Featured Forex Broker

This secure framework acts as a base for some of lowest cost trading in the market with trade execution backed up by some very impressive behind the scenes infrastructure designed to offer the best access to the financial markets. Read the full review of Tickmill

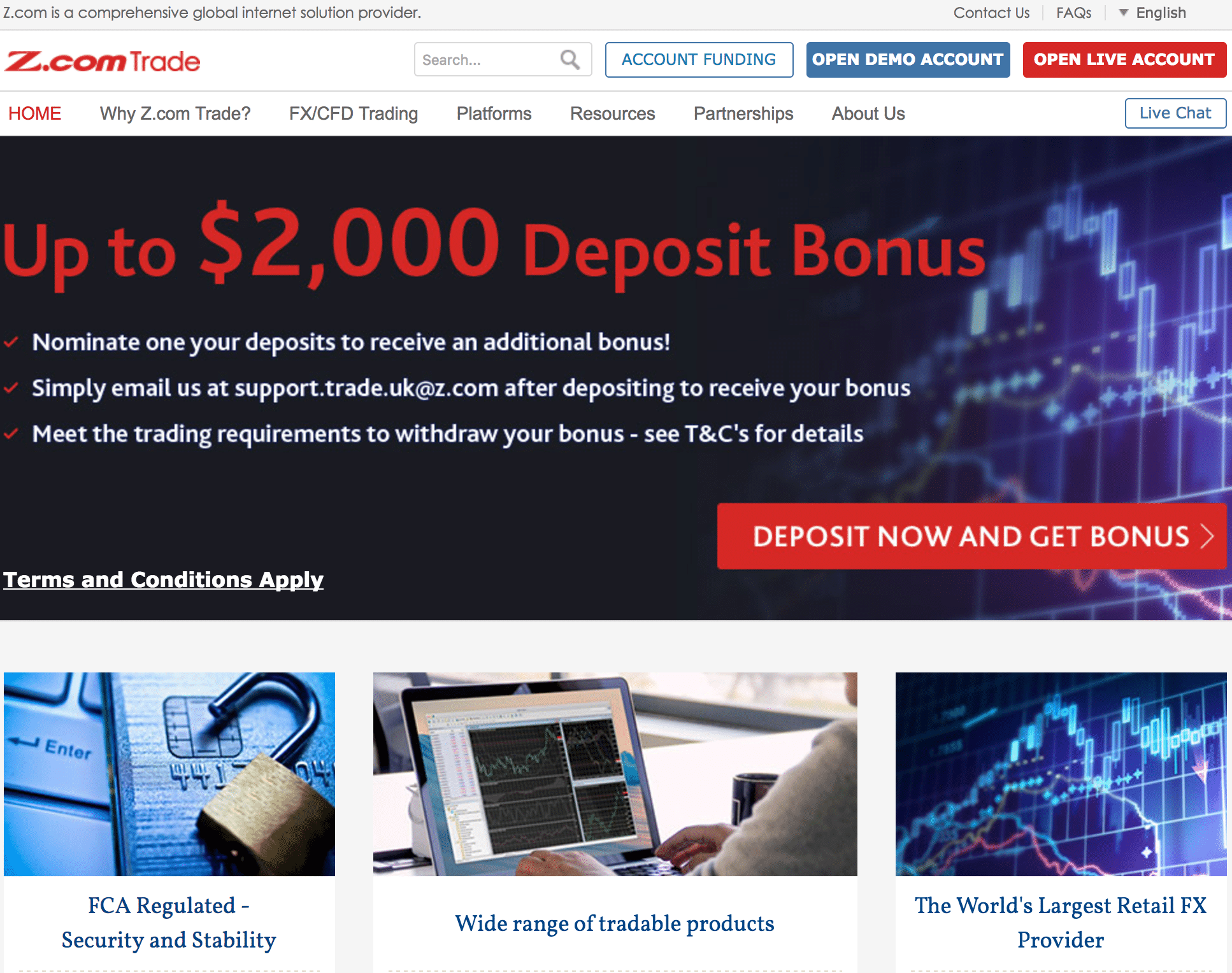

Acknowledged as the retail forex industry volume leader, the GMO CLICK Group officially launched its UK subsidiary Z.com Trade, in March 2015. Founded in Japan in 2005, the group has offices in the global financial centres of Tokyo, Hong Kong and London, with over 400,000 clients worldwide. GMO-Z.com Trade UK Limited is authorised and regulated in the UK by the Financial Conduct Authority (FCA), and its firm reference number is 622897.

Trading in leveraged products carries a high level of risk. Your losses may exceed your initial investment requiring you to make further payments.

Numbers do not lie, and the group’s volume awards and 400,000+ customer base are evidence that they are doing something right. Much of the group’s growth has been in Japan, Hong Kong, and other parts of Asia, and by adding London to its global footprint, the group are looking to bring the benefits of their service to more traders worldwide. The firm is proud of its flagship proprietary trading platform, Z.com Trader, and it does also offer MT4 and API connectivity. Aside from flexibility in its technology offerings, Z.com Trade provides some of the tightest spreads in the industry, that range in the fractions of a pip for major currency pairs and crosses.

Z.com Trade is authorised and regulated by the Financial Conduct Authority (FCA) in the UK, and client funds are segregated in top tier financial institutions. Z.com Trade also participates in the UK Financial Service Compensation Scheme (FSCS), which can provide compensation of up to £50,000 per person per regulated entity.

With so many options and choices to make, it is also a valuable benefit to have highly capable Customer Service staff at the ready to assist you in setting up, getting the most out of the technology on offer, and with any other questions that you might have. These professionally trained reps speak several languages and can be reached via live chat, email, or telephone.

Features

Why trade with Z.com Trade? The firm lists these reasons:

・A subsidiary of the GMO CLICK Holdings, Inc., group of companies, headquartered in Tokyo, established in 2005, and listed on the Tokyo Stock Exchange

・Growth benchmarks: $1 trillion in monthly volume in 2013 (first in the industry); volume leader in the world today; and over 400,000 global clients

・Z.com Trade is based in London and is authorised and regulated by the Financial Conduct Authority (FCA) in the UK

・Client funds are segregated in top-tier financial institutions, and the firm also participates in the UK Financial Service Compensation Scheme (which can provide compensation of up to £50,000 per person per regulated entity)

・Deposits can be made by major credit or debit card, wire transfer, China UnionPay or Skrill at no additional charge. There is also no minimum deposit requirement.

・In-house developed online trading platform (Z.com Trader) with advanced charting support available, along with MT4 software and mobile apps

・Tight spreads that range from 0.5 to 0.8 pips for major pairs and crosses

・Broad array of currency pairs with up to 200:1 leverage available, supplemented by CFD trading in commodities and indices

・STP model, with fixed spread pricing available on Z.com Trader platform, and variable spread pricing on MT4/API

・Multilingual customer service representatives, accessible via live chat, email, or telephone

Spreads and Leverage

Being a volume leader allows Z.com Trade to offer extremely tight spreads, especially for major currency pairs. Spreads on Z.com Trader are fixed as low as 0.5 pips for USD/JPY and 0.6 pips for EUR/USD, with a maximum available leverage of up to 200:1 on selected currency pairs. For CFDs in commodities or indices, leverage and margin requirements vary by asset choice.

Platform

A large enterprise with such resources also has the capability to develop their own software internally, without having to depend on a partner for innovative upgrades. Such is the case with Z.com Trade. Its proprietary flagship platform goes by the name of Z.com Trader and comes with an intuitive interface and advanced charting tool. The software is completely online and does not require any complicated downloads. For MetaTrader4 enthusiasts, the firm can also support MT4 which is operated on an STP model, offering an ultra-low latency solution with no “last look” execution. For professional traders their API service offers a more flexible and tailored option. Mobile apps are also available for iOS and Android, allowing users to trade from charts as well as lightning fast “one touch” trading.

Deposits and Withdrawals

Z.com Trade accepts deposits via major credit and debit cards, Skrill or by bank wire transfer, and does not charge any additional service fees. Withdrawal requests are processed promptly, and a charge is only made for international bank wire transfers. There is also no minimum deposit requirement, allowing you start with an amount you feel comfortable with.

Beginner’s and Customer Support

Customer service representatives have been professionally trained to assist you with any query that you may have. They can be accessed via live chat, email, or telephone. For beginners and experienced traders alike, support materials include platform guides, information on fundamental and technical analysis, pricing streams, advanced charting tools, news, and an economic calendar of significant events.

Conclusion

The opening of Z.com Trade is one more step by the GMO CLICK Group of companies to solidify its dominance in the global forex trading arena. As per the words of its CEO, “We are excited to announce the full launch of Z.com Trade and with the strong foundation of the in-house technology and expertise that we have developed in our home market of Japan, we look forward to connecting with even more traders around the world through our Forex and CFD trading service.” With respect to this group, “Big” is better. The benefits are plentiful – tight spreads, innovative services, and regulatory peace of mind. Z.com Trade is definitely worthy of your consideration.

Please be advised that certain products and/or multiplier levels may not be available for traders from EEA countries due to legal restrictions.

Safest Forex Brokers 2025

-

-

-

-

-

4.8-

-

-

-

-

4.9-

-

-

-

-

5-

-

-

-

-

4.9-

-

-

-

-

4.9-

-

-

-

-

5-

-

-

-

-

5Forex Fraud Certified Brokers

Stay up to date with the latest Forex scam alerts

Sign up to receive our up-to-date broker reviews, new fraud warnings and special offers direct to your inbox

Stay up to date with the latest Forex scam alerts

Stay up to date with the latest Forex scam alerts

Sign up to receive our up-to-date broker reviews, new fraud warnings and special offers direct to your inbox

Stay up to date with the latest Forex scam alerts