Further US Dollar losses into early May, are likely to extend, as we had anticipated and looked at in our previous weekly report on ForexFraud.com here. Despite a modest USD correction attempt, the US currency looks set to continue the weakness seen since mid-April against most of the major G10 currencies. Although the bigger picture bullish view for the US$ is intact, we see potential for further corrective losses into mid-May and potentially for the month.

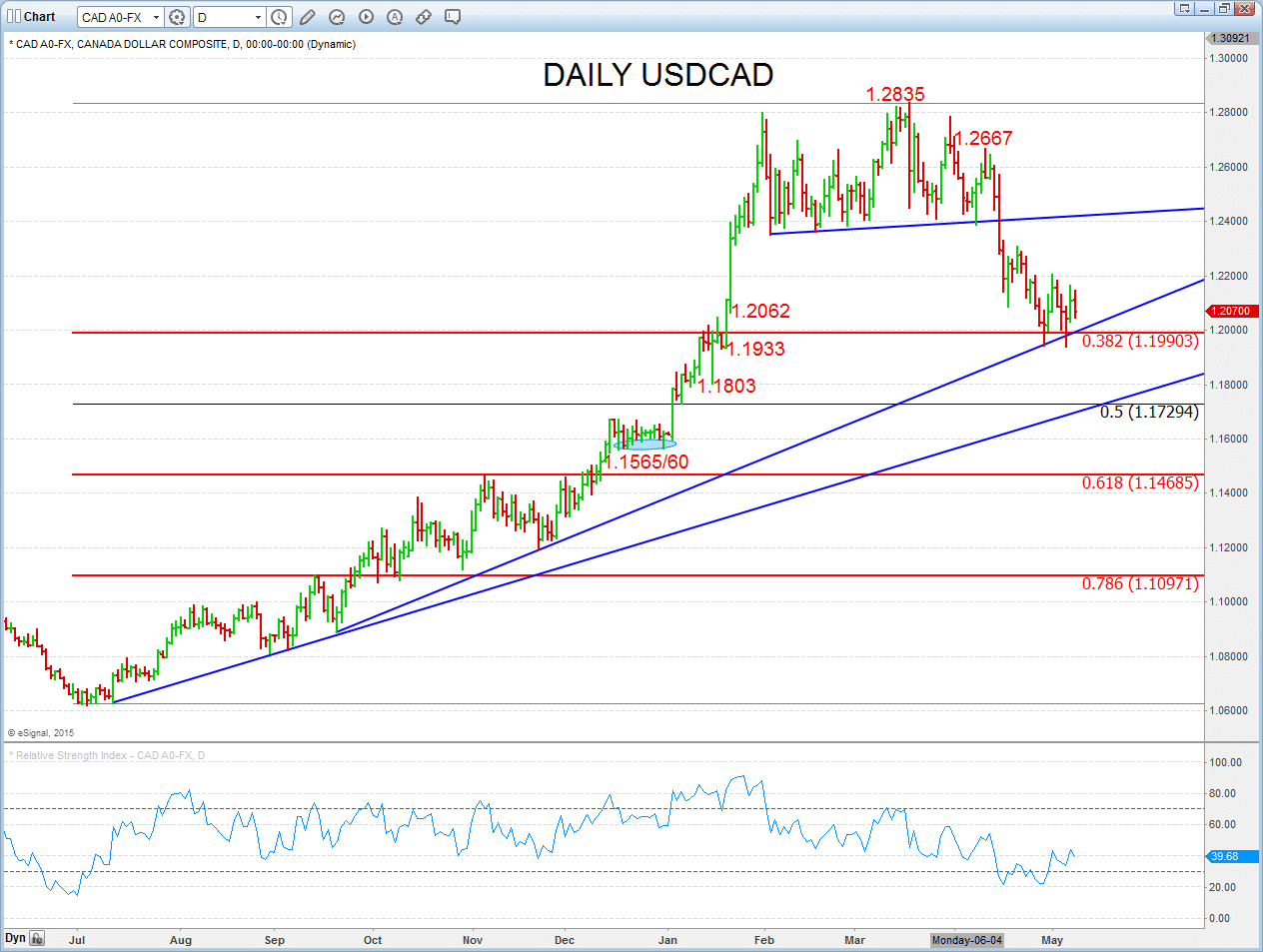

GBPUSD Sets a Still More Bullish Tone

- A significant setback ahead of the UK Election last week, but then a strong rebound from ahead of support at 1.4854.

- The rally back through the 1.5500 recent recovery peak reinforces the intermediate term base and short-term bullish view for mid-May and likely this month.

- We now see May

- upside pressures for 1.5552/69, 1.5620, 1.5786, 1.5826 an maybe for 1.6000

Daily GBPUSD Chart

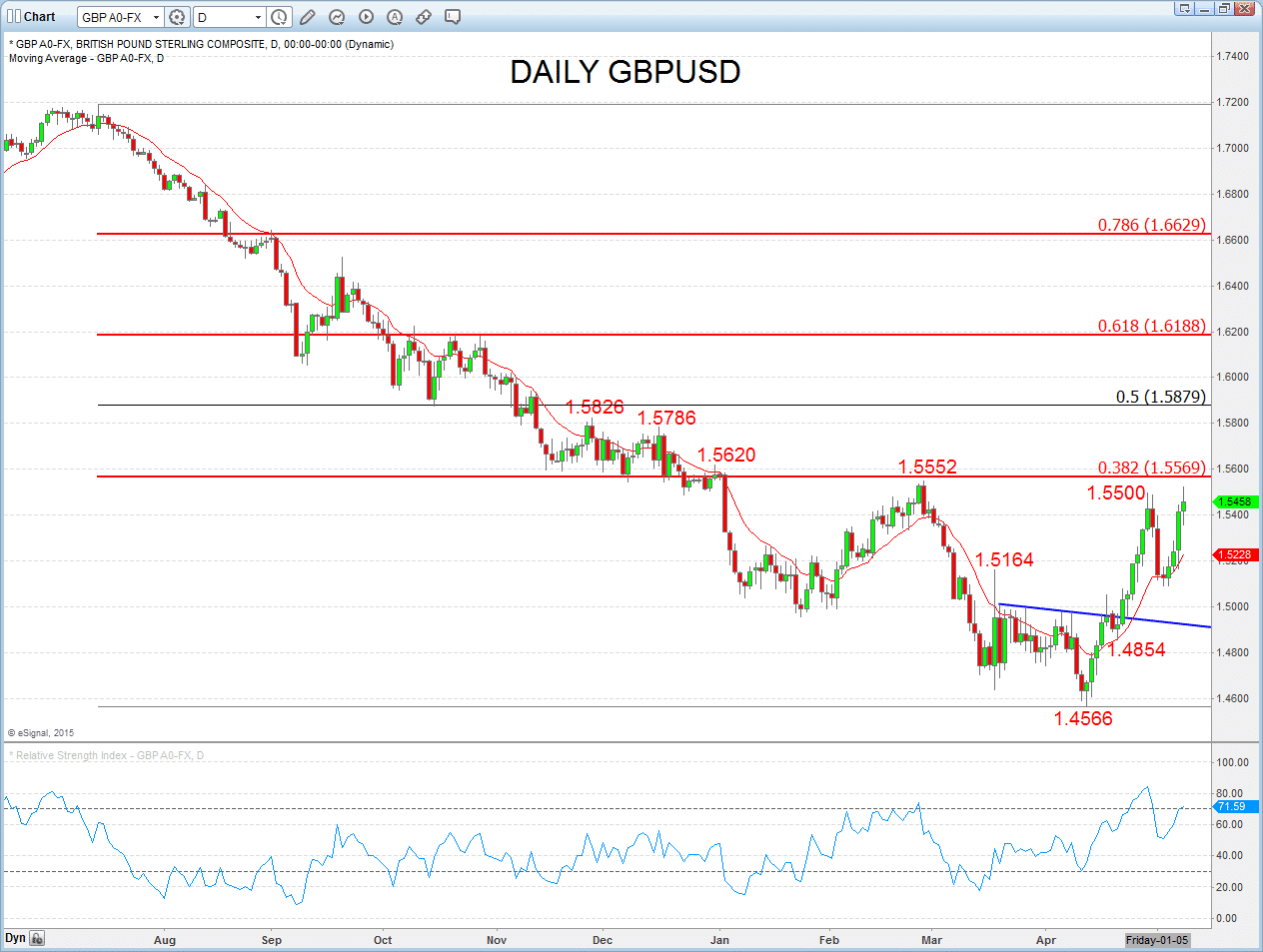

EURUSD Bullish Theme Intact

- A dip and solid rebound from ahead of 1.1000, from 1.1064 to maintain the bullish base and recovery theme.

- The previous basing through 1.1036/53 has been enhanced above 1.1249 and leaves the bias still higher for mid-May and likely for this month.

- We see bias to 1.1380 next, the above here to target 1.1449 and 1.1534.

Daily EURUSD Chart

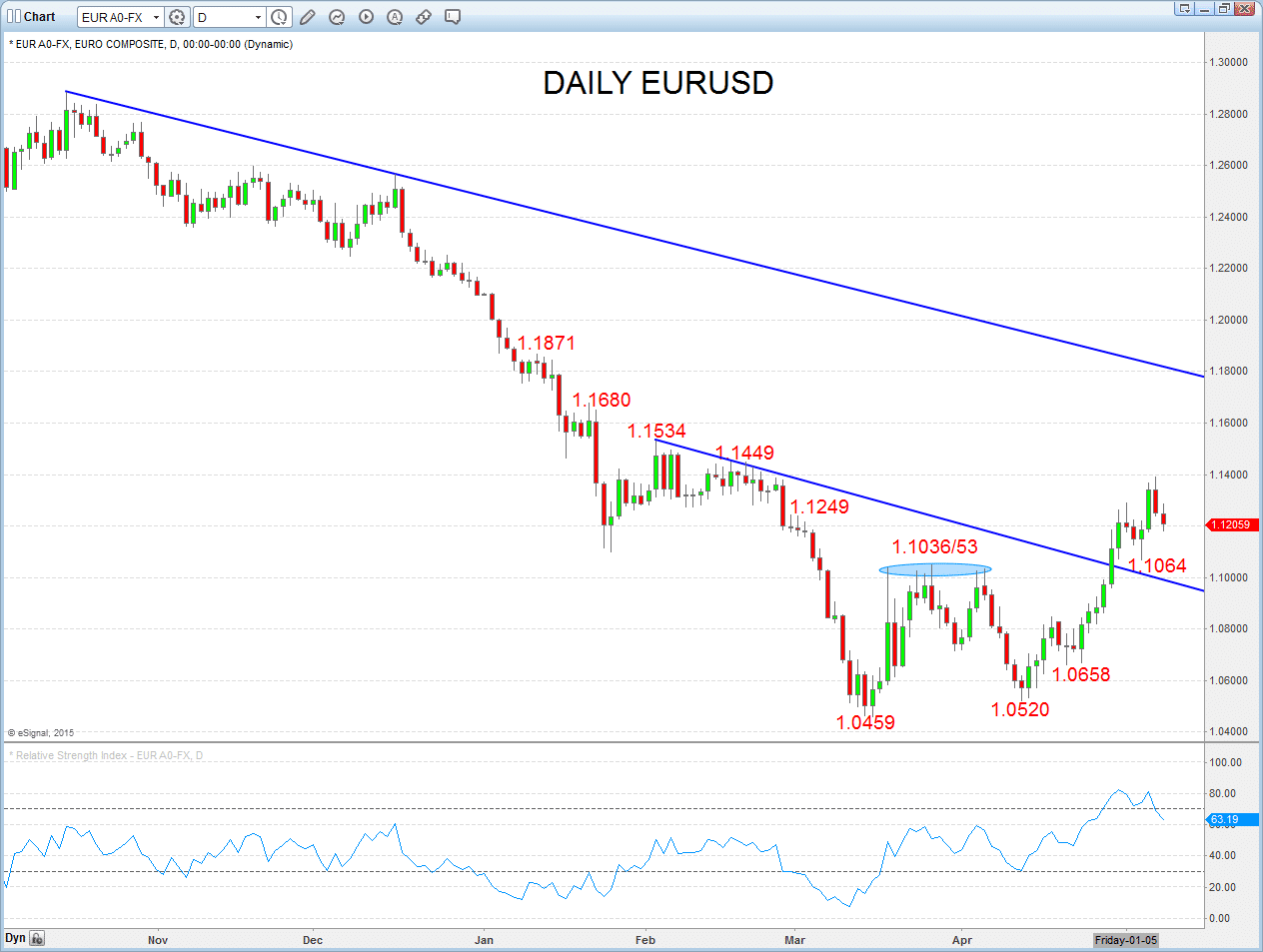

USDCAD Top Leaves Bias Lower for May

- Erratic consolidation for early May, but the previous bear break in April for a multi-month top leaves the bias still lower for mid-May and for the month.

- The recent probe below the trend line from 2014 and the 38.2% retrace of the 2014-15 rally, at 1.1990, aims still lower.

- We see the May bias now for 1.1933, 1.1803 and retrace level at 1.1729.

Daily USDCAD Chart