Featured Forex Broker

This secure framework acts as a base for some of lowest cost trading in the market with trade execution backed up by some very impressive behind the scenes infrastructure designed to offer the best access to the financial markets. Read the full review of Tickmill

Founded in 2015, Finmarket may not be one of the veterans of the FX/CFD scene, but it is certainly not a rookie either.

Interestingly, though it’s been operating for 4 years now, it hasn’t accrued much in the way of relevant feedback from actual traders. It does not have a TrustPilot page and it does not seem to be discussed at any of the other major FX message boards.

While there are a few reviewers who do not seem to think much of it, they fail to provide any proof to argue their case. Indeed, most of these reviews fail to point it out exactly what it is that they do not like about Finmarket.

Some of these feature poor, broken English too, so we cannot exclude the possibility that they are in fact nothing more than cheap hit-pieces.

The regulatory status of the brokerage may not be particularly impressive, but it makes the cut. Based on Cyprus (at 56 Griva Digeni Avenue, Anna tower, First floor, 3063, Limassol), the broker is regulated by CySEC – one of the most popular regulators (as far as brokers are concerned).

The license number of the brokerage is 273/15. Thus license allows the broker to provide derivatives-based financial services, personalized trading accounts as well as access to personalized support.

Cyprus is an EU member and CySEC is an EU regulator, which means that Finmarket should be able to legally peddle its trading services all over the EEA – in theory. There are a number of countries in the Economic Area though, which observe very restrictive laws in regards to derivatives trading, like Belgium, and there, Finmarket cannot operate.

In addition to Belgium, the broker does not accept traders from the US, Iran and North Korea either.

That said, it has to be noted that Finmarket is MiFID-compliant.

The corporate operator of the Finmarket brand is a certain K-DNA Financial Services Ltd, based at the above mentioned address.

K-DNA is a registered Cyprus investment firm and as such, it offers its clients a number of protections stemming from the legal obligations entailed by its status.

The monies deposited by traders are kept in segregated bank accounts for instance, and the brokerage is a member of the Financial Compensation Scheme.

Why would a rank-and-file trader find Finmarket’s services interesting and attractive?

The broker provides access to 3 powerful trading platforms, which cover the full desktop and mobile platform-ranges.

24 hour support is available in multiple languages and market coverage of the broker is quite exceptional. In addition to “legacy” asset-classes like Fx pairs, indices and various commodities, Finmarket also supports cryptocurrencies.

The minimum required deposit is just $250, which makes Finmarket accessible to just about everyone interested in trading.

Trading Platforms

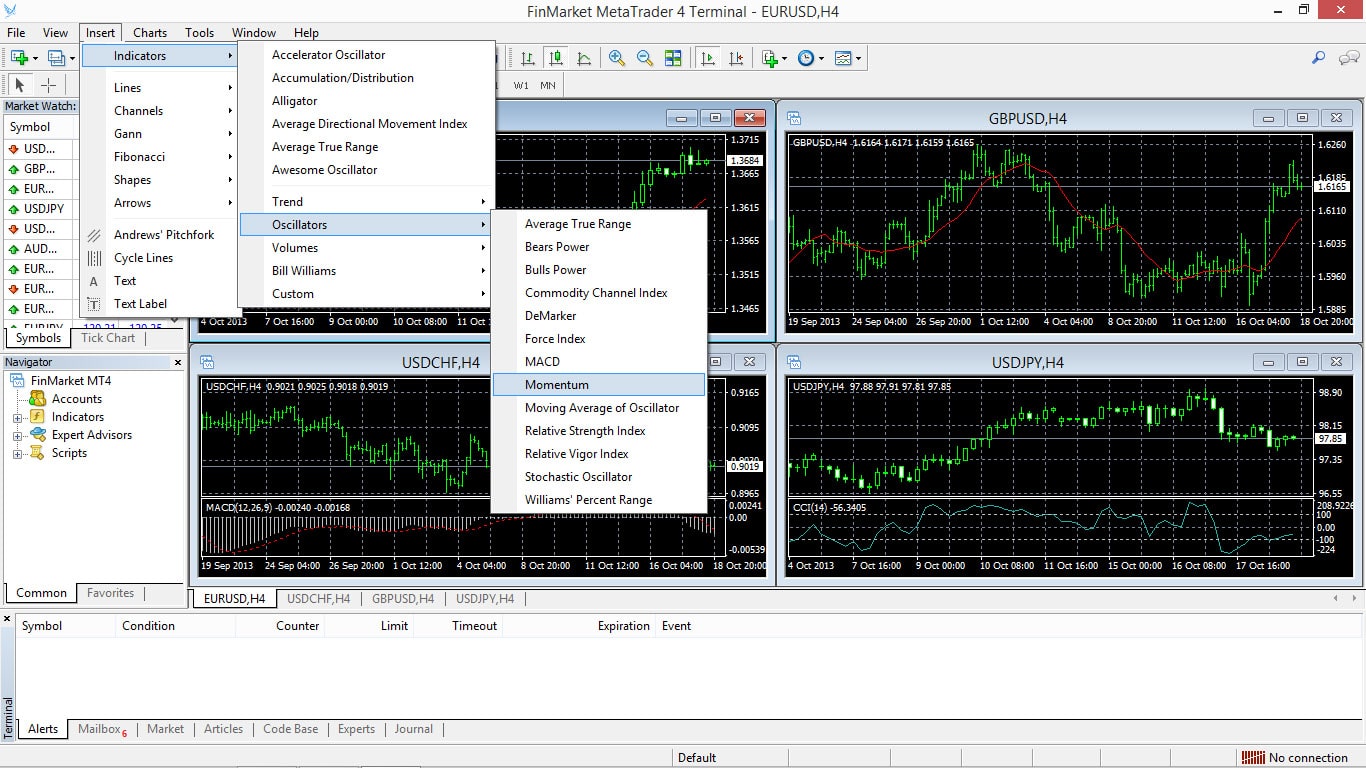

The backbone of the brokerage trading platform-wise is beyond a doubt MT4. MetaQuotes’ creation is the most popular trading platform for several reasons.

First of all: it is downright unbeatable charting- and technical analysis-wise. What it offers in this regard is best described as a “fully customizable trading environment”.

Scores of time frames are supported, and the customized charts can be saved as templates for later use. MT4 usually comes with around 50 preinstalled technical indicators, though this does not mean that traders cannot add more down the line.

In fact, traders are free to create their own technical indicators, making use of the powerful programming language available in the MT4 suite, or they can buy such indicators from 3rd parties and install them.

The same goes for EAs. Expert Advisors are universally loved by MT4 users as they trade automatically according to the parameters defined by traders. When coupled with a custom script and a good VPS service, they can indeed transform one’s trading game completely.

MT4 supports one-click trading and a more than comfortable number of order types.

The platform can be downloaded for free, directly from the official Finmarket site.

The WebTrader offered by Finmarket is for those who – for whatever reason – cannot download MT4 and install it on their local computers.

As far as browser-based trading goes, WebTrader is indeed a superb solution. Featuring outstanding compatibility with all the major web browsers, it offers an excellent trading experience and an impressive set of features.

WebTrader supports one-click trading as well as advanced charting and analysis, with an impressive number of time frames. Its Trading Cubes feature serves up the hottest assets and trading opportunities, according to the individual interest of users.

This platform type also comes with a social trading feature, which lets users see and copy the trades made by their more experienced and knowledgeable peers. The broker does not accept any responsibility in regards to the profits and losses traders realize by using this feature.

Finmarket’s Mobile Trader is available in 2 versions: one for Android and another for iOS.

Both apps deliver an amazing set of trading tools, charting options and technical indicators. Both can be used as fully-fledged environments for trading on the move.

Deposit/Withdrawal Methods

Traders can make their deposits via a selection of credit cards (VISA, MasterCard) as well as eWallets and other online payment solutions, such as Skrill, GiroPay, Klarna, Rapid Transfer and EPS.

Withdrawals are processed within 48 hours.

Account Types

The most basic of the account types offered by Finmarket is the Blue one. The minimum required deposit for this account type is $250.

The Blue Account covers some 50 tradable assets, and it features floating spreads starting from 0.4 pips.

The Silver Account ups the stakes quite a bit: it requires a minimum deposit of $5,000. The floating spreads start from 0.2 pips. Some 70 tradable assets can be accessed through this account option.

The Gold Account requires a minimum deposit of $20,000. In exchange for that, traders gain access to over 100 tradable assets, and the spreads start from as low as 0.1 pips.

The Elite membership features by-and-large the same trading conditions as the Gold option. For the $50,000 minimum deposit though, traders are offered personalized support, VoD Library access, daily market reviews, and an interesting selection of trading tools, not to mention a London Stock Exchange course.

In addition to these “standard” account options, there’s a free demo account and an Islamic Account type available too.

The minimum deposit for the Islamic Account is $500. The floating spreads start from 0.65 pips on this one.

The maximum available leverage is 1:30 on all the above account types.

It has to be made clear that cryptocurrencies cannot be purchased from the broker. The trading of these assets is done through financial derivatives called CFDs.

Conclusion

Finmarket looks like a decent trading destination. It is accessible and its trading conditions – as well as trading platforms – are more than decent.

Above and beyond the trading tools featured by its platforms, Finmarket offers comprehensive education. There is a Trading Academy at the official site, featuring strategies, tutorials, a VoD archive, as well as courses aimed at beginners.

The above detailed account types cater for every possible need.

As far as drawbacks are concerned, the broker does not offer localized support, and some say that multi lingual support is only available on paper. Finmarket support can be contacted though [email protected].

The website does not currently feature an FAQ section.

Please be advised that certain products and/or multiplier levels may not be available for traders from EEA countries due to legal restrictions.

Safest Forex Brokers 2025

-

-

-

-

-

4.8-

-

-

-

-

4.9-

-

-

-

-

5-

-

-

-

-

4.9-

-

-

-

-

4.9-

-

-

-

-

5-

-

-

-

-

5Forex Fraud Certified Brokers

Stay up to date with the latest Forex scam alerts

Sign up to receive our up-to-date broker reviews, new fraud warnings and special offers direct to your inbox

Stay up to date with the latest Forex scam alerts

Stay up to date with the latest Forex scam alerts

Sign up to receive our up-to-date broker reviews, new fraud warnings and special offers direct to your inbox

Stay up to date with the latest Forex scam alerts