The Reddit-WallStreetBets-GameStop frenzy of last week has, to some extent fizzled out. Given that the story jumped from being a financial market story to a main-stream media one, there was always going to be a lull in proceedings when the general population moved on to other topics.

It’s unlikely, however, that the story is completely over. The demonstration of how internet chat rooms can allow a group of smaller investors to take on positions in a coordinated way is now under scrutiny by regulators. But for now, at least, it looks like a phenomenon about which millions of smaller traders want to know a lot more.

Reddit vs Wall Street – the Next Steps

Independent traders taking time-out to review their trading performance might want to look past just adding up their P&L data. The extreme market conditions led to several brokers melting down and locking traders out of their account. Therefore, it is an appropriate time to consider the operational security of brokers.

The Wall Street titans that were the target of much of the Reddit activity invest heavily to ensure their trading infrastructure is reliable. Operational due diligence is carried out on internal processes and third-parties. If Reddit users are going to take on the big hedge funds, they need to match them in terms of having a reliable trading account.

Not being able to access your account to manage positions is the equivalent of a gun jamming. For traders, it can be immensely costly. It’s a situation made much worst by it typically happening when prices are volatile – few brokers go into meltdown when prices are trading sideways.

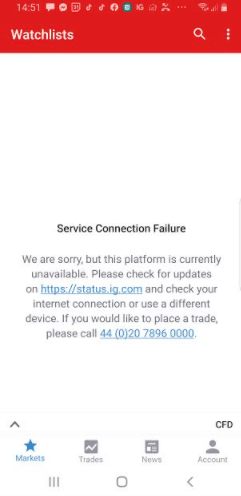

Taking IG as an example. The well-known and long-established retail broker had technical issues on Friday that locked account holders out of their portfolios. If you tried to log-on to salvage a position, you likely came across the error message below.

Source: IG

On Monday, the broker decided to message users about the situation. They acknowledged that “some clients have experienced disruption to service.” The message then detailed new account restrictions.

- “We have temporarily paused new account opening so that we can focus on providing our existing clients with the service they deserve.”

- “We have also made the difficult decision to temporarily suspend new trading on GameStop and AMC Entertainment. “

Source: IG

This is the Ideal Time to Switch Brokers

Any traders who had system outages during the spike in trading volumes would do well to consider their options. The problems were not universal and some brokers had the forethought and capacity to be able to continue supporting their clients, at the time when they needed it most.

So now is an excellent time to shop around and maybe even try out some Demo accounts to ensure a site’s functionality matches your tastes.

If you want to switch, then doing so when markets are calmer makes sense. There’s every likelihood that brokers might put an embargo on new registrations if, or is that when, the situation comes back to a head.

This list of safe brokers includes firms that have been subject of a Forex Fraud in-depth review. Our processes pay particular attention to broker regulation, the firm’s viability, governance and track record.

If you want to know more about this topic or have been scammed by a fraudulent broker, please contact us at [email protected]

Related Articles

- Forex vs Crypto: What’s Better For Beginner Traders?

- Three Great Technical Analysis Tools for Forex Trading

- What Does Binance Being Kicked Out of Belgium Mean for Crypto Prices?

- Crypto Traders and Coin Prices Face New Challenge as Binance Gives up its FCA Licence

- Interpol Declares Investment Scams “Serious and Imminent Threat”

- Annual UK Fraud Audit Reveals Scam Hot-Spots

Forex vs Crypto: What’s Better For Beginner Traders?

Three Great Technical Analysis Tools for Forex Trading

Safest Forex Brokers 2025

| Broker | Info | Best In | Customer Satisfaction Score | ||

|---|---|---|---|---|---|

| #1 |

|

Global Forex Broker |

BEST SPREADS

Visit broker

|

||

| #2 |

|

Globally regulated broker |

BEST CUSTOMER SUPPORT

Visit broker

|

||

| #3 |

|

Global CFD Provider |

Best Trading App

Visit broker

|

||

| #4 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #5 |

|

Global CFD & FX Broker (*Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more) |

ALL-INCLUSIVE TRADING PLATFORM

Visit broker

|

||

| #6 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #7 |

|

CFD and Cryptocurrency Broker |

CFD and Cryptocurrency

Visit broker

|

||

|

|

|||||

Forex Fraud Certified Brokers

Stay up to date with the latest Forex scam alerts

Sign up to receive our up-to-date broker reviews, new fraud warnings and special offers direct to your inbox