Expert Summary

The FP Markets group of companies includes the First Prudential Markets Pty Ltd, First Prudential Markets Ltd and FP Markets LLC.

Established in 2005, the CFD broker comes under the regulations of the Australian Securities and Investment Commission (ASIC) and the Cyprus Securities and Exchange Commission (CySEC). FP Markets LLC, on the other hand, is an offshore company registered in St Vincent and the Grenadines.

FP Markets offers more than 10,000 CFD instruments, spread across forex, commodities, metals, cryptocurrencies, indices, and shares, besides futures trading. Clients registering with the broker can access these products on the MT4, MT5, and the proprietary IRESS platform, specially designed for CFD trading in the equities markets.

Rating Overview

| Overall rating | ⭐⭐⭐⭐⭐ |

| Regulation | ⭐⭐⭐⭐⭐ |

| Fees | ⭐⭐⭐⭐ |

| Range of Markets | ⭐⭐⭐⭐⭐ |

| Platforms | ⭐⭐⭐⭐ |

For money managers, the broker provides the MAM/PAMM accounts, with all the product offerings except equity CFDs available on the MT4 platform. When it comes to analytics, FP Markets provides a suite of online trading tools like the correlation matrix, sentiment trader, the live economic calendar, and the Autochartist. These are besides the tons of analytical tools already available on the MetaTrader and the IRESS platforms. The broker also provides clients with free VPS access and funding options.

Clients signing-up for the forex accounts have two choices- Standard and Raw. Both of them come with ECN pricing, a minimum deposit of A$100 and are accessible on the MT4/MT5 platforms with the key differences in the quantum of spread and commissions. However, if you are interested only in share CFDs, set up a separate account and execute your trades on the IRESS platform.

FP Markets offers raw spread from zero pips, caters to all categories of customers- beginners, professionals, and those following the Shariah law. Besides the numerous trading tools, state of the art platforms and access to global markets, the CFD broker offers ultra-fast trade execution without requotes. FP Markets is globally regulated, maintains client funds in segregated accounts, provides 24/5 multilingual customer support, and a personal account manager. Since its inception, FP Markets is accredited with 40 + International Awards, including the ‘Best Global Forex Value Broker,’ at the Global Forex Awards in 2019.

Indeed, while FP Markets is one of Australia’s leading CFD and Forex brokerages, the operation is about much, much more. It essentially offers a full suite of trading-related services, not only for the retail traders, but for other online trading startups and money managers as well.

Free Demo Account

No Purchase NecessaryFP Markets Reputation

While no brokers’ reputation is “spotless”, FP Markets is certainly as close to that as an operation which has been running since 2005 could possibly be. Overall, the traders feedback we’ve seen has been massively positive.

Over the years, the brokerage has accrued no fewer than 35 awards, granted by various organizations and trading media outlets. These awards cover almost every operational aspect, from client satisfaction to trade execution and actual costs involved, and thus they offer a rather accurate picture of FP Markets’ place in the trading industry.

Besides their experience and the appreciation of various industry authorities, FP Markets are liked by the public for the transparency which defines the corporate background of the operation as well as the price making process. The massive range of markets covered by the brokerage has to be mentioned as well: more than 10,000 assets can be used for trading in various forms.

The company behind FPmarkets.com is First Prudential Markets Pty Ltd, a registered Australian company, which provides full legal documentation about its identity as well as its activity, through the About Us section of the FP Markets site. They are regulated by ASIC (Australian Securities & Investment Commission) in Australia which has a historically strong culture of corporate governance. Client funds are not only held separately from the company’s funds, in segregated client trust accounts, ASIC requires that all funds are reconciled each day. Therefore, in the unlikely event that there were to be an issue with the company, clients’ funds would remain separate (and protected) so that funds can be returned to clients.

In the above mentioned legal documentation, the issue of conflicts of interests is touched upon too, though there aren’t many details provided in this regard.

The head office of FP Markets (First Prudential Markets) is located at Level 5, Exchange House, 10 Bridge St, Sydney NSW 2000. There’s an obvious focus on global markets with a lot of expansion going on over the last few years.

FP Markets’ Products

This is where things turn serious with FP Markets, as this is where it is revealed that we’re dealing with much more than a simple brokerage, although even in that respect, the site is very solid indeed.

As far as retail traders are concerned, there are two main categories of products on offer: CFDs and Forex trading.

Originally known for its Equity CFD offering the company has certainly become much more. They are now a truly full service destination. Traders can access over 10,000 tradable instruments with CFDs across Forex, Equities, Futures, Commodities and Cryptocurrencies. The site boasts “global access” for the CFD section, and in this instance, that is indeed the perfect way to describe the situation.

Forex covers a handsome selection of 45 currency pairs, and although the majority of traders choose MT4 as their platform, Forex can be traded on IRESS. FP Markets also have a few products for Introducing Brokers and Money Managers. For the first of those two categories, we’re obviously talking about the White Label program the brokerage runs. Two account types are available for Forex traders; Standard and Raw.

CFD trading is hosted on the IRESS platform, which is web-based and different from MT4. It was recently updated and it now offers some of the best charting and Indicator tools in the market. IRESS has a bit of a cult following among Equity CFD traders. Three different account types are available for CFD traders; Standard, Platinum and Premier.

Share trading does appear as a separate category here and there on the site, but it has to be made clear that these are all shares-based CFDs and not trading involving the actual buying of shares.

For Money Managers, the MAM/PAMM accounts are potentially very useful. Through them, they can manage several clients on different trading accounts, setting individual stop losses and profit targets for each of the concerned accounts. MAM/PAMM accounts offer access to all the 60+ assets tradable through the MT4 platform.

Compare FP Markets with other approved brokers

|  |  |  | |

| Regulation | ASIC, CySEC | FCA, CySEC, FSCA, Seychelles FSA, Labuan FSA | FCA, FSCA, CMA and FSC | FCA (FRN 509909), ASIC, FMA, and FSCA |

| Customer Support | email, phone, live chat | email, phone, live chat | email, phone, live chat | email, whatsapp, live chat |

| Trading Platforms | MT4, MT5, WebTrader, Mobile Apps | MT4, MT5, WebTrader | MT4, MT5 | desktop and mobile via brokers own platform |

| Minimum Deposit | $100 | $100 | $200 | 100GBP/AUD/EUR/USD |

| Leverage | 1:30 | Tickmill Ltd 1:500, Tickmill Europe 1:30 (retail) & 1:300 (pro), Tickmill UK 1:30 (retail) | Flexible | 1:30 |

| Total Markets | 10,000 | 637 | 252 | 2800+ |

| Total Currency Pairs | 60 | 62 | 62 | 65 CFD Forex pairs |

| Total Cryptocurrencies | 11 | 9 (* CFD Crypto trading is available only to Professional Clients under Tickmill UK.) | 4 | 19 |

FP Markets Trading Platforms

There are two main trading platforms featured, for the two-major product-classes detailed above. Each platform has full mobile and tablet accessibility.

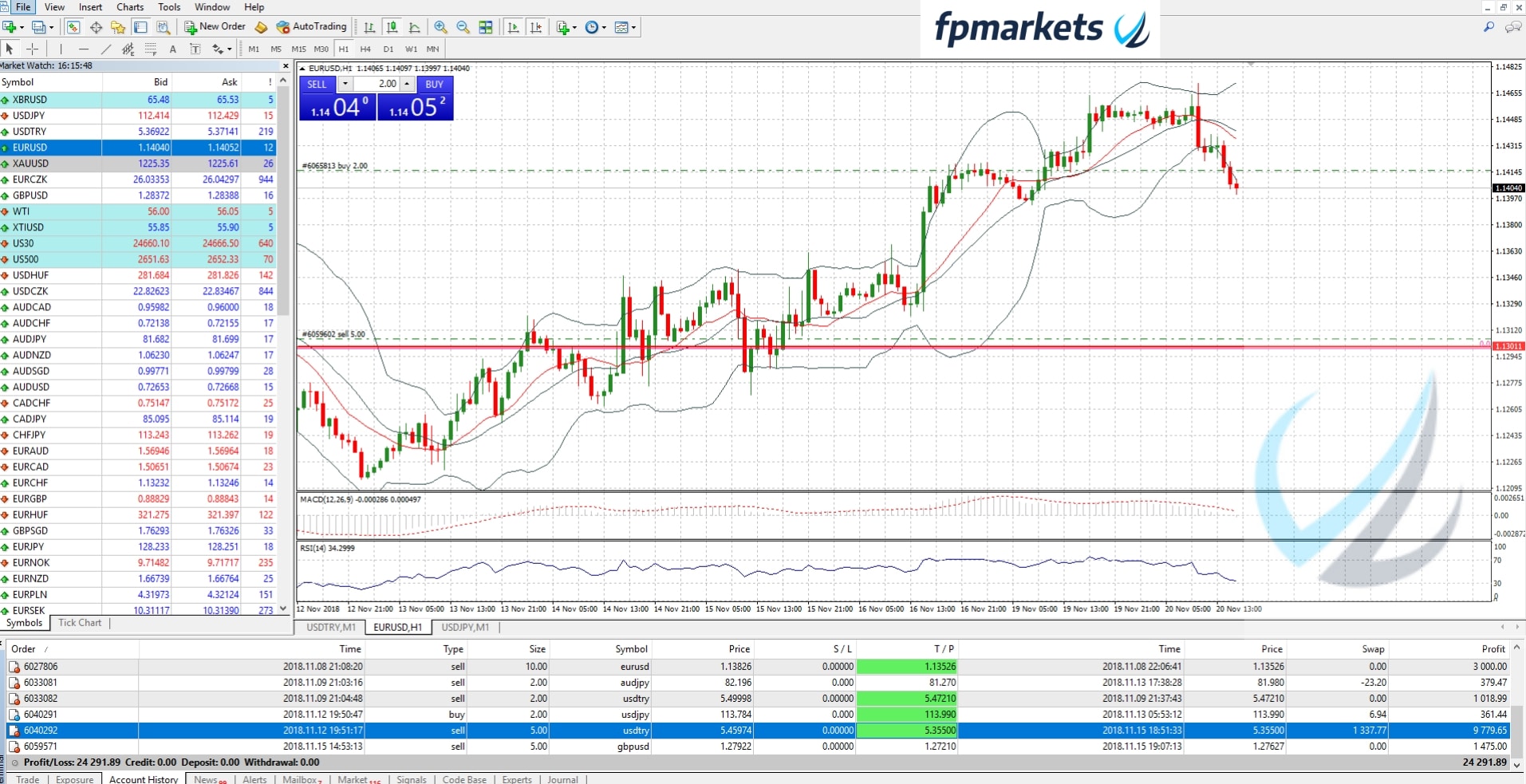

Forex traders will enjoy the familiarity of MT4 & MT5 but FP Markets’ versions has a little extra. Their spreads often go as low as 0.0 pips and there are leverage options up to 500:1. The trading is all done through ECN pricing (electronic communication network) which delivers very fast execution. ECN pricing also offers traders full transparency so this broker does guarantee no dealing desk, no price manipulation and no re-quotes.

The technical analysis capabilities of MT4 are well-known and in this instance we have some 50+ technical indicators already included in the package, with the possibility to install more. The Expert Advisor section of the platform is very popular, and to run such EAs properly, traders need access to a reliable VPS service, which FP Markets does indeed promptly deliver. MT4 also comes with one-click trading, various alert features and trading signals.

CFD trading is done through the IRESS platform, more precisely through the latest, Iresstrader iteration of the platform, which features cutting edge charting technology, and a surprisingly massive selection of analytic instruments.

In addition to all the above, traders can choose from a large selection of time frames, and they can fully personalize their charts. Templates can also be saved for later use.

As far as the MT4 platform is concerned, there are no surprises here. The technical analysis capabilities of this platform are well-known and in this instance too, we have some 50+ technical indicators already included in the package, with the possibility to install more. The Expert Advisor section of the platform is very popular, and to run such EAs properly, traders need access to a reliable VPS service, which FP Markets does indeed promptly deliver.

MT4 also comes with one-click trading, various alert features and trading signals.

Start Your Trading Journey

Simple Sign Up ProcessFP Markets Account Types

As said above, Forex-wise, there are two FP Markets account types. The cheaper one of these is the Standard account, which requires a minimum deposit of just AUD/EUR/USD100. For that money, traders will get spreads starting from 1 pip, and maximum leverage of 1:500.

The ECN Raw account offers spreads from 0 pips, a similarly generous 1:500 maximum leverage and the same STP trade execution. To open such an account, traders are required to deposit at least AUD 100.

A Demo account is available on the MT4 platform too.

On the CFD front, the account situation is a bit more crowded. Three account types are on offer here, starting with the Standard, which requires a $1,000 deposit. This account type comes riddled with all sorts of fees, most of which are waived though, provided the trader hits certain monthly commission targets. The commissions and margin rates are decent though.

For even better commissions and margins, traders can turn to the Platinum account, which requires a $25,000 deposit.

The Premier account is the top-tier account version. It has all the above-mentioned fees waived by default. Aimed at professional traders, this account type is free of brokerage charges and platform fees.

FP Markets Support

The most straightforward way to contact FP Markets support is through the live chat feature, which can be accessed at a click from the homepage. Other than that, there are two phone numbers available: 1300 376 233 for Australians and +61 (0)2 8252 6800 for non-Australian residents and an email address – [email protected].

FP Markets Review Conclusion

FPmarkets.com is a serious trading destination for retail and institutional actors alike. The spreads are competitive, and for active traders, the various additional fees are not a problem either. Licensed and regulated by ASIC, FP Markets has been around since 2005.

Safest Forex Brokers 2025

-

-

-

-

-

4.8-

-

-

-

-

4.9-

-

-

-

-

5-

-

-

-

-

4.9-

-

-

-

-

4.9-

-

-

-

-

5-

-

-

-

-

5Forex Fraud Certified Brokers

Stay up to date with the latest Forex scam alerts

Sign up to receive our up-to-date broker reviews, new fraud warnings and special offers direct to your inbox

Stay up to date with the latest Forex scam alerts

Stay up to date with the latest Forex scam alerts

Sign up to receive our up-to-date broker reviews, new fraud warnings and special offers direct to your inbox

Stay up to date with the latest Forex scam alerts