Expert Summary

Octa belongs to a group of companies that include Arlear Inc OU, Octa Markets Inc, and Octa Markets Cyprus Limited.

Incorporated in 2011, the CFD broker comes under the stringent regulations of the Cyprus Securities and Exchange Commission (CySEC) in Europe. To expand its services to include international clients, Octa Markets Inc has included a registered office in St. Vincent and the Grenadines. In line with the expansion of services, OctaFX as the main brand was previously known has now rebranded into Octa as of September 2023, embarking on the next step by streamlining corporate branding.

Rating Overview

| Overall rating | ⭐⭐⭐ |

| Regulation | ⭐⭐⭐ |

| Fees | ⭐⭐⭐⭐ |

| Range of Markets | ⭐⭐⭐⭐ |

| Platforms | ⭐⭐⭐⭐ |

The CFD broker offers investors the choice of two account types. The Octa MT4 account is ideal for beginners because of the small-scale trading it offers. The minimum deposit size can be as small as $20 and offers leverage of up to 1:500 (depending on the residence of the customer). The MT5 account is for smart tech trading with a max trading volume of 500 lots, offers a wider range of markets, and there are no swaps.

It is effortless and inexpensive to register with Octa. All you have to do is choose your kind of trading account, select your platform, make a minimum deposit from $20-500 and start trading.

When it comes to the trading conditions, the broker’s retail clients in Europe receive max leverage of 30:1 while professional and international clients receive leverage up to 500:1.

Octa provides several educational resources for beginners. These comprise video tutorials, forex education, glossary and frequently asked questions.

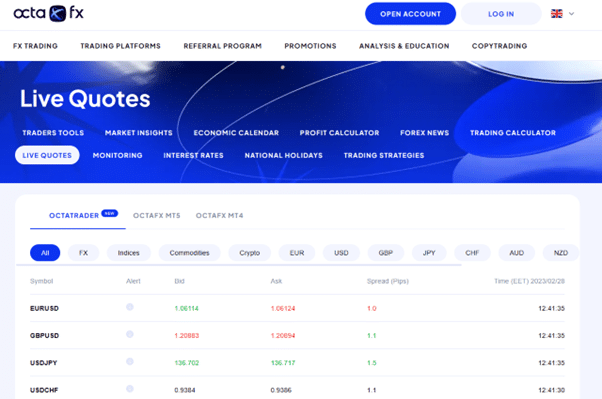

To benefit experienced traders, the broker has included numerous analytical features and tools like a live economic calendar, market insight, forex news, and a trading calculator. Most of them are directly accessible from the website. In terms of customer support, you can get in touch with the broker 24/5 via phone, email and live chat.

Octa is an STP-ECN broker, offers tight spreads, negative balance protection, ultra-fast order execution, zero slippage, and no requotes.

The broker’s multiple deposits/withdrawal methods come at zero cost, the choice of two base currencies for fund transfers and immediate processing of withdrawal requests. Clients outside the European Union also receive bonuses and promotional offers from time to time.

Octa is the recipient of several industry awards for excellence in customer support, services, superior trading apps and others. A couple of the accolades are for the ‘Best forex broker Asia’ in 2018, the ‘Best forex ECN broker’ in 2017 and ‘Best Online Broker Global 2022.’

Free Demo Account

No Purchase NecessaryOcta Trading Features

Why trade with OctaFX.com? The firm lists these reasons:

- Founded in 2011 and headquartered in Saint Vincent and the Grenadines;

- Regulated by CySEC.

- 12 major industry awards received for services in 2022;

- STP/ECN format ensures no slippage, no re-quotes, tight spreads, and fast execution;

- No trading room or dealing desk in ECN environment trading against you;

- There are two different types of account available to Octa users – MT4 and MT5.;

- Customer service reps work “24X5” on market days to fulfill your every need for assistance;

- State of the Art Network ensures stability, great execution, reliability, and deep liquidity from global banking providers;

- ECN fixed spreads begin as low as 0.2 pips;

- Up to 1:500 leverage with micro-lots (0.01 size) available for everyone;

- Client deposits are always held in safe and secure accounts, segregated from the firm’s operating capital;

- Scalping, hedging, trading on the news, and EAs are permitted at Octa.

- The firm is always conducting a contest or a new promotion for the benefit of its clients.

Octa Leverage and Spreads

As a non-dealing desk STP/ECN broker, Octa can guarantee very tight spreads from 0.2 pips, no slippage, and no re-quotes. Leverage up to 500:1 is also offered, even on small micro lot positions.

Octa Trading Platform

Octa offers two different trading platforms for your use, each allowing for unlimited access from your desktop, laptop, or mobile device. Octa grants access to the highly popular MetaTrader series of forex trading platforms. The MT4 set will support your android, iphone, or any WinMobile OS compliant device. The latest technology in 128-bit SSL protection routines are utilized to encrypt all trading session and personal data, providing peace of mind from any unexpected compromise from the hacking community.

** MT5 Platform now available!

Low Minimum Deposit - $5!

Click Below To Get Started

Opening an Account

Octa FX has built a strong reputation in the trading community for providing a user-friendly and fast-moving trading platform which helps traders execute trades with cost-effective pricing. Unsurprisingly, the process of setting up a new Octa FX account is also streamlined and easy to navigate.

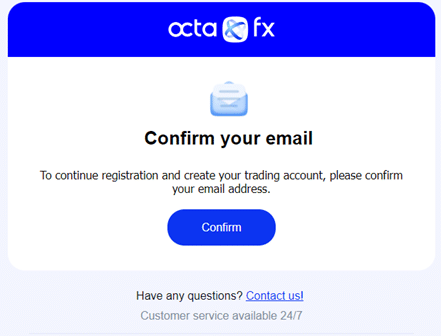

The ‘Open Account’ button can be found on the home page, and after entering your basic details, the broker requests new users verify an email sent to their account.

Right from the start of the process, Octa FX is keen to support traders by offering access to the 24/7 customer support team who are on hand around the clock to help with any queries.

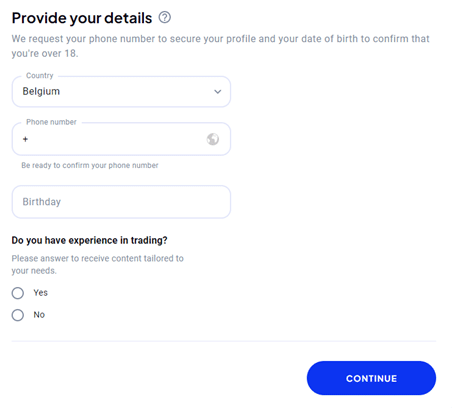

The next stage of onboarding involves following a clearly laid out series of questions. The broker needs to establish where you live, your trading experience, your educational qualifications and what you want to achieve from investing in the financial markets.

This process is in line with standard market practice and a sign that the broker is well-regulated – they have to build a user profile to comply with KYC (Know Your Client) protocols.

There aren’t any right or wrong answers to the questions asked, it’s more a case of ensuring client care is paramount, and the process also provides a convenient way for traders to evaluate their investment aims.

Compare Octa (Formerly OctaFX) with other approved brokers

|  |  |  | |

| Regulation | CySEC | ASIC, MiFID, FSA, FSCA | FCA, CySEC, DFSA, BaFIN, SCB, CMA & ASIC | FCA, CySEC, FSCA, Seychelles FSA, Labuan FSA |

| Customer Support | email, phone | email, phone, live chat | email, phone, live chat | email, phone, live chat |

| Trading Platforms | MT4, MT5, WebTrader, Mobile Apps | MT4, MT5, Mobile App | MT4, MT5, cTrader, TradingView | MT4, MT5, WebTrader |

| Minimum Deposit | $5 | $100 | $200 | $100 |

| Leverage | 1:500 | 400:1 | 1:30 | Tickmill Ltd 1:500, Tickmill Europe 1:30 (retail) & 1:300 (pro), Tickmill UK 1:30 (retail) |

| Total Markets | 80 | 1260 | 1200 | 637 |

| Total Currency Pairs | 30 | 55 | 62 | 62 |

| Total Cryptocurrencies | 0 | 17 | 18 | 9 (* CFD Crypto trading is available only to Professional Clients under Tickmill UK.) |

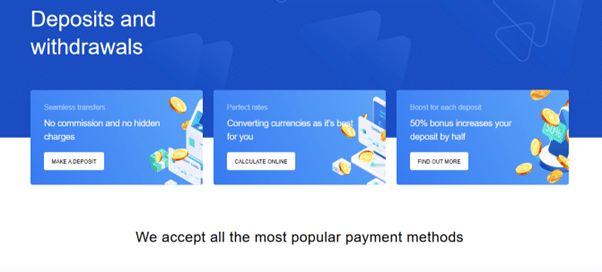

Making a Deposit

After providing the required information, new users can move on to funding their new brokerage account with the cash required to finance their trading.

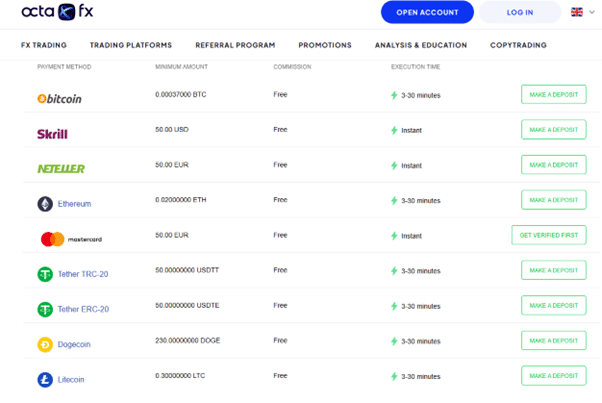

Octa FX stands out from the rest of the sector regarding payment options. Credit card and debit cards can be used, but also ePayment services such as Skrill and some cryptocurrencies such as Bitcoin and Ethereum.

The payment processing times vary across the different services. Card transactions are instant, and crypto deposits take 3 – 30 minutes to clear. Checking the T&Cs of your chosen provider can help you establish the best way to fund your account. Some may also apply charges, which are out of Octa FX’s control, but the broker doesn’t apply any fees during the deposit process.

The minimum deposit requirement is also low. It’s possible to fund your account with as little as $50 or the equivalent. That is an excellent option for beginners who don’t want to risk too much capital in the first instance.

Withdrawals are commission-free, but it is worth checking if your third-party provider offers equally competitive terms.

Placing a Trade

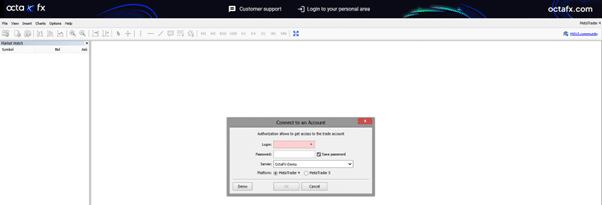

Three platforms are available at Octa FX: MetaTrader’s MT4 and MT5 and the in-house Octa Trader platform. All can be downloaded to desktops, accessed from a web browser, or used on mobile devices by selecting and downloading the appropriate app.

The Octa Trader platform is the easiest to access as it is the broker’s own interface. Setting up with MT4 or MT5 requires making a note of the additional log-in details provided by MetaTrader, which provides the platform to Octa FX under licence.

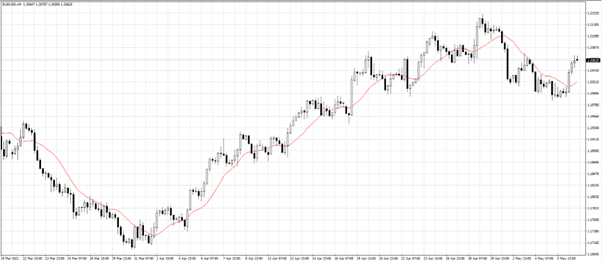

To test the trade execution credentials of Octa FX, we logged into the MT4 platform and booked trades in EURUSD and GBPUSD. MT4 is packed full of powerful software tools and trade indicators designed to help users, but in both instances, we found it easy to navigate to the desired market and book trades within seconds.

The trades were reported accurately in the site’s Portfolio section, and closing them out was a similarly hassle-free process. The crisp aesthetic of the dashboard is appealing and gives traders everything they need without creating a cluttered feel.

Contacting Customer Support

Octa FX customer support is available on a 24/7 basis. The broker pledges to be ready to respond to Live Chat requests within 30 seconds, and during live testing, we found they improved on that benchmark with queries being handled immediately. The staff were well informed and professional and able to help us deal with the beginner / intermediate grade questions we presented them.

More in-depth issues can be addressed by sending the broker an email. We found that the questions we asked via this method were fully addressed within 24 hours.

There is a dedicated telephone helpline referenced during the account opening process. Still, most queries are dealt with by the Live Chat, which refreshingly doesn’t involve talking with a ‘bot’ before being put through to a human agent. The chat service is provided in seven languages.

The impressive customer support service is backed up by a range of additional resources. There are articles and videos on how the financial markets work, investment ideas, and the practicalities of trading and operating an account. All of the materials are easy to access and presented in a straightforward manner.

Octa Review Conclusion

Octa has already garnered a number of prestigious industry awards and favorable testimonials, a good basis for choosing this relatively new entrant in the forex broker arena. Having built a reputation under the brand name of OctaFX, it is a big move to streamline the brand name, but one which makes a lot of sense based on the direction of the broker. They are also one of the few brokers willing to share volume data online. For example, on average, 500 new clients, 50,000 profitable trades, and $4 billion in value traded happen on a daily basis. Octa also acts in full compliance with international legislation and regulatory standards, in addition to local oversight. FXEmpire, a reputable forex site in London offered these words of praise, “Octa have managed to conquer the hearts and minds of many of their clients with the effort and dedication that they put into providing top notch services to their clients. For those who are in the market for a reliable and efficient forex broker, Octa certainly comes highly recommended.”

Safest Forex Brokers 2025

-

-

-

-

-

4.8-

-

-

-

-

4.9-

-

-

-

-

5-

-

-

-

-

4.9-

-

-

-

-

5-

-

-

-

-

5Forex Fraud Certified Brokers

Stay up to date with the latest Forex scam alerts

Sign up to receive our up-to-date broker reviews, new fraud warnings and special offers direct to your inbox

Stay up to date with the latest Forex scam alerts

Stay up to date with the latest Forex scam alerts

Sign up to receive our up-to-date broker reviews, new fraud warnings and special offers direct to your inbox

Stay up to date with the latest Forex scam alerts