Both the Euro and GBP and have produced corrective rebound activity in early 2017 against the US currency. However, a renewal of bearish pressures for EURUSD and GBPUSD after the US Employment report on Friday (6th January) sets the bias lower this week.

Moreover, this threat is for a renewal of the bearish theme that was evident in November/ December 2016.

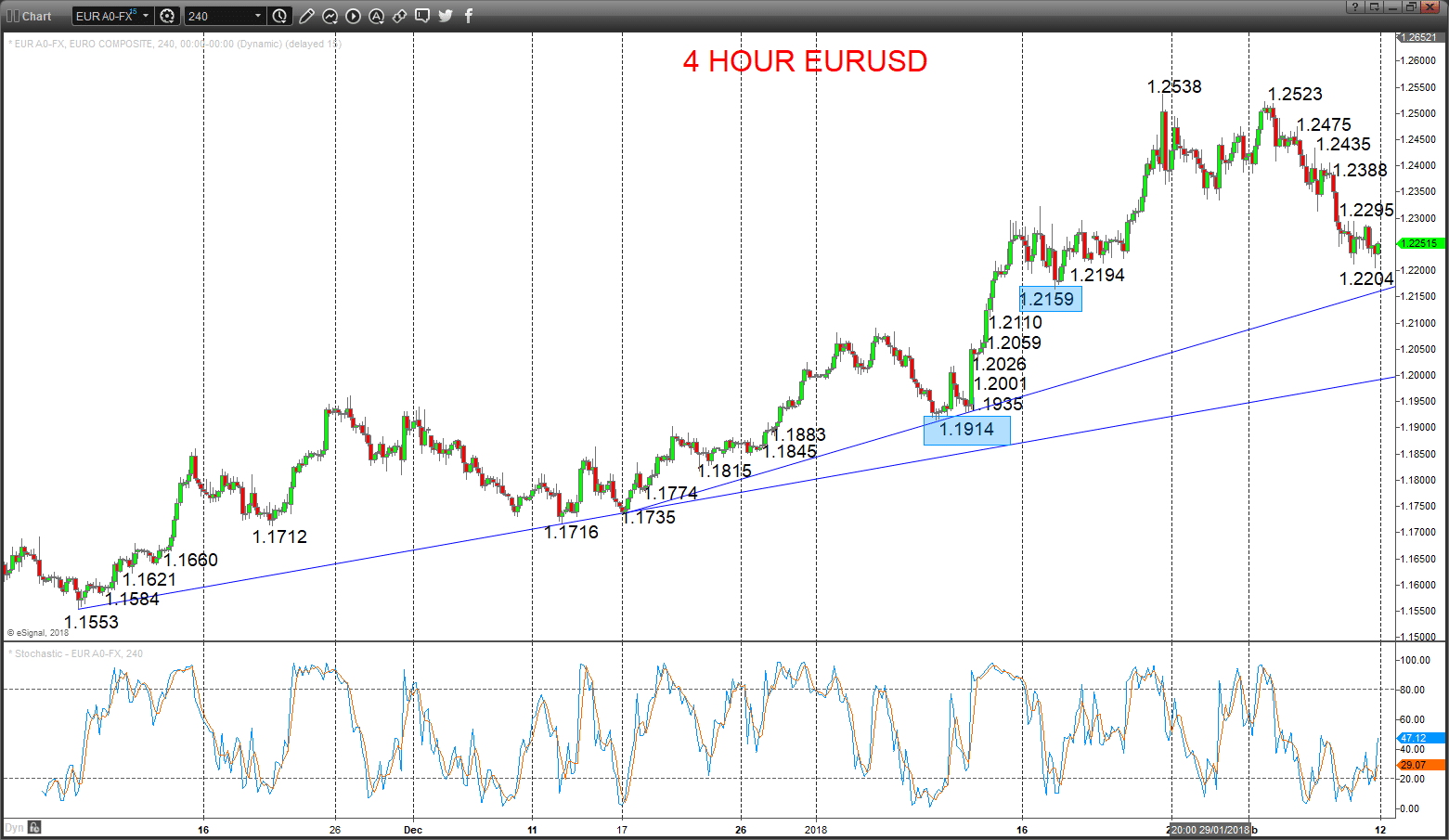

EURUSD

A notable setback Friday from ahead of the key resistance area at 1.0653/70/75, rejecting the rebound effort last week, shifting risk back lower Monday.

Furthermore, the early 2017 breakdown to another new cycle low below 1.0350 served to reinforce the intermediate-term bearish theme.

For Today:

- We see a downside bias for 1.0522; break here aims for 1.0480, maybe 1.0421.

- But above 1.0583 opens risk up to 1.0622, key resistance area at 1.0653/70/75, which we would look to cap.

Short/ Intermediate-term Outlook – Downside Risks:

- We see a negative tone with the bearish threat to parity (1.0000) and .9900, maybe as deep as .9610

What Changes This? Above 1.0670 signals a neutral tone, only shifting positive above 1.0874.

Daily EURUSD Chart

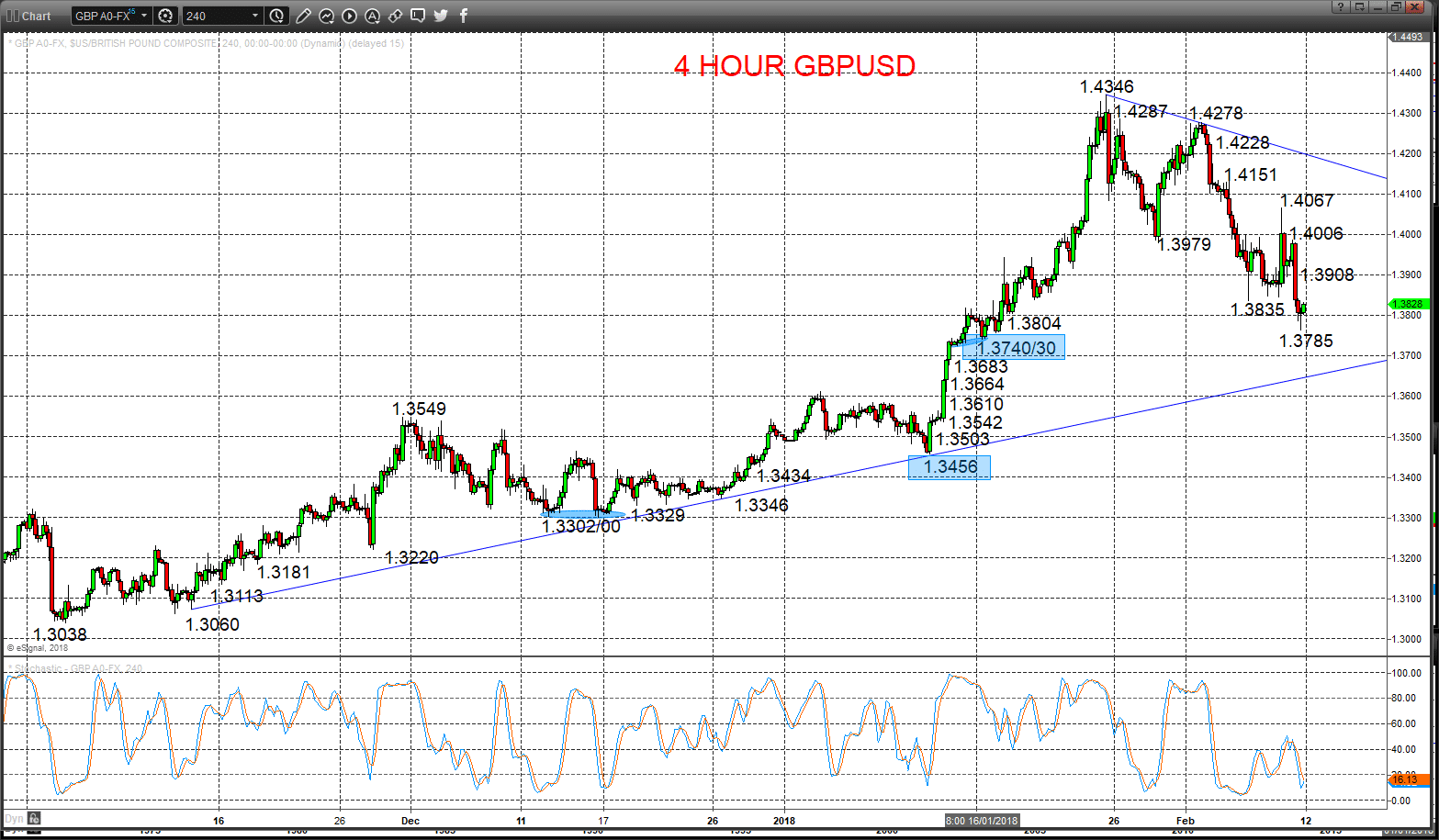

GBPUSD

Early strength faded on Friday, with the sell-off through support at 1.2306 and 1.2269 rejecting the rebound effort from last Wednesday and switching the risks back to the downside for Monday.

For Today:

- We see a downside bias for 1.2250; break here aims for key 1.2199/98.

- But above 1.2346 opens risk up to 1.2395, maybe 1.2432.

Our intermediate-term view is neutral since the early December push above the 1.2674 level.

Short/ Intermediate-term Range Parameters: We see the range defined by 1.3121 and 1.2083.

Range Breakout Challenge

- Upside: Above 1.3121 aims higher for 1.3445 and 1.3534.

- Downside: Below 1.2083 sees risk lower for 1.1943 and 1.1000.

Daily GBPUSD Chart