairs and 40 exotic pairs in the forex market; major precious metals like gold, silver, platinum, palladium and copper; energy products that include U.S. oil, Brent crude and natural gas; and soft commodities like cocoa, orange juice, coffee, cotton, and sugar. The broker also provides CFD pricing in 23 of high volume stock indexes that include the S&P 500, the Nikkei 225 and the FTSE 100.

An unusual feature for online forex brokers is that Swiss Markets charges as much as an $11.00 commission per trade for all forex currency pairs, with the exact amount dependent on what type of account the client trades in.

That fact is balanced by the broker’s very tight STP dealing spreads that average between a very narrow 0.2 of a pip for EUR/USD to 2.4 pips for the GBP/NZD currency pair that has the widest dealing spread within the major crosses. Dealing spreads are not fixed but can vary substantially depending on liquidity.

Swiss Markets lets its clients deal in amounts as small as 0.01 of a lot to a maximum of 50 lots per currency trade, in addition to being able to enjoy a leverage ratio as high as 500 to 1 in the Classic account, or up to 200 to 1 in the other live account types.

Trading Software

Swiss Markets centers its trading platform experience on the ever-popular MetaTrader4 or MT4 that remains the market standard for forex traders and is available as a free download from the broker. In addition to its desktop and web-based versions, MT4 also has a mobile trading platform that runs on all Android and iOS mobile devices.

The beauty of MetaTrader is that it permits a wide variety of technical analysis to be performed on real time data, as well as providing account monitoring, custom indicators and trading automation capabilities. MT4 even allows a trader to backtest strategies over historical data.

Putting STP trading access and pricing together with the powerful MT4 platform makes Swiss Markets state of the art when it comes to pricing, analysis and execution.

Deposits and Withdrawals

The minimum initial deposit required by Swiss Markets for a live trading account is $200, although some account types have higher requirements. After the initial deposit, there is no further minimum deposit requirement. The maximum leverage is 500 to 1 in the Classic account, but only 200 to 1 in the other live accounts.

Swiss Markets allows deposits to be made at no charge using various payment options that include: credit cards like Visa, MasterCard and Maestro; electronic payment services like postepay, giropay, Neteller, SOFORT, eps, Przelewy24, Skrill (formerly Moneybookers); and by Swift Bank Wire Transfer. Deposits are typically credited immediately to the account other than for wire transfers can take from one to four days to complete. Traders then use the broker’s Client Portal to make further deposits.

Withdrawals require appropriate documentation to be submitted and verified, and withdrawals can only be made to the account that the original deposit originated from. Withdrawals can be made to Visa, Mastercard, Skrill, Neteller, etc…, and using a Swift Bank Wire Transfer. No charge is made for withdrawals that usually take 24 hours to complete.

Beginner Support

Swiss Markets’ customer service largely consists of direct telephone numbers in the UK, Switzerland, Poland, Germany, the Czech and Slovak Federative Republic, Spain, Hungary and Russia. While they do not specify their support hours, several email contact addresses are available on their website’s “Contact Us” page.

The broker’s live chat function does not presently seem to be functioning properly, and a query was met with a request to leave a message and email address. A response was eventually received several hours later by email.

Furthermore, while the broker claims to offers advanced educational resources in the “About Us” section of its website, no such material was found by searching for it as of this writing.

Safety

Swiss Markets is fully owned by BDSwiss Holdings PLC that backs up its broking activities. Furthermore, as an investment firm registered in Cyprus, Swiss Markets is subject to extensive and stringent EU regulations over its financial activities and must comply with the MiFID or Markets in Financial Instruments European Directive. The broker also must segregate client account funds from its own.

In addition, Swiss Markets provides the extra safety net of Negative Balance Protection to its trading clients that assures them their account balance will never go below zero, irrespective of market conditions when trades are closed out.

Other Services:

Swiss Markets provides access to demo account trading for new potential clients and those looking to practice or test out a trading system.

In addition, the broker offers four live STP account types. These include a Classic STP account with only a $200 minimum deposit required, as well as a RAW STP SWISS 11 account, a RAW STP SWISS 8 account and a RAW STP SWISS 5 account that each differ by the amount of initial deposit needed to open them with and have differing commissions charged per trade.

Swiss Markets provides mobile trading via MT4 that is compatible with both Android and iOS mobile devices.

Conclusion

Although Swiss Markets is a relatively new online broker, they are regulated by CySEC and offer a potent combination of STP trading and MetaTrader4 that will strongly appeal to more advanced and high volume traders looking for the best possible dealing spreads and execution speed in a wide variety of interesting asset classes.

One possible issue active traders may have with Swiss Markets is that fact that the broker charges a commission on each trade. This can become problematic for high transaction frequency strategies like those used by some scalpers.

Furthermore, since virtually no training material or live chat feature currently seems to be available from the Swiss Markets website, this broker may not suit novice traders who need more training options and consistent live chat support from their trading partner.

Safest Forex Brokers 2025

-

-

-

-

-

4.8-

-

-

-

-

4.9-

-

-

-

-

5-

-

-

-

-

4.9-

-

-

-

-

4.9-

-

-

-

-

5-

-

-

-

-

5Forex Fraud Certified Brokers

Stay up to date with the latest Forex scam alerts

Sign up to receive our up-to-date broker reviews, new fraud warnings and special offers direct to your inbox

Stay up to date with the latest Forex scam alerts

Stay up to date with the latest Forex scam alerts

Sign up to receive our up-to-date broker reviews, new fraud warnings and special offers direct to your inbox

Stay up to date with the latest Forex scam alerts