Expert Summary

Bursting onto the scene in 2014 as a result of collaborations between forex industry veterans and fintech disruptors, Alvexo is a subsidiary of the VPR Safe Financial Group Ltd. Alvexo was founded with a vision to empower and educate their client base, and to provide them access to industry-leading technologies. But has it lived up to this founding vision?

Catering equally well to both novice and more advanced traders, Alvexo is an all-around solid trading platform that delivers favourable trading conditions through a user-friendly website that is robust and stable.

Although the commission on certain transactions is slightly on the higher side of the industry average, Alvexo nevertheless offers a client-friendly trading environment through five main account types: Classic, Gold, Prime, ECN Gold, and ECN VIP.

Although the spreads are somewhat high on the Classic account, intermediate traders will be pleased to see the Gold and Prime accounts offer competitive spreads from 2.2 and 1.8 Pips respectively.

For the professional trader, the ECN Gold and ECN VIP accounts are incredibly competitive in terms of pricing, although the account minimums are obviously much higher as a result.

Regardless of what account type you choose, Alvexo provide clients with access to over 450 financial instruments traded in real-time, including forex, indices, commodities, shares, and cryptocurrencies. Importantly, Alvexo operates an STP—or Straight Through Processing—broker model, which gives you direct access to the broker’s liquidity providers which, in theory, should give you much tighter spreads.

Trading is delivered through the popular MetaTrader 4 (MT4) platform that we all know and love, although Alvexo has also developed their own in-house, cloud-based WebTrader platform to supplement this. In terms of functionality, the WebTrader platform provides a well-rounded trading experience that doesn’t leave you feeling like you are missing out when compared to the desktop version.

To help their clients reach their trading potential, Alvexo provides an extensive range of educational materials in the ‘Academy’ section of the Alvexo website. This contains a number of useful resources, including articles, tutorials, and both fundamental and technical analysis resources.

Regardless of whether you are a rookie trader or an industry veteran, there is something of value for you. The research reports prepared by the in-house industry analysts are a particular highlight, which gets published as daily, weekly, and monthly reports of market trends.

In general, Alvexo is a broker that performs solidly all-round in terms of the trading experience on offer. The combination of educational materials, trading resources, and impeccable customer service gives you the impression that Alvexo is a broker that is very much customer-focused.

The STP NDD brokerage model gives you access to plenty of liquidity across all the liver markets with competitive spreads for the most part. All this combines to make Alvexo an easy recommendation for traders of all skill and experiences levels. If any of this has sparked your interest, we recommend giving it a go.

Alvexo was established in 2014 by its parent firm VPR Safe Financial Group Limited and has its headquarters in Limassol, Cyprus. The forex broker has a global presence with additional offices in the UK and Switzerland.

As a forex broker founded by market veterans and technology professionals, Alvexo remains committed to providing comprehensive investment and trading services that give traders the best prospects for success.

Alvexo submits to regulation by CySEC and complies with the EU’s MiFID or Markets in Financial Instruments Directive.

The official website of Alvexo is situated at http://www.alvexo.com, and a screenshot showing its home page appears below:

**Alvexo does NOT accept Clients from USA**

Unique Features of Trading with Alvexo

One of the most notable features Alvexo provides trading clients with is its highly desirable STP (Straight Through Processing) NDD (No Dealing Desk) broker model that allows clients to see very tight markets in the major currencies from the broker’s liquidity providers who act as the counterparty to transactions.

On the downside, that benefit gets somewhat offset by the volume-based commissions that the broker charges for three of their account types. Only their Classic accounts have no commissions, although clients typically pay a considerably wider dealing spread to compensate the broker.

Alvexo offers a demo account with $50,000 of virtual funding, in addition to four types of live trading accounts with different spreads, perks and minimum deposit requirements. The leverage offered by this broker ranges from 1:2 to 1:30 for each live trading account.

Trading Software

Alvexo offers a trading platform for just about every type of trader, including a fully-functional mobile platform that works on the Android and Apple iOS operating systems. Each platform allows traders to access over 40 currency pairs, and a total of more than 100 other assets, including stocks, indices and commodities.

This broker also allows traders to use the highly popular MetaTrader 4 software developed by MetaQuotes. This platform has just about everything a forex trader could want in terms of market analysis, programmable automated trading, and the availability of third party trading software and custom indicators.

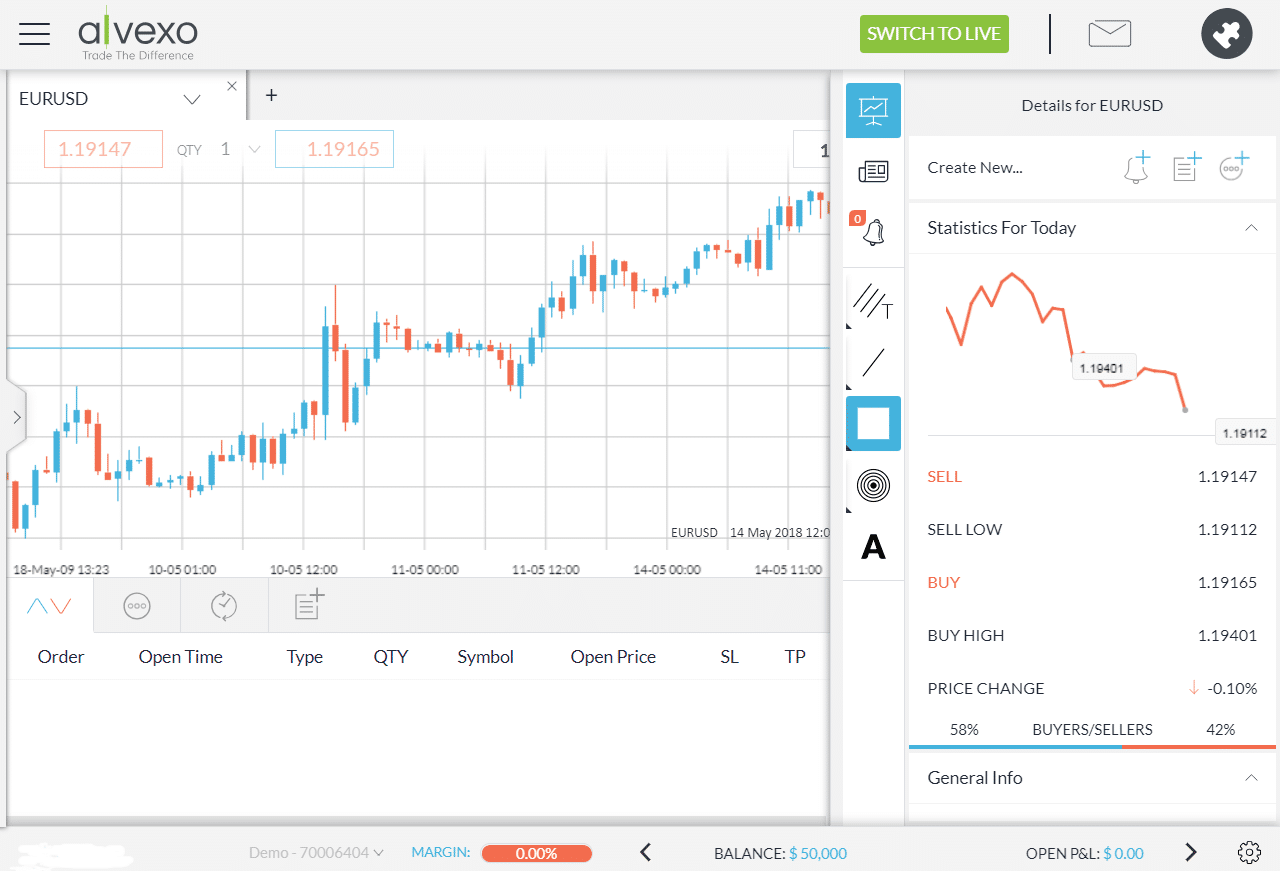

Alvexo also provides their proprietary WebTrader software to clients that can be used from any up to date web browser. The screenshot below illustrates some of the functions Alvexo’s WebTrader offers, which includes position management, market alerts, statistics, and technical analysis features.

Deposits and Withdrawals

The minimum initial deposit requirement of Alvexo is $500, with higher amounts required by more premium account types. Accounts are held in either U.S. Dollars or Euro, and clients are not charged for deposits or withdrawals.

The broker allows clients to make immediate deposits through popular credit cards like VISA, MasterCard and American Express, as well as debit cards, a selection of electronic wallets, and wire transfers. Withdrawals to a credit card can only be made up to the amount deposited via that card, and otherwise they need to go to a bank account.

Deposits made via credit or debit card or e-wallets generally get credited immediately to a trading account, while those made via wire transfers can take up to four days to show up.

Beginner Support

Avexo provides customer support in multiple languages via phone within the UK, Sweden, Cyprus, Spain, South Africa, France, Italy and Romania. Support, finance, compliance and market communications can also be done via email or by fax to the UK, Swiss and Cyprus offices.

One of the major plusses of dealing with this broker for novice traders is its Trading Academy that offers tutorial videos and other learning materials for both novice and more advanced traders alike.

Safety

Avexo is owned and operated by VPR Safe Financial Group Limited, which operates as a Cyprus Investment Firm that submits to CySEC’s oversight under registration number HE322134. Alvexo’s CySEC regulation comes under license number 236/14.

Due to its regulatory oversight, the broker must comply with the EU’s MiFID regulations and Law 144(1)/2007, so the broker’s accounts need to be kept segregated from client accounts. If this segregation fails, then account balances are covered up to €20,000 per person by the EU’s Investors Compensation Fund.

Other Services

Avexo offers clients a variety of additional services that depend on the account type, with those types that require a higher initial deposit having more features. For its four STP live account types, the basic and special features are as follows:

The Classic Account

- Initial deposit of $500,

- Minimum dealing size of 0.01 lot

- Dealing spreads beginning at 3.3 pips.

- No commissions are charged

- Leverage of 1:2 to 1:30

- Free trading signals.

- Stop Out 50%

- Margin Call 80%

The Gold Account

- Initial deposit of $2,500

- Minimum dealing size of 0.05 lots

- Dealing spreads begin at 2.2 pips

- Leverage of 1:2 to 1:30

- Free trading signals

- One-on-one support

- Economic calendar

- SMS capabilities

- Technical analysis.

- Stop Out 50%

- Margin Call 80%

The ECN Account

- Minimum deposit of $5,000

- Minimum dealing size of 0.05 lots

- Dealing spreads begin at 0.0 pips

- Leverage of 1:2 to 1:30

- Cryptocurrency and CFD trading

- Free trading signals

- One-on-one support from Senior Account Managers

- Economic calendar

- SMS capabilities

- Technical analysis.

- Stop Out 50%

- Margin Call 80%

The Prime Account

- Minimum deposit of $10,000

- Minimum dealing size of 0.25 lots

- Dealing spreads begin at 1.8 pips

- Leverage of 1:2 to 1:30

- Cryptocurrency and CFD trading

- Free trading signals

- One-on-one support from Senior Account Managers

- Economic calendar

- SMS capabilities

- Technical analysis and reports.

- Stop Out 50%

- Margin Call 80%

Alvexo Conclusion

Overall, Alvexo looks like a fairly new but well regulated STP NDD broker that also offers clients who qualify for its ECN accounts the opportunity to trade via an Electronic Communication Network with multiple liquidity providers. Under this broker model, Alvexo does not act as a market maker or take on positions from clients itself, so that substantially reduces their conflict of interest with clients.

Although they offer decent trading platform options — including the forex market’s favorite MetaTrader 4 software — one substantial drawback in dealing with this broker if you are using their Gold, ECN or Prime accounts is that Alvexo charges a volume-based commission on transactions. This is partly compensated for by the associated tighter dealing spreads, but it can present an issue for traders with high transaction volumes like scalpers and day traders.

Still, their multi-lingual customer service and learning resources offered via the broker’s Trading Academy should provide enough support for a novice trader to get started, while more experienced traders will like the broker’s materials on advanced trading strategies.

Basically, if their $500 minimum deposit and per-trade commissions do not present an issue, then this broker should offer a reasonable transaction service suitable for traders of any skill level.

Please be advised that certain products and/or multiplier levels may not be available for traders from EEA countries due to legal restrictions.

Safest Forex Brokers 2025

-

-

-

-

-

4.8-

-

-

-

-

4.9-

-

-

-

-

5-

-

-

-

-

4.9-

-

-

-

-

4.9-

-

-

-

-

5-

-

-

-

-

5Forex Fraud Certified Brokers

Stay up to date with the latest Forex scam alerts

Sign up to receive our up-to-date broker reviews, new fraud warnings and special offers direct to your inbox

Stay up to date with the latest Forex scam alerts

Stay up to date with the latest Forex scam alerts

Sign up to receive our up-to-date broker reviews, new fraud warnings and special offers direct to your inbox

Stay up to date with the latest Forex scam alerts