ApolloFinances is another new broker to emerge from the Marshall Islands jurisdiction. There is naturally plenty of interest in this broker and what it can offer from its ‘offshore’ location.

Established as recently as 2020, some traders will be playing a game of wait and see before considering whether to join this new broker – and that’s fair enough, though the good news is that you have nothing to worry about because ApolloFinances has shown that it is a brand that can be trusted.

What does ApolloFinances offer its clients? On the table is a library of 100+ tradable assets across all of the key areas, including stocks, forex, commodities, CFDs and more besides. You will be delighted to know that you can trade without fees.

As an offshore operator, ApolloFinances is able to offer higher leverage to its clients, and it has taken that opportunity with enthusiasm – you can utilise leverage of up to 1:400, depending on the account option you choose (more on that later), and while spreads are variable, the top-tier clients with this broker can enjoy spreads as low as 0.1 pips on their EUR/USD positions.

You’ll get to access the MetaTrader 4 (MT4) platform, in both its web-based and mobile forms, which ensures that you have 24-hour access to the markets and your open positions. This is widely considered to be the best trading software in the game, so ApolloFinance’s clients have that peace of mind to fall back on. As well as traditional trading techniques, you can deploy strategies such as scalping and hedging with no fear of being ‘punished’ later.

Many of the most important nuts and bolts are in place at ApolloFinances, including efficient customer support that is available through a variety of channels and a secure payments platform that enables you to deposit and withdraw with ease.

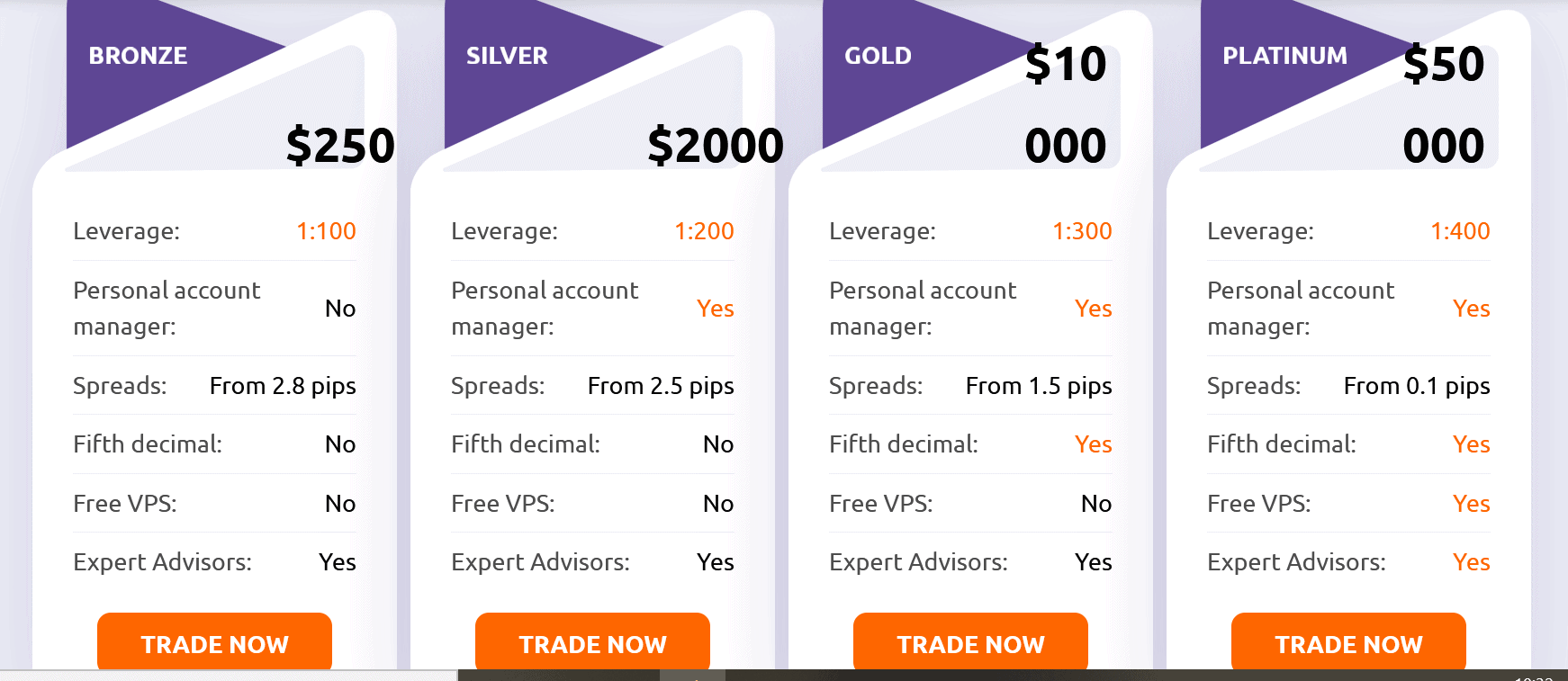

There are four different account types at ApolloFinances, and sadly, as is often the case, those with the least to invest as a deposit are hampered by less agreeable trading conditions than those at the premium end.

That gripe aside, there is plenty to like about ApolloFinances’ platform, and we are confident that traders seeking a new avenue for their investments will be delighted with what is on offer.

Broker Summary

From its Marshall Islands headquarters, ApolloFinances is positioned to offer its brokerage services to clients in jurisdictions around the globe – apart from the US, where access is denied.

Even though it was established as recently as 2020, ApolloFinances reportedly has a client base into the thousands already, and this suggests that it is doing plenty of things right in its early days as a broker.

With a wide range of tradeable assets available, ApolloFinances suits all traders’ needs and presents them with access to the MT4 platform. You can make the most of a number of charts and technical indicators to open and close positions at exactly the right time.

There’s further good news for new traders to the firm. While it doesn’t publicise the fact, ApolloFinances will offer occasional welcome bonuses to new clients. Our advice is to drop the broker a line. You might be surprised at what it can offer you.

With more than 100 tradeable assets available, ApolloFinances doesn’t offer the most exhaustive of asset libraries when you compare it to some other brokers. However, there is still plenty here for traders to explore.

There is a range of currency pairs to trade, including all of the majors and even some exotics and minor pairs to explore. You can monitor prices in real time via MT4, and utilise a range of charts and tools to determine when to get in – and out – of your forex trades.

You can open positions in a number of stocks, with a tech-influenced selection headlined by Google, Facebook, Amazon and more. There are plenty of SMEs to invest in, as well as companies from all over the globe.

If commodities are more your thing, you will find an abundance to work with at ApolloFinances – precious metals, gas, oil, and so much more, with CFDs also widely available.

There is plenty to like about ApolloFinances as far as its product offering is concerned, and you have stacks of profit-making opportunities at hand.

Broker Introduction

Like a number of new brokers that have emerged in recent times, ApolloFinances has decided to set up its registered home in the Marshall Islands.

Admittedly, there are fewer regulatory hoops to jump through, and that is why some traders worry about the ‘scam’ potential of offshore firms, but don’t forget that operating from such a jurisdiction enables the broker to offer higher levels of leverage – this is of great benefit to its clients.

This is a firm that is very much a ‘human’-centred outfit, and you can contact its support team directly via phone, live chat or email should you have any questions.

Depending on the ApolloFinances account type that you opt for, you may also have access to your own personal account manager, and they can provide you with reassurance and assistance should you have any queries about your account, the trading software, or any other trading concerns. This is a broker that is built around personal interaction when required.

Spreads & Leverage

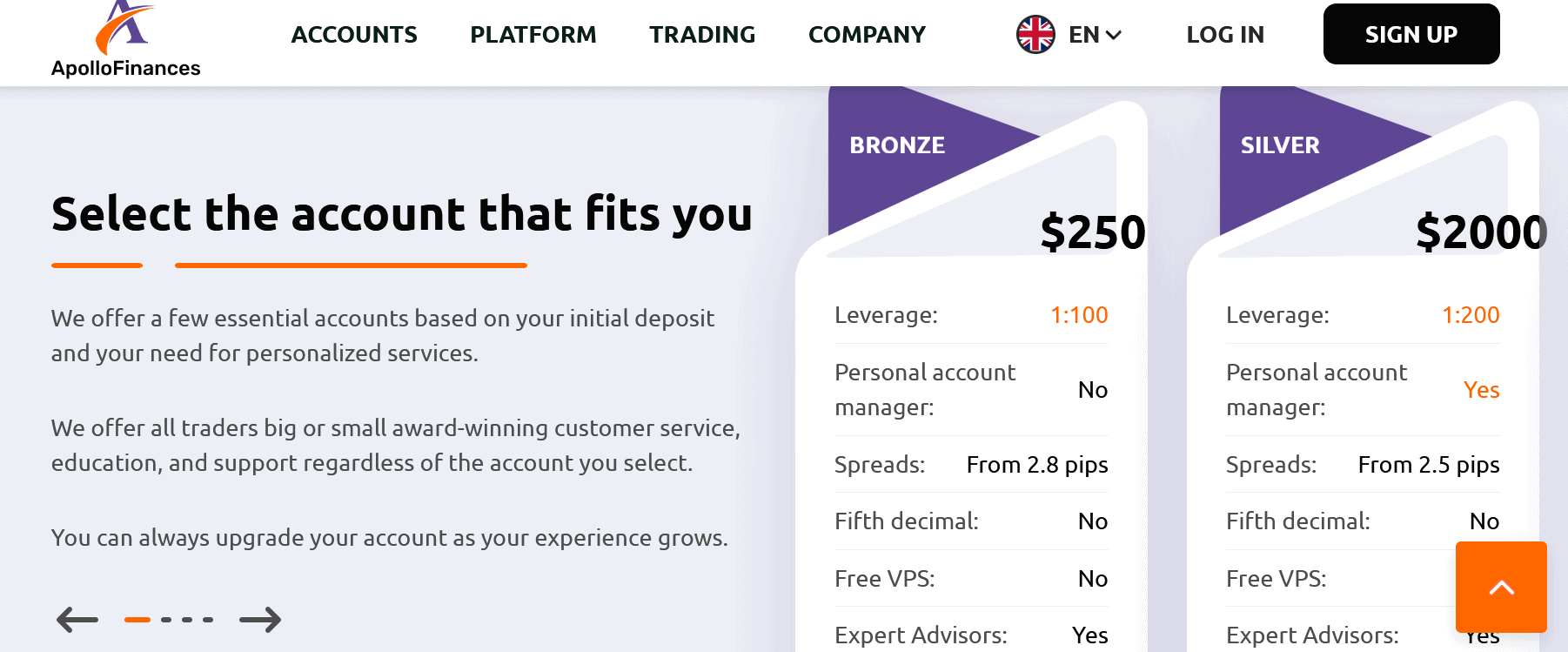

As with most brokers, ApolloFinances offers its clients four different account types that they can choose between based upon their budget and the trading conditions they require.

This is relevant here because the account type you choose will ultimately determine the spreads and leverage levels that you have exposure to. Frustratingly, this is on the proviso that the more you can afford to invest, the more agreeable your set-up will be.

The Bronze account is the entry-level offering from ApolloFinances, and this means that you can invest less as an opening deposit in order to get up and running. However, the upshot of this is that you will only have access to a still admittedly generous 1:100 leverage, with spreads starting from 2.8 pips depending on the asset.

The Silver account is next up, and here trading conditions are slightly more agreeable – you can access leverage of up to 1:200, with spreads dipping down to 2.5 pips depending on the market.

There are two more account types to consider, and as you might have guessed, trading gets even better based on how much you invest initially. The Gold account turns the leverage up to 1:300 with spreads as low as 1.5 pips in some areas. Lastly, there’s the Platinum account – there’s leverage of 1:400 and spreads as low as a game-changing 0.1 pips, depending on the instrument.

Platform & Tools

We’re delighted to see ApolloFinances offering the MT4 platform to its clients.

MT4 remains the absolute standard for trading software, and rather than trying to create anything proprietary in-house, ApolloFinances has realised that you can’t better the best.

With the MT4 platform, you can open and close positions across the broker’s library of assets and instruments, with access to global markets throughout their session opening times.

However, more than this, you can access a variety of industry-standard charts and analytical tools that offer powerful insights into how an asset – or the overall market – is performing and may perform in the future.

ApolloFinances offers its clients access to both the standard WebTrader platform offered by MetaTrader, and also the mobile version, which enables you to manage your trades on the move. The broker even has its own dedicated app, so you can access all of your trading positions and manage your account functions from one place.

ApolloFinances Commissions & Fees

Knowing that many of its up-and-coming rivals are offering fee-free trading conditions, ApolloFinances has opted for a similar approach.

Therefore, there are no fees on your account whatsoever, which is great because you can more easily calculate your overheads to subtract from your trading revenue.

There are no fees on deposits either, though it should be noted that the actual merchant you use – be it a credit card or an e-wallet – may charge fees, so always check before making a transaction.

When it comes to withdrawals, ApolloFinances charges a $20 fee for wire transfers. Bank transfer withdrawals below $500 are charged a 25-unit fee in the currency of the initial deposit.

As you might have guessed, this ensures that ApolloFinances takes its seat at the top table as far as trading conditions are concerned.

Education

For registered traders, there is a dedicated education section of the site where there’s plenty of material to be devoured.

From the mechanics of using trading platforms to the practicalities of opening positions, the education section also teaches about trading strategies and the use of analysis tools.

We would prefer it if there was a continuously updated blog with market insights and updates, and an economic calendar, but we would say that the educational content at this broker is adequate for beginners to trading.

Elsewhere, there’s a full user guide for MT4 published on the site, and all account holders at ApolloFinances can utilise the services of an Expert Adviser if they wish. To reiterate, all but Bronze account holders have access to a personal account manager.

Customer Service

There’s a comprehensive customer service offering at ApolloFinances that affords the peace of mind of knowing that help is at hand should you need it.

You can contact the support team via the website’s live chat function or by email, and there’s also an international phone line that you can call for more immediate assistance.

One of the most pleasing aspects of ApolloFinances’ customer support is just how quickly they authorise withdrawal requests. Those are processed within minutes, and this starts the ball rolling to ensure that any profits you make will reach your bank account in as swift a fashion as possible.

Final Thoughts

In this ApolloFinances review, we have explored this new broker in detail to discover whether it is deserving of the investment of its prospective clients.

The takeaway is that this is a new broker that can be trusted to deliver an excellent service.

Some traders are nervy when it comes to investing with an offshore broker, and that reticence is absolutely understandable. However, there has been no suggestion that ApolloFinances is anything other than a trustworthy broker.

The broker offers enough assets and instruments to trade to keep most traders interested, and even beginners to the game will feel comfortable using the industry-leading MT4 platform.

Trading conditions are agreeable, with access to high leverage and zero fees and commission. However, it should be said that – as is often the case – the traders with the most money to invest, who opt for the higher-tier accounts, will benefit the most from low spreads and even higher leverage.

We would like ApolloFinances to offer more in the way of educational content, but with efficient customer support, the majority of boxes are ticked, and this is why we give this broker a thumbs-up for what we have seen so far.

Broker Details

ApolloFinances is based in the Marshall Islands and is owned and operated by MGX Consalt Group Ltd.

It was established in 2020 and offers a range of trading services to clients all over the world.

With leverage of up to 1:400, ApolloFinances is the perfect broker for those who want to trade aggressively.

Contacts

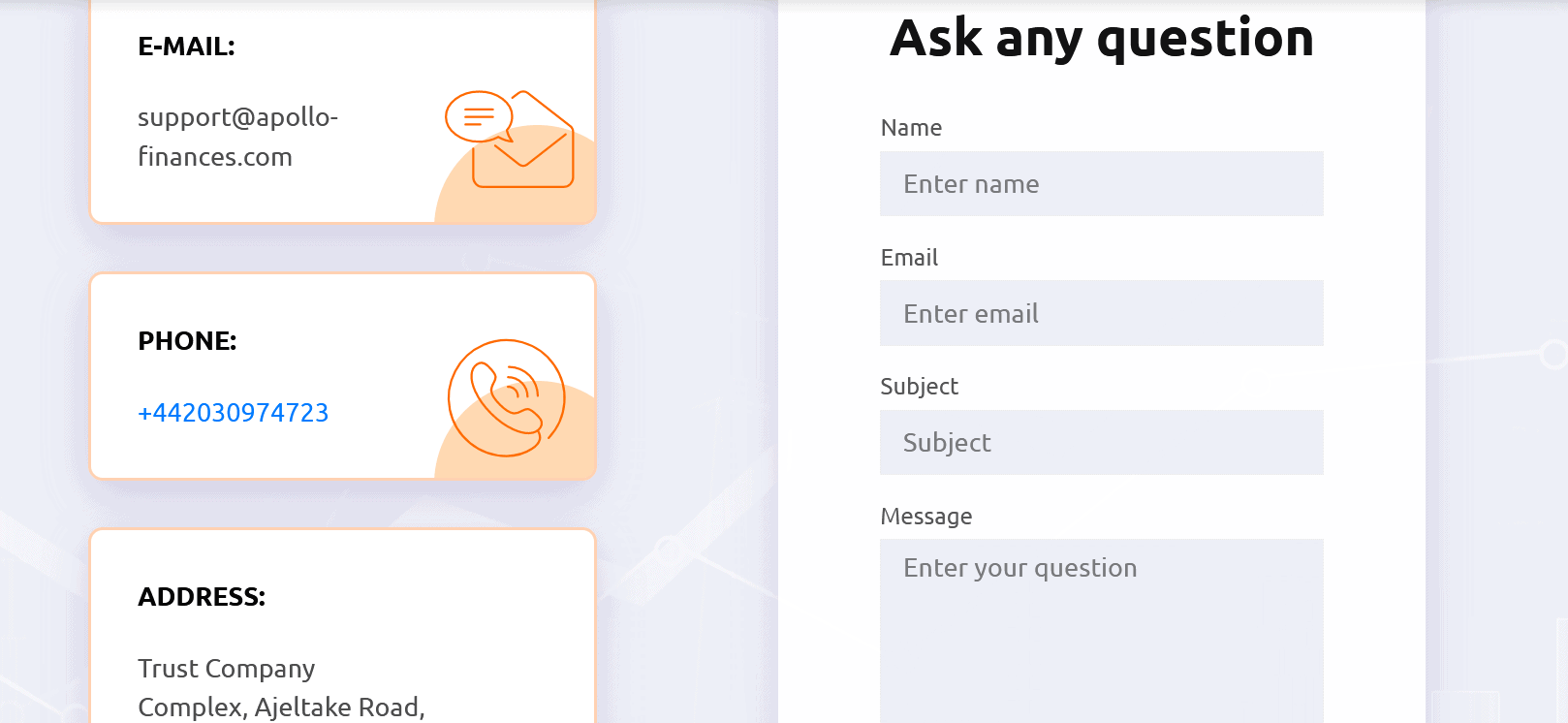

Address: Trust Company Complex, Ajeltake Road, Ajeltake Island, Majuro, Republic of the Marshall Islands, MH 96960

Phone: +442030974723

Email: [email protected]

FAQs

How Can I Open a Demo Account with ApolloFinances?

You can’t miss the sign-up button – it’s at the top of the screen in the right-hand corner – and it’s this that gets you started on your way to getting a demo account with ApolloFinances.

You’ll be asked for some personal information – don’t worry, this data is kept perfectly safe – and then you can make your first deposit using the payment methods accepted. However, you don’t have to take this final step. You can instead for a demo account that lets you trade with virtual currency while you’re learning the ropes.

Is ApolloFinances a Regulated Broker?

The matter of regulation for brokers stationed in the Marshall Islands is a thorny subject.

In essence, the legal landscape is very liberal and there are not too many regulatory concerns – the Global Financial Services Authority does operate in this part of the world, but its powers are limited at best.

However, not all offshore brokers should be judged equally – our research has found ApolloFinances to be a trustworthy, responsive and professional broker.

How Can I Change Leverage with ApolloFinances?

With ApolloFinances, you can enjoy leverage as high as 1:400 on many of its tradeable assets and instruments.

However, it really does depend on which account you sign up for – as ever, the more money you have to invest as a first deposit, the more ‘prestigious’ your account. Platinum users get their hands on the 1:400 leverage, while Bronze clients are offered 1:100.

Therefore, to change your leverage, you simply need to change your account type – you can do that by contacting the ApolloFinances customer support team.

How Do I Withdraw Money from ApolloFinances?

Hopefully, your trading at ApolloFinances will prove to be profitable.

Down the line, you may wish to withdraw funds from your ApolloFinances account, and you can do that by visiting the banking section of the website.

Simply select the amount and the payment method you wish to use, and assuming that your account is verified (don’t worry, this process is much easier than with brokers based in more robust legislative regions), your money will hit your bank account within a matter of days.

Please be advised that certain products and/or multiplier levels may not be available for traders from EEA countries due to legal restrictions.

Safest Forex Brokers 2025

-

-

-

-

-

4.8-

-

-

-

-

4.9-

-

-

-

-

5-

-

-

-

-

4.9-

-

-

-

-

4.9-

-

-

-

-

5-

-

-

-

-

5Forex Fraud Certified Brokers

Stay up to date with the latest Forex scam alerts

Sign up to receive our up-to-date broker reviews, new fraud warnings and special offers direct to your inbox

Stay up to date with the latest Forex scam alerts

Stay up to date with the latest Forex scam alerts

Sign up to receive our up-to-date broker reviews, new fraud warnings and special offers direct to your inbox

Stay up to date with the latest Forex scam alerts