The Euro and the GB Pound both resumed their downward paths against the US$ last week, with rebound attempts rejected.

Moreover, the underlying bear themes for EURUSD and GBPUSD for Q4 and arguably from the summer, leaves the risk to the downside for both late November and into year-end.

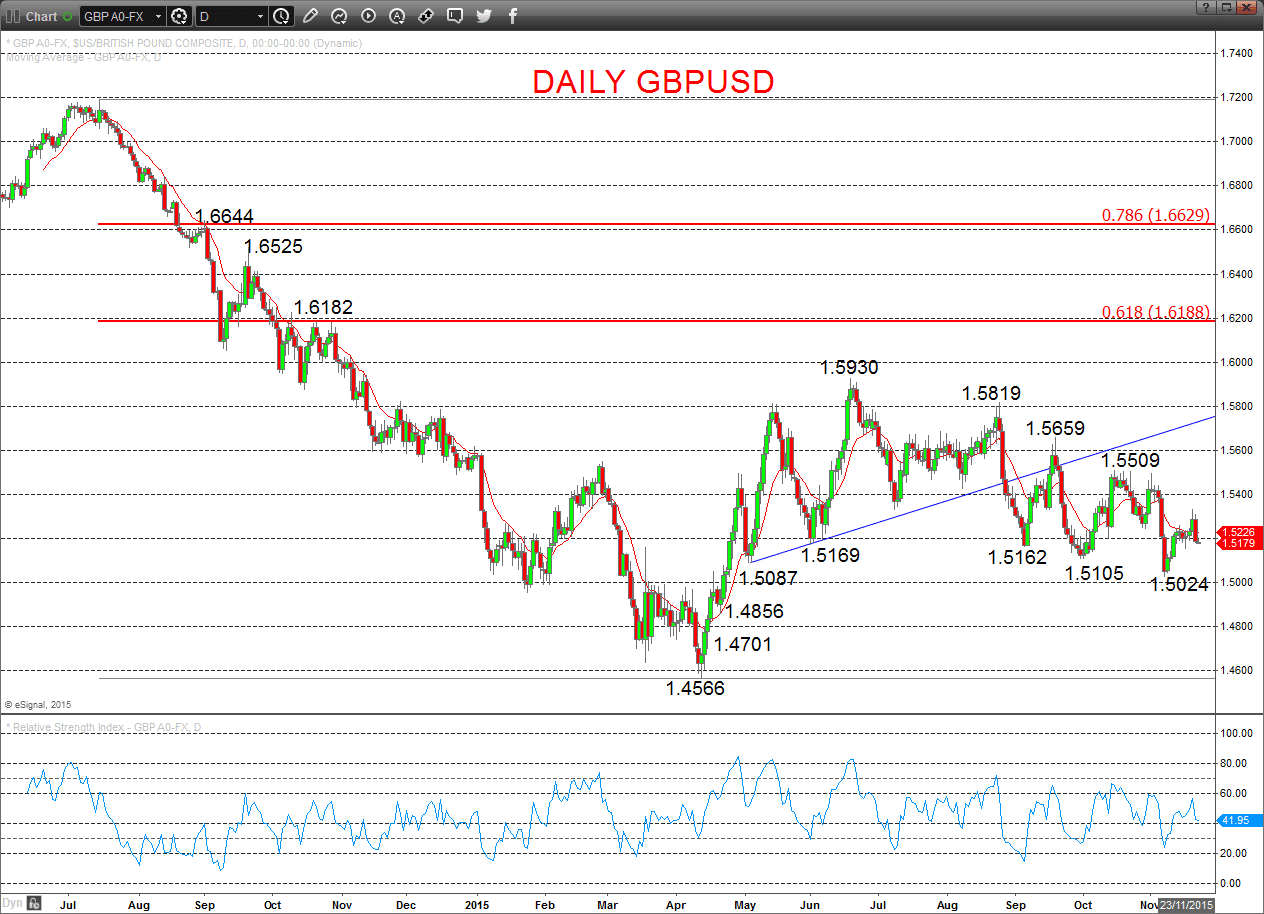

EURUSD

A rebound above our initial resistance at 1.0692, but an unexpected failure Friday back from ahead of 1.0776 through minor support sees the bias lower for Monday.

The previous break of 1.0658 reinforced the aggressive October bear break below 1.1085, which leaves a bearish outlook for November.

For Monday:

- We see a downside bias for 1.0615/07; break here aims for 1.0570, maybe 1.0520.

- But above 1.0710 opens risk up to 1.0763/76.

Short/ Intermediate-term Outlook – Downside Risks:

- We see a more negative tone with the bearish threat to 1.0607.

- Below here targets 1.0520 and 1.0459.

What Changes This? Above 1.1395 signals a neutral tone, only shifting positive above 1.1495.

Daily EURUSD Chart

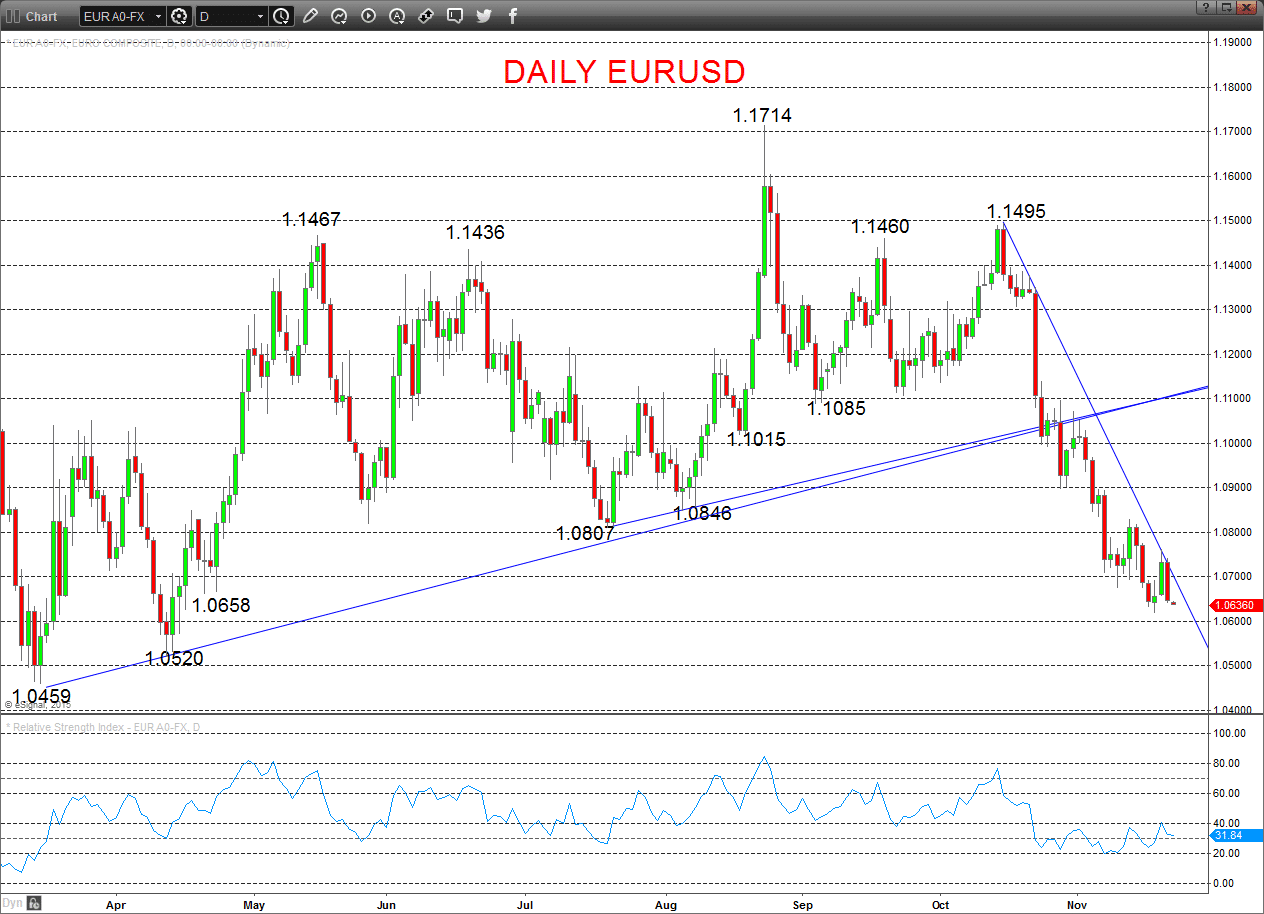

GBPUSD

A firm rebound above our initial resistance at 1.5263/64, but a setback from within our 1.5332/58 resistance area Thursday, to plunge back lower Friday, sets the bias lower for Monday.

Moreover, previous bear signals from Q4 to push down to 1.5105 and 1.5024, leave a still bearish theme for late November.

For Monday:

- We see a downside bias for 1.5152/31; break here aims for 1.5089.

- But above 1.5273 opens risk up to 1.5310 and 1.5336.

Short/ Intermediate-term Outlook – Downside Risks:

- We see a negative tone with the bearish threat to 1.5000 and 1.4856.

- Below here targets 1.4701 and 1.4566.

What Changes This? Above 1.5509 signals a neutral tone, only shifting positive above 1.5659.

Daily GBPUSD Chart