Free Demo Account

No Purchase NecessaryExpert Viewpoint

Based on our extensive review of Skilling, ForexFraud is happy to let our readers know that the CFD broker is trustworthy and you can deposit your funds with them. Operating out of Nicosia, Cyprus, Skilling is a market-making/STP CFD broker.

Clients in the UK and Europe are under regulations of the tier-I Cyprus Securities and Exchange Commission (CySEC). On the other hand, the Seychelles Financial Services Authority (FSA) monitors the broker’s clients outside the European Union.

Rating Overview

| Overall rating | ⭐⭐⭐⭐ |

| Regulation | ⭐⭐⭐ |

| Fees | ⭐⭐⭐⭐ |

| Range of Markets | ⭐⭐⭐⭐⭐ |

| Platforms | ⭐⭐⭐⭐ |

You can access 800+ financial instrument, comprising FX, commodities, shares and indices across two trading platforms- the broker’s proprietary Skilling trading, cTrader and MT4.

The exclusive offering is available as web and mobile applications while the cTrader and the MT4 also have the desktop version. You can read all the features of the platforms along with the scalability in our extensive section titled ‘Platforms & Tools.’

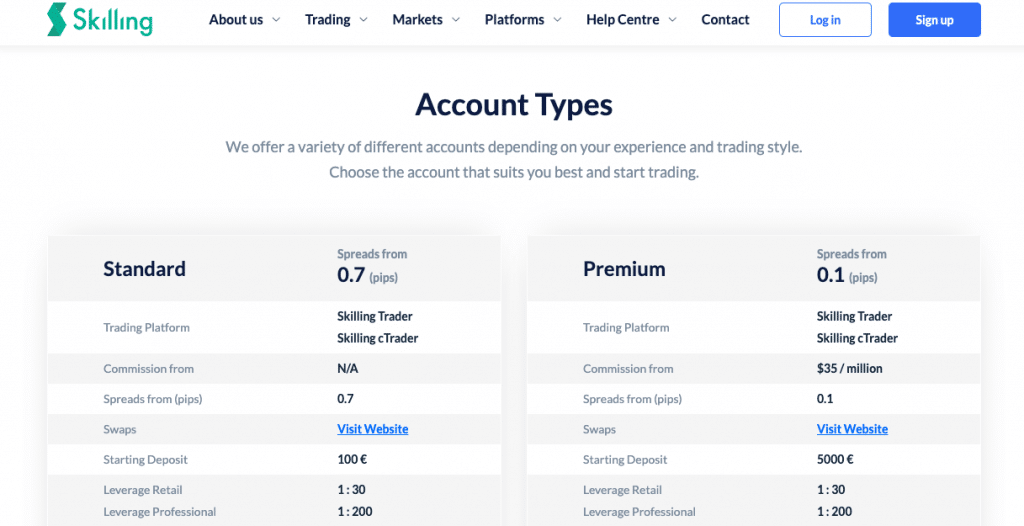

When it comes to the account types, the CFD broker offers the choice of two accounts- Standard and Premium. The account features include minimum deposit from $€100, micro lots, stop out levels, option to carry out scalping, and negative balance protection for retail clients. Professional account is only open to professional traders who request it directly instead of signing up online. The minimum deposit required for that account is USD/EUR 5,000 or SEK/NOK 50,000.

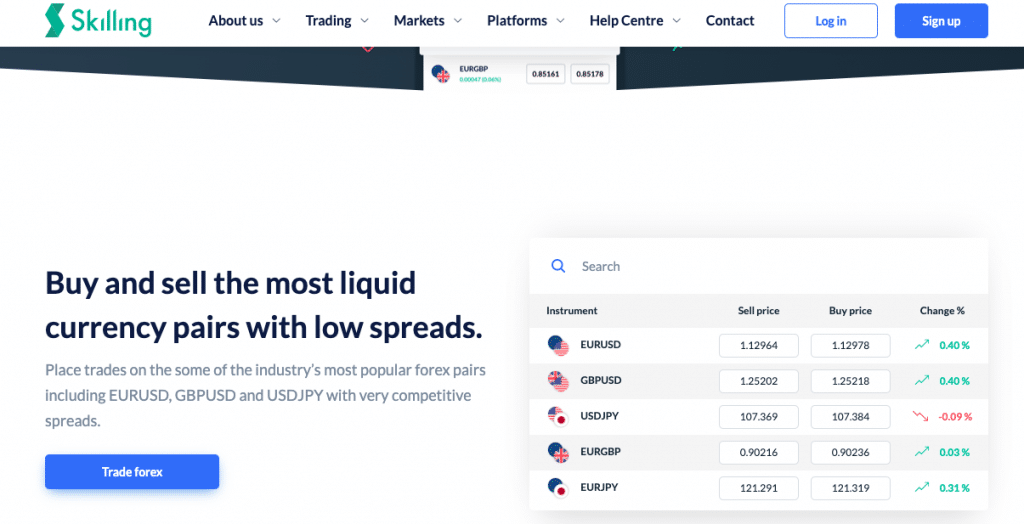

The trading conditions at Skilling comprise of spreads starting at 0.1 pips, max leverage of 1:200 applicable to elective professionals via CySEC licence and 1:500 with the FSA regulation, zero-low commissions in FX and metals, minimal fees and plenty of trading and analytical tools. The broker’s offering caters to all categories of traders- beginners and professionals.

Start Your Trading Journey Now

Simple Sign Up ProcessClients can access high-speed order execution and the choice of several order types, including instant and pending. The firm relies on multiple liquidity providers, and the execution venues include Broctagon Prime Limited.

Depending on your country of residence, you could deposit/withdraw funds via cards, wire transfers or through third-party processors like Neteller, Skrill, Klarna, Google Pay, Apple Pay, PayPal, VISA, Mastercard, Trustly.

On the flip side, the CFD broker does not have anything much to offer in terms of training, education, webinars or seminars, and has limited options for clients to reach out to the helpdesk. However, if you consider the broad perspective, Skilling is a reliable broker, offering the best in client privacy, data security, trading tools/conditions and cutting-edge platforms.

Broker Summary

Skilling is a Cyprus-based financial services provider, licensed by the Cyprus Securities and Exchange Commission (CySEC) and the Seychelles Financial Services Authority (FSA).

The broker offers a range of 800 + CFD products across five asset classes from two account types and trading platforms correspondingly. The product mix primarily comprises more than 700 publicly-traded global companies besides 73 FX pairs.

The CFD broker’s USP is the state of the art trading platforms. While the proprietary trading terminal is accessible as a web and mobile application, the cTrader supports web, desktop, and handheld devices.

Both the platforms come with a user-friendly interface, support multiple browsers/operating systems, include several trading tools and multiple order placement options. The trading conditions are mixed. The commissions are low and charged only for the Premium Account, while the fees are only limited to the swap costs. The other features include multiple funding methods, client support via phone, email, live chat, FAQs, and a multilingual website in five languages.

The other features include multiple funding methods, client support via phone, email, live chat, FAQs, and a multilingual website in five languages.

In this exhaustive Skilling review, we analyse all the key parameters of the CFD broker- from account opening to customer support and also answer a few frequently asked questions. The purpose of the review is to provide an unbiased view so that prospective customers can choose between investing or steering clear of the broker.

Compare with other approved brokers

|  |  |  | |

| Regulation | CySEC, FSA, | FSPR | ASIC, MiFID, FSA, FSCA | FCA, CySEC, FSCA, Seychelles FSA, Labuan FSA |

| Customer Support | email, phone, live chat | email, phone, live chat | email, phone, live chat | email, phone, live chat |

| Trading Platforms | Skilling Trader, Skilling cTrader, Skilling MetaTrader 4, Skilling Copy. | MT4, MT5, WebTrader, Mobile Apps | MT4, MT5, Mobile App | MT4, MT5, WebTrader |

| Minimum Deposit | $100 | $200 | $100 | $100 |

| Leverage | 1:200for pro-clients | 1:500 | 400:1 | Tickmill Ltd 1:500, Tickmill Europe 1:30 (retail) & 1:300 (pro), Tickmill UK 1:30 (retail) |

| Total Markets | 900+ | 182 | 1260 | 637 |

| Total Currency Pairs | 70+ | 72 | 55 | 62 |

| Total Cryptocurrencies | 50+ | 0 | 17 | 9 (* CFD Crypto trading is available only to Professional Clients under Tickmill UK.) |

Broker Introduction

Skilling was founded in 2016 in Malta by technology experts from Scandinavia. A year later, the firm applied for a Cyprus registration and a CySEC license, before shifting its headquarters to Nicosia, Cyprus in early 2018.

The following year, Skilling launched in Sweden, Norway, Germany, and the United Kingdom besides the other countries in the EEA. In 2020, Skilling expanded its global operations through its Seychelles Financial Services Authority licence.

The Skilling Group currently comprises Skilling Ltd, authorised and regulated by the Cyprus Securities and Exchange Commission (CySEC) to offer its services to countries in the European Union.

The market-making/STP broker currently operates from four global offices, has a team of about 40 employees, and is the principal partner of the EFL Championship club, Fulham FC for the 2019/20 season.

Avoid The Pitfalls

Fully RegulatedSpreads & Leverage

When it comes to the trading conditions, our Skilling Review broadly covers all info related to the spread and leverage. While the spread is typically a component of the account type, the leverage is dependent on the market regulator, the financial instrument and your client category.

On the spread, the bid-ask difference for clients signing up for the Standard Account starts from 0.7 pips, while Premium Account holders receive a lower spread, from 0.1 pip.

Coming to the leverage, since Skilling is under the stringent tier-I regulations of the Cyprus Securities and Exchange Commission (CySEC), they can only offer max leverage of 30:1 to retail clients.

However, ‘Elective Professional Clients’ can receive higher leverage of up to 1:200 with the Cysec regulation and 1:500 with the FSA regulation. Also, the broker uses a three-tier dynamic leverage model for professional clients trading CFDs in FX, indices and commodities. So, the more exposure you have in any of the products from the three asset classes, the max leverage also shrinks correspondingly.

The following illustrations highlight the margins for retail, professional clients and the impact of dynamic leverage

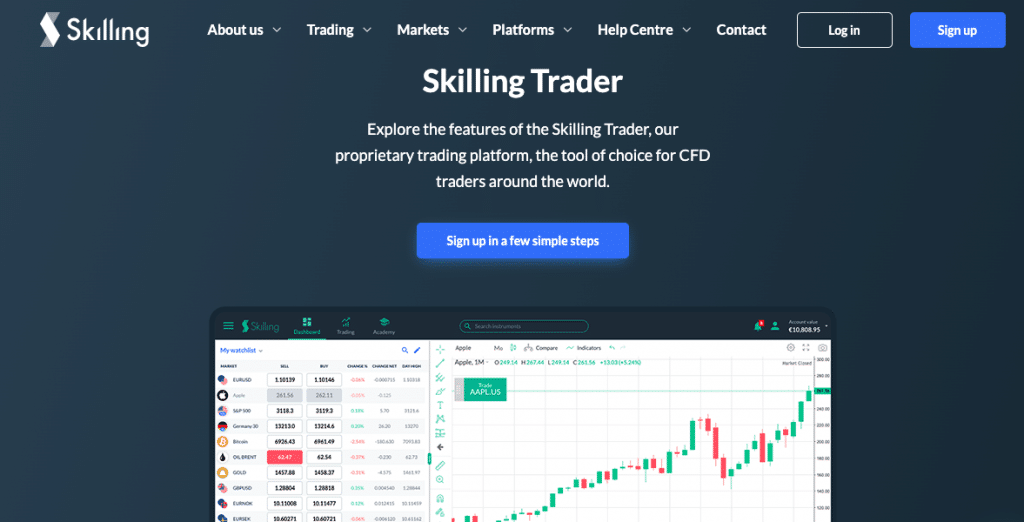

Platform & Tools

If you register with the Skilling broker, you have the option of two trading platforms, as well as MetaTrader4:

- Skilling Trader- Web, Android, and iOS.

- cTrader- Web desktop, Android, and iOS.

- MT4- Web, desktop, , Android, and iOS

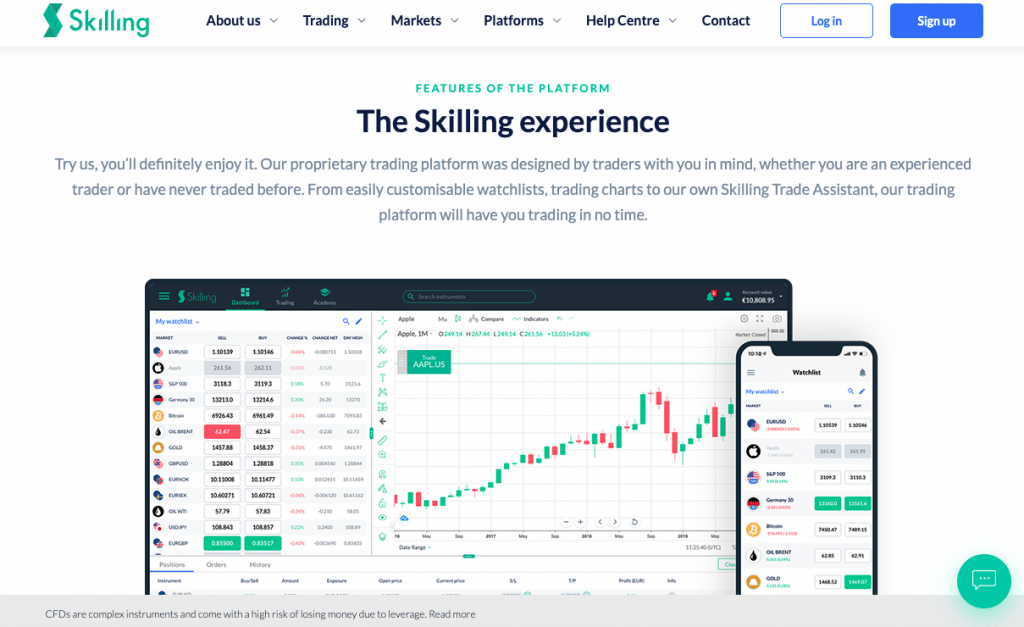

In our trading platform review of Skilling, we analysed the Skilling Trader web and Android versions plus the cTrader desktop application from a demo account. Our extensive study includes the user interface, features, and performance of the client trading terminals.

You can access 800+ financial instruments on the Skilling Trader on your computer, directly from the client area.

Access Over 800 Instruments

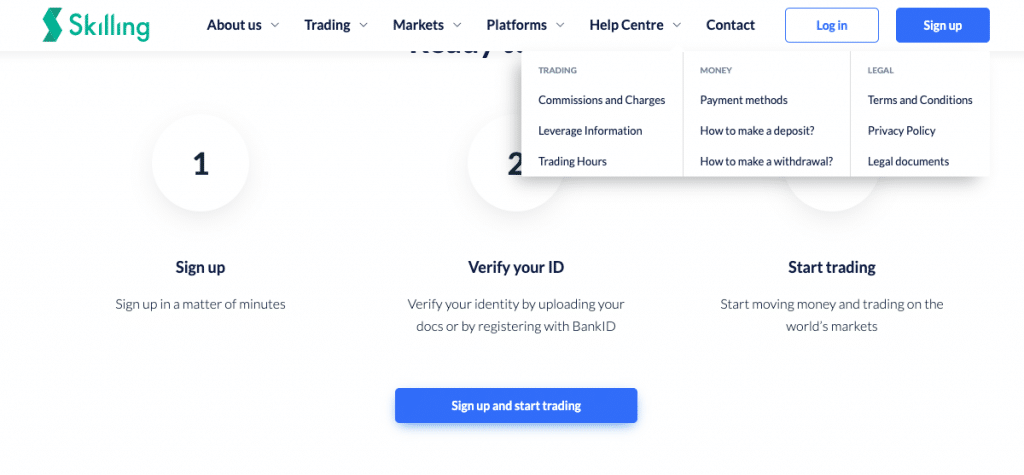

On Desktop, Table Or PhoneTo do that, you have to sign-up with the CFD broker by filling out some basic info like your email address and your country of residence.

Once done, log in with your credentials to be directed to the Skilling Trader. The platform comes in two colour themes and five language settings. You can choose between the live or demo account and start trading straight away.

The default terminal comprises watchlist, charts, positions, orders, and trading history. The order types include market, pending, with the SL/TP function. You have the option to place trades from the watchlist, charts or exit all positions in one go from the ‘Positions’ tab.

On the individual panels, the watchlist has only the primary columns, and you cannot add, delete or change the column headings.

The only option you have here is to add or delete instruments from the watchlist. When it comes to technical analysis, you can access eight chart types in ten-time frames and 81 technical indicators, besides several graphical objects and drawing tools. You can also compare the charts of the other instruments, and carry out in-depth chart analysis using the several charting tools.

The other features include the option to monitor transactions, switch between demo and live accounts, deposit/withdraw funds, submit documents, or chat with the live help desk team.

Based on our review of the Skilling proprietary web application, we found the cutting-edge platform was user friendly and easy to operate.

Also, the order execution is in the blink of an eye, has several analytical tools and is suitable for all kinds of traders. However, individuals carrying out either automated, social or copy trading may not find the platform useful.

The Skilling cTrader is a revolutionary platform with a unique design, excellent user interface, and tons of trading tools. You can access all the financial instruments, including stock trading on the Skilling cTrader.

The platform is accessible in 22 languages, with the option to hedge, scalp or carry out manual/ automated trading with ease. The default layout comprises watchlist, charts, positions, market depth, and the global economic calendar.

The key features of the platform include level-II pricing, order fills on VWAP, market depth, a massive range of technical indicators, and drawing tools.

You can create price alerts, short-cut keys, trailing stops, monitor multiple charts and carry out in-depth market analysis. Also, if you are a chartist or an algo trader, you can access the cBot library, download tons of trading tools and indicators, design your strategy, or modify the existing strategies from the database.

The order types include market, pending and trailing, with the option to place one-touch and pending orders from multiple panels in the workspace.

The cTrader also allows copy trading, a unique feature for beginners to copy strategies of professional traders.

The Skilling Trader mobile app supports all Android and iOS devices and can be downloaded from the Google PlayStore or the Apple App Store.

The features of the Android app are similar to the ones on the Skilling WebTrader except that the various panels on the mobile platform are in separate windows, giving it a clean appearance. You can access them from the menu on the top left of your screen or monitor your positions, orders and trade history by clicking on the menu at the bottom of the dashboard.

Besides real-time streaming data and high-speed order execution, traders can access news or go to the Skilling Academy and learn from several online trading courses that are freely available.

Also, beginners who are not very familiar with the markets or the platform can use the ‘Trade Assistant’ for a step by step walkthrough to placing trades.

Commissions & Fees

Besides the spread, the commission and fees make up the overall client trading costs. Our extensive review of Skilling details all the info you need to know about the commissions and fees charged by the CFD broker.

The commissions at Skilling are a part of the account type. The broker does not charge clients registering for the Standard Account, but if you sign-up for the Premium Account, you are liable for a brokerage of $35-50 per million in FX and $60-120 in precious metals.

Besides the two asset classes, you do not have to pay a commission for the other financial instruments.

When it comes to the fees, the broker charges a swap or rollover fee for overnight positions, which can either be positive or negative.

Also, these vary across asset classes and can be a differential in the overnight interest rates of two currencies or the sum of ‘Libor plus Markup’ in the case of shares and indices.

Education

Skilling does not have a separate education section for beginners to learn about the markets, except for a financial glossary. However, if you go to the dropdown in the ‘help centre’ menu, you can find information on some of the frequently asked questions about the broker’s products, services, and policies.

Log in to the secure Skilling client area by signing-up with the CFD broker. Once in, you can access the Skilling Academy, from where you can learn the basics of trading along with fundamental and technical analysis.

The CFD broker also has a trading wizard called the Trade Assistant. If you are a beginner, you can employ this feature to place your first trades on the Skilling demo or live platform.

Learn How To Trade

Build Your ExperienceCustomer Service

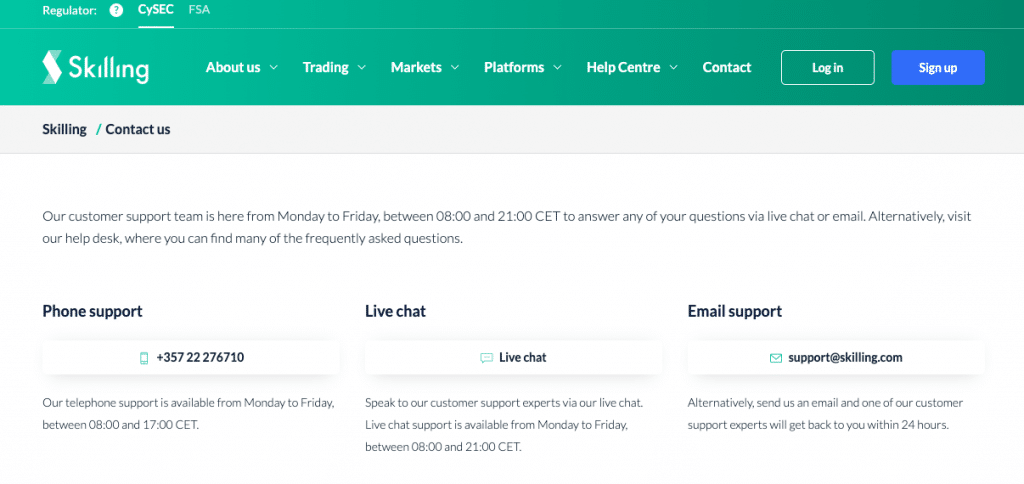

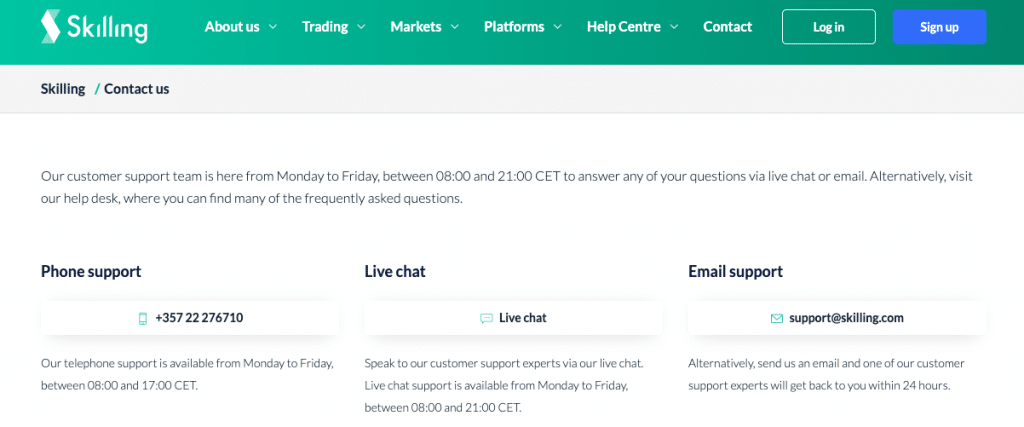

The multilingual customer support channels at the Skilling broker include phone, email and live chat. The broker also has a ‘frequently asked question (FAQ) section where you can find answers to some of the common inquiries on fees, funding, client categorisation and others.

Unlike a majority of CFD brokers who have a 24/5 help desk.

As part of our Skilling review, we interacted with the live chat team on several occasions to check the response time, the quality of answers, and the professionalism of the help desk team.

Based on our interaction, we found that the average initial response time was <1 minute, the members upheld a professional approach while communicating with us, and the quality of the replies was moderate to good.

Final Thoughts

As we wind down on our review of Skilling, we are pleased to inform our readers that the CFD broker is not only trustworthy and safe but offers a host of features that cater to all categories of traders. As we mentioned earlier, the USP is the trading platform. But if you include the instant access to 700+ Skilling stock trading CFD instruments covering listed companies from Europe, UK, Canada and the US, the broker can be easily counted among the elite group of financial service providers.

The other positives include excellent trading conditions, low client trading costs, multiple funding methods and complete clarity not only in terms of offerings but on the policies too.

On the flip side, Skilling does not give clients the option to execute copy or social trading. Besides, the customer help desk is open only between 9-13 hours a day while the website is accessible in only five languages.

If you ignore the few negatives and focus at the several features offered by Skilling, you would want to include them in your list of reliable go-to CFD brokers.

Contacts

You can get in touch with the Skilling broker via any of the communication channels illustrated below

Open Your Skilling Account

Forexfraud Trusted BrokerFAQ

The minimum deposit depends on your account type and the base currency. For the Standard Account, the minimum deposit is USD/EUR 100 or SEK/NOK 1,000 while for the Premium Account, it is USD/EUR 5,000 or SEK/NOK 50,000.

The Key Information Document (KID) provides all info on the financial products tradable at Skilling, potential gains/losses and the risk. You can also go through the general risk disclosure, business terms & conditions documents to get a clearer picture of the policies, legal & regulatory framework, conflicts of interest, and other useful information.

The minimum funds that you can withdraw from your trading account are €50. The withdrawal conditions include processing fund payouts the same day, an alternate payment method from the one used for deposits, and the likelihood of bank/intermediary charges on withdrawals.

Safest Forex Brokers 2025

-

-

-

-

-

4.8-

-

-

-

-

4.9-

-

-

-

-

5-

-

-

-

-

4.9-

-

-

-

-

4.9-

-

-

-

-

5-

-

-

-

-

5Forex Fraud Certified Brokers

Stay up to date with the latest Forex scam alerts

Sign up to receive our up-to-date broker reviews, new fraud warnings and special offers direct to your inbox

Stay up to date with the latest Forex scam alerts

Stay up to date with the latest Forex scam alerts

Sign up to receive our up-to-date broker reviews, new fraud warnings and special offers direct to your inbox

Stay up to date with the latest Forex scam alerts