Expert Summary

Andrey Dashin, the owner of the Alpari brand, founded ForexTime Ltd (FXTM) in 2011. The multi-asset ECN broker comes under the regulations of the Financial Conduct Authority (FCA) in the UK, the Cyprus Securities and Exchange Commission (CySEC) in Europe and the Financial Services Commission (FSC) in the Republic of Mauritius.

The regulators governing the CFD broker ensure negative balance protection to retail clients in Europe and the UK. Besides, client capital is secure up to €20,000 and £85,000 under the Investor Compensation Fund (ICF) and the Financial Services Compensation Scheme (FSCS), respectively.

All clients of FXTM have the choice of two MetaTrader platforms- the MT4, MT5. While the MT5 is a common platform for all the account types offered by the CFD broker, the MT4 is not accessible only if you sign-up for the Stock Account. FXTM offers ultra-fast order execution with deep liquidity, and the choice of manual, automated, social, and copy trading features.

Once you register with FXTM, you can trade in 250+ financial instruments comprising CFDs in FX, commodities, indices, futures and shares. Individuals signing-up with FXTM in the UK also have the option of accessing the spread-betting markets.

CFD traders receive tight spreads from 0.1, floating leverage of up to 2000:1, zero or low commissions, swap-free accounts, and the option to invest in fractional stocks trading in the US markets. With more than 30-funding options, zero deposit and withdrawal fees, you can open a live account with as low as $10 and start trading.

With a combined experience of more than 30 years, the management pledges transparency and quality services. The ECN broker is estimated to have more than 2,000,000 clients, provides direct access to stocks listed on the NYSE and Nasdaq, supports clients via the 24/7 multi-lingual helpdesk, and permits traders to carry out hedging, scalping activities. FXTM does not offer its services to residents from the US, Canada, Japan, Haiti, Mauritius, Noth Korea, Puerto Rico, and a couple of other countries.

Rating Overview

| Overall rating | ⭐⭐⭐⭐⭐ |

| Regulation | ⭐⭐⭐⭐⭐ |

| Fees | ⭐⭐⭐⭐ |

| Range of Markets | ⭐⭐⭐⭐ |

| Platforms | ⭐⭐⭐ |

Free Demo Account

No Purchase Necessary

Additionally, there’s the FXTM Pro trading account, tailored for high-end trading professionals and institutions. It features ultimate trading conditions like ultra-fast market execution, spreads from 0.1 pips, and deep interbank liquidity.

Since we last reviewed FXTM, the broker also introduced three times as many CFDs on Spot Metals Commodity Futures, and more. Their Shares trading account – specifically geared for Shares CFDs – is reinforced by a direct connection to the NYSE and NASDAQ for their listed products’ pricing.

As a modern approach to investing and copy-trading, FXTM Invest is an easy-to-use program that brings traders and investors closer to the markets. The company holds true to its core value of transparency by publishing important trading stats on their website: speed of order execution, slippage and requotes levels. Additional information feeds, educational materials, charting tools, and free-flowing commentary make your trading experience ideal and its customer support department is top of the line. Also, if you like contests and promotions or social trading, FXTM does not disappoint.

Compare FXTM with other approved brokers

|  |  |  | |

| Regulation | FCA, FSCA, CMA and FSC | ASIC, MiFID, FSA, FSCA | FCA (FRN 509909), ASIC, FMA, and FSCA | FCA, CySEC, DFSA, BaFIN, SCB, CMA & ASIC |

| Customer Support | email, phone, live chat | email, phone, live chat | email, whatsapp, live chat | email, phone, live chat |

| Trading Platforms | MT4, MT5 | MT4, MT5, Mobile App | desktop and mobile via brokers own platform | MT4, MT5, cTrader, TradingView |

| Minimum Deposit | $200 | $100 | 100GBP/AUD/EUR/USD | $200 |

| Leverage | Flexible | 400:1 | 1:30 | 1:30 |

| Total Markets | 252 | 1260 | 2800+ | 1200 |

| Total Currency Pairs | 62 | 55 | 65 CFD Forex pairs | 62 |

| Total Cryptocurrencies | 4 | 17 | 19 | 18 |

In truth, it is still difficult to find any area of FXTM that’s lacking. They have shown tremendous progress over past couple of years and, if you reside in one of their covered markets, they are well worth your patronage.

** FXTM Limited Does NOT accept Traders from US.

Unique Features of Trading with FXTM

Why trade with ForexTime.com? The firm lists these reasons:

- A management team with a combined 30 years of experience, committed to quality service;

- ForexTime has currently reached over 2, 000,000 clients;

- Brand FXTM is regulated in multiple jurisdictions (ForexTime Ltd by CySEC 185/12 and licensed by FSCA 46614 Exinity Limited by FSC under number C1130112295, Forextime UK Limited by FCA 777911);

- Mobile trading applications are supported (including ForexTime App for iOS and Android devices);

- 250+ trading instruments including forex currency pairs, CFDs, Futures, Precious Metals and Commodities;

- 31+ payment options currently available with no deposit fees and minimum deposits from $200;

- Deep bank liquidity ensures tight trading spreads and superfast execution;

- Hedging, EAs, and scalping strategies permitted;

- No Dealing Desk standard adopted, with eight classifications built on full ECN trading models for professional accounts. Swap-free option available for all account types;

- A direct connection to the products’ price listing on the NYSE and NASDAQ exchanges for the Shares Account;

- Customer service representatives are multi-lingual and may be accessed “24X7” by email, live chat, social media or direct telephone line to one of several satellite offices;

- 18+ languages are supported, and more are added to the site and MyFXTM, the trader’s gateway.

- Promotions and live and demo contests on a regular basis (applicable to clients of Exinity Limited – T&Cs apply);·

- Learning center support includes streaming news feeds, commentary, webinars, educational videos, free training courses and local seminars;

- Investment program offered: copy-trading solution, FXTM Invest;

- Social trading features, trading signal subscription option, charting tools, email and mobile alerts, and streaming news feeds are included in the basic package;

- Client funds segregated in Tier-One banks at all times for protection, in strict compliance with regulatory standards;

- FXTM brand does not provide services to residents of the USA, Mauritius, Japan, Canada, Haiti, Suriname, the Democratic Republic of Korea, Puerto Rico, the Occupied Area of Cyprus).

- FXTM offer a CFD for cryptocurrency trading with floating leverage 1:20000.(*Trading CFDs on cryptocurrencies is only available under Exinity Limited)

FXTM Spread Betting and Leverages

Tight spreads depending on account type and market conditions. With the FXTM Pro Account, spreads start at the tightest possible 0.1 pips. Flexible Leverage, based on country of residence, knowledge and experience. FXTM offers negative balance protection.

Bonus Offer For Forexfraud Visitors

Professional traders can get cash weekly

Opening an Account

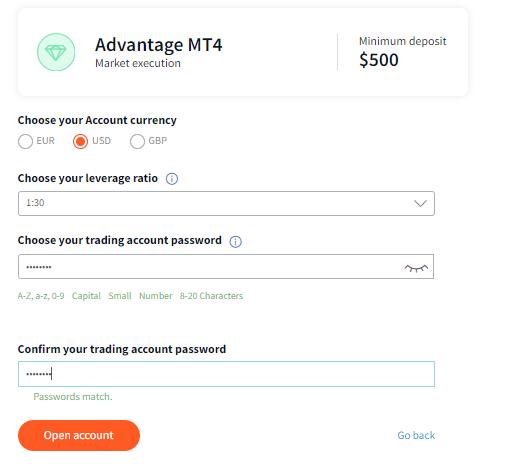

Once that check is completed, the next part of the process involves selecting which of the three FXTM accounts is the best fit. The Advantage, and Advantage Plus accounts are tailored to beginner, intermediate, and advanced level traders.

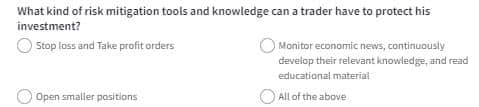

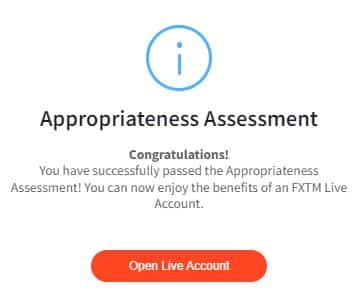

New clients must complete a questionnaire to establish their trading experience and knowledge. It also asks for information on the source of funds and investment objectives. This type of questionnaire is standard procedure for a well-regulated broker such as FXTM. The KYC (Know Your Client) information allows them to establish a user profile for new clients and ensure they follow the duty of care protocols designed to protect client interests.

The three accounts all use the MetaTrader MT4 platform for executing trades. It is possible to choose from three base currencies, USD, EUR and GBP, and to also set leverage terms to the preferred level.

One final KYC check involves uploading two pieces of documentation so that FXTM staff can verify the new user’s credentials. A passport and a driver’s licence can be used for the photo id section, and utility bills and other documents can be used to confirm the home address.

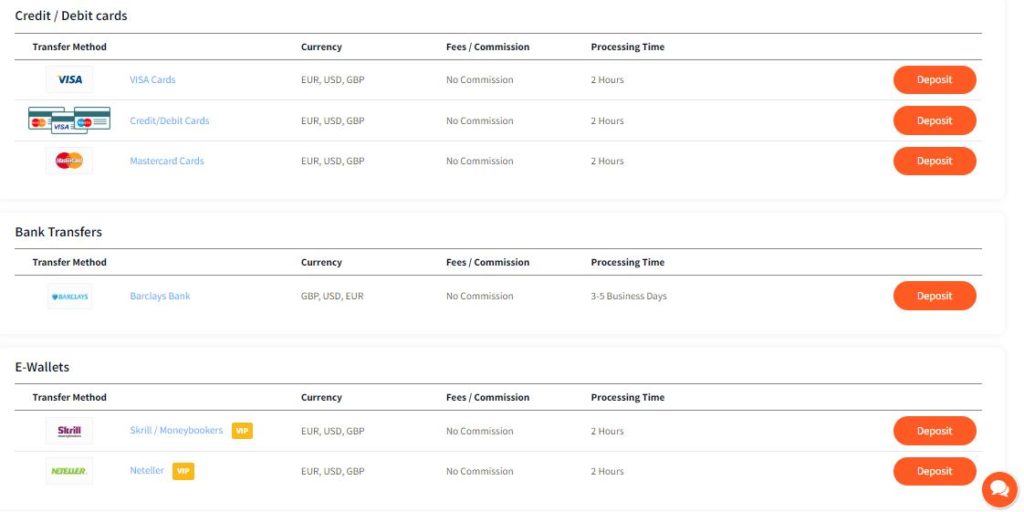

Making a Deposit

There is no need to wait for the KYC documents to be processed before depositing funds in a new FXTM account. Payment options include debit and credit cards, bank transfers, and e-Wallets. Some payment methods can only be used for higher-level accounts, but the basic range of options is in line with standard market practice.

Even more good news: FXTM does not charge fees or commissions on deposits. In all, the onboarding process with FXTM took approximately 30 minutes. Some sections of the questionnaire were more detailed than with some other brokers but offered reassurance that the broker takes its compliance obligations seriously.

Placing a Trade

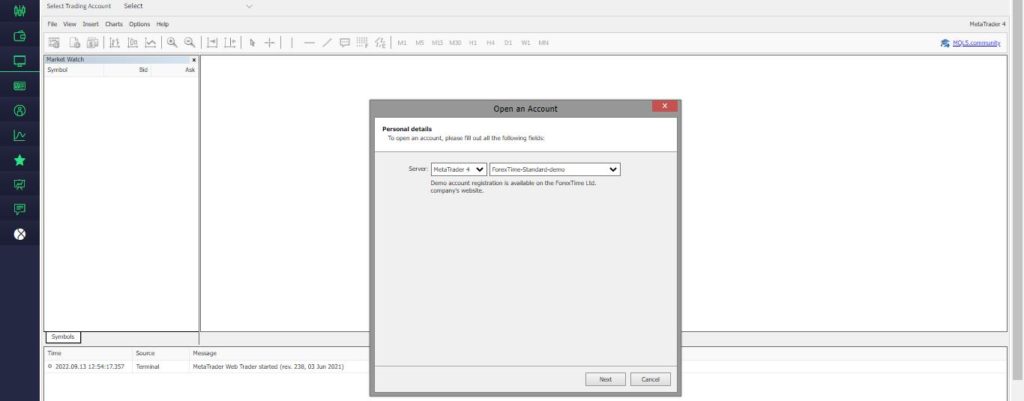

The platform provided by FXTM is the most popular forex trading platform in the world, MetaTrader’s MT4. As a third-party agent provides this software, registering for an account and downloading the platform requires new users to agree to licence agreements with MetaTrader. This process is relatively straightforward and involves simply reading and clicking on agreements. Once completed, a new set of login details will be emailed to the new user, which are required to access the trading platform.

This email is sent instantly, so there was no delay in accessing MT4 to try out the platform. The MT4 platform is available in desktop, Webtrader, and mobile phone app format and can be downloaded on Windows, Mac, Android and iOS devices.

During the period when the account is being verified, it is possible to access the Demo account version of the MT4 platform and carry out some test trades. That allows new users to become familiar with the platform’s mechanics and to try out trading ideas.

Signing in to the MT4 platform and booking a test trade in EURUSD took seconds. The market could be located using the sidebar and the MT4 trade execution GUI is well known for keeping things simple. After our virtual trades were executed, the position was reported accurately in the Portfolio section of the platform. We could easily trade in and out of it as market prices fluctuated.

Contacting Customer Support

FXTM customer support can be contacted by LiveChat, Telegram, Facebook, phone and email. That selection of messaging systems, particularly the social media ones, is a stand-out feature for FXTM.

Our testing team chose the phone call-back option as not many other brokers offer that service. A representative from FXTM typically responded to the request within approximately 60 seconds. The one big plus point of this approach is that it was beneficial to speak with a team member without having to navigate through a LiveChat chatbot or a range of FAQ questions.

The representative was professional and client-focused, and as we had chosen a beginner-grade question, they solved the query for us within 30 seconds. A more complex question was sent to the email address [email protected]. In this instance, we asked for more information regarding research materials on the FXTM site, and that question was answered satisfactorily in an email response received overnight / 14 hours later.

During testing, our team of researchers found the FXTM customer services team to be easily contactable, knowledgeable, and professional. All our questions were answered well within timelines most would consider acceptable.

It is also worth reporting that the KYC documentation required to open an account was processed within 30 minutes of it being sent. The new FXTM accounts being set up far sooner than the official T&Cs state might be the case.

FXTM Review Conclusion

Few firms have entered the forex brokerage market with such a flourish as FXTM did. This management team understands what it takes to please a highly demanding global clientele. Prestigious awards and favorable testimonials are just the icing on the cake. As their website states, “We always strictly abide by the regulations, highly emphasizing our clients’ fund safety and security and the protection of our clients and their investment is our primary concern. We are committed to create a safe and reliable trading environment for all our clients.”

With so many things going for it, FXTM is very worthy of your time and consideration.

Open Your FXTM Account

Five Star Forex Fraud BrokerDisclaimer

ForexTime Limited (www.forextime.com/eu) is regulated by the Cyprus Securities and Exchange Commission with CIF license number 185/12, licensed by the Financial Sector Conduct Authority (FSCA) of South Africa, with FSP No. 46614. The company is also registered with the Financial Conduct Authority of the UK with number 600475. Exinity Limited (www.forextime.com) is regulated by the Financial Services Commission (FSC) of the Republic of Mauritius with an Investment Dealer License bearing license number C113012295. Forextime UK Limited (www.forextime.com/uk) is authorised and regulated by the Financial Conduct Authority, firm reference number 777911.

– Leverage is offered based on your country of residence, knowledge and experience.

– Bonuses and promotions are offered based on your country of residence while terms and conditions apply.

Safest Forex Brokers 2025

-

-

-

-

-

4.8-

-

-

-

-

4.9-

-

-

-

-

5-

-

-

-

-

4.9-

-

-

-

-

4.9-

-

-

-

-

5-

-

-

-

-

5Forex Fraud Certified Brokers

Stay up to date with the latest Forex scam alerts

Sign up to receive our up-to-date broker reviews, new fraud warnings and special offers direct to your inbox

Stay up to date with the latest Forex scam alerts

Stay up to date with the latest Forex scam alerts

Sign up to receive our up-to-date broker reviews, new fraud warnings and special offers direct to your inbox

Stay up to date with the latest Forex scam alerts