81% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

It has been nearly a year since we commented on the ongoing saga of Teddy Sagi and his gambling software and services company juggernaut by the name of Playtech Plc. If you recall, Sagi was in the news big time back in 2015, when he went on an acquisition binge to expand his footprint in to the retail forex sector, only to be rebuked by regulators at every turn. Nevertheless, in our last article in September of 2016, we wrote: “Teddy Sagi, our undaunted Israeli billionaire and precocious founder of Playtech, keeps plugging along, having already developed a thick skin long ago.”

Much has transpired behind the scenes over the last eighteen months, while Sagi and his Playtech management team licked their wounds, learned their lessons, regrouped and restructured inefficient operations, improved earnings, and implemented a new industry strategy that “B2C” scavenger hunts in favor of institutional-related partnerships. For Playtech, these machinations have yielded record profits and allowed Teddy to reorder his personal stock portfolio by selling a portion of Playtech shares for nearly half a billion dollars, US.

Businessmen generally focus on internal operations, when the market is less receptive to overt takeover contrivances. Cleaning out the corporate crabgrass and rethinking your overall strategy is a prudent course of action in any venue, but in the highly lucrative gambling space, a few changes here and there can yield enormous results, improving both operating margins and bottom line earnings per share. As a consequence, public stockholders smile broadly, as are the corporate executives pictured below that have benefited from bloated stock option compensation programs:

The broadest smiling fellow in the back row is Mor Weizer, the current CEO of Playtech that has served since 2007. He knows for sure that he is riding high on a profitable moneymaking machine that will not quit anytime soon. Perhaps, if he had disguised his glee at the prospect of receiving an out-of-this-world bonus, then his board might have approved a 1.5 million share, one time only grant, on his behalf at its last meeting in August.

It is rare for boards to balk at such “suggestions”, especially when the firm is performing well and setting new record high stock values, but as reported: “The shareholder vote for the grant was 44% for, and 56% against. The value of the rejected grant, at current share prices, was £14.7 million (USD $19 million).” Perhaps, the grant was a little bit on the extravagant side, a point that Teddy Sagi may have whispered in a few directors’ ears, at least those that wish to follow his direction. Weizer will be compensated at a later date for his successes, such that no tears need be shed on his behalf.

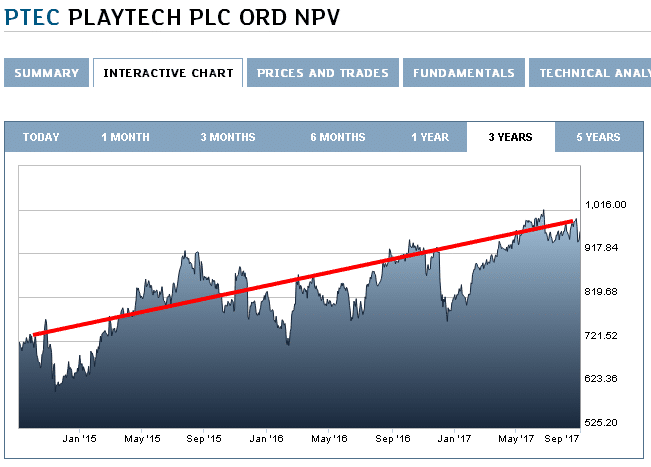

In any event, the market has approved of the so-called travails of Playtech from 2015 onward, even after a few bumps in the road made a few investors pause and take profits. LSE stocks are recorded in Pence, and, if you do the math with the data in the chart depicted below, there has been a 52% appreciation in share value over the last 33 months, not bad by anyone’s standard for return expectations over trying times.

81% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Onward and upward, as the expression goes. There is a definite long-term trend line portrayed here that would make any investor salivate. Even after regulators blocked Sagi’s 2015 buying spree and even after regulators threatened to impose restrictive standards on the industry in December of 2016, Playtech shares rebounded with a flourish on both occasions. Operating results do command attention, but there is more than ample profits driving this train. Let’s take a finer look at what is going on behind the corporate veil.

What has transpired since 2015 to warrant Playtech’s escalating share price?

The financial press became enamored with the exploits in 2015 of Teddy Sagi, who wasted no time bragging about his appetite for merger deals in the retail forex space. Playtech had recently acquired the Market Limited franchise and had reorganized internally to make way for a “Financial Trading” division within the firm. Two highly publicized takeover bids soon hit the airways for Plus500 and AvaTrade, respectively, but regulators in both the UK and Ireland refused to approve either deal.

Sagi’s dreams of an empire may have sustained a temporary setback, but he and his team were undaunted in their desire to expand. Playtech’s treasury was also brimming with nearly $1 billion in cash to feed its merger appetite, but with roadblocks raising their ugly heads in the British Isles, Playtech began to look elsewhere for its targets. It quickly snapped up two gaming related entities in Sweden and Austria for a tidy sum of €308 million, each of which would be separate from the “Financial Trading Division”.

What about the newly created division devoted to financial trading? With two deals that had gone sour, reporters began to smell blood and were going in for the kill. Exaggerated press headlines began surfacing that claimed that “massive cutbacks” and lease cancellations were signaling a failing enterprise, but this trimming process actually involved less than 5% of the staff and represented an innovative step to use newer marketing technology.

The press was off the mark. Operating results soon debunked previously made claims. We had reported the following for 2015: “How lucrative is the gambling business for Playtech, a software provider? Revenues in 2015 were €630.1 million, and Net Income after taxes were €136.3 million, a hefty 21.6% margin on total turnover. The margin before taxes was 33.7%, revealing that one out of every three Euros of revenue was profit. Yes, Playtech is a very profitable venture and lucrative proposition by any measure.”

81% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

How did the first six months of 2016 turn out? Per Alan Jackson, the Chairman of Playtech: “Total revenue increased by 18% to €337.7 million (H1 2015: €286.0 million) and by 24% on a constant currency basis, with underlying growth of 17% (after excluding acquisitions at constant currency).” Playtech’s primary business is transacted in Pounds, but it has elected to report in Euros. The “constant currency” references were necessary to explain shortfalls related to the demise of Pound Sterling leading up to the Brexit referendum in June of 2016.

Fast forward another year, and the first half results for 2017 sound more stellar than the year before, another reason the share price keeps rising northward. Here are a few excerpts from their published report:

- Total revenues up 25% vs H1 2016 on a reported basis

- 30% revenue growth at constant currency

- 10% revenue growth excluding acquisitions and at constant currency

- Adjusted diluted EPS up 21% at constant currency

- Gross cash at period end of €536 million

Cash balances were less than the $1 billion level back in 2015, but the firm has moved forward with several acquisitions, many of which denote a departure from a strategic perspective from purely “B2C” in the Financial Division to a focused “B2B” offering. The rules that regulate dealing with the public can often be constraining, but when you deal with the “institutional” side of the business, these partners are presumed to be more investment savvy. In other words, regulatory compliance concerns are diminished.

How has Playtech modified its corporate strategy going forward?

By the second half of 2016, it was evident that Sagi and Playtech were in the midst of a directional change. The heat was rising in the binary options space. Animosity from regulators was building. We reported: “In late August, press accounts began to surface that Playtech had exited the binary options space by selling for an undisclosed price its TopOption subsidiary to Lead Trade, another Israeli firm licensed to operate in Cyprus and the EU. Lead Trade owns such other binary option brands as PrestigeOption, ExcellenceOption and OptionsClick. Sagi is obviously steering well clear of any more regulatory skirmishes on his turf, at least the ones that he can control.”

Two new acquisitions clearly delineated another departure from retail forex trading, as noted below:

1) Playtech buys CFH Group in November 2016: The terms of this deal have been cloudy, since there are several moving parts, but industry insiders have pegged $120 million as the total buyout. 30% of that figure is tied to options with exercise dates out to 2019. CFH has gained a reputation as a liquidity provider and FX brokerage technology firm and contributed 28% or €12.5 million of the revenue in the Financial Division for H1 of 2017;

2) Playtech buys Alpha Capital Markets in August 2017: Known simply as Alpha or ACM, this firm is a financial broker for institutional and professional clients. The company also acts as an introducing broker for other companies in the retail and institutional financial field. Per accounts in the press: “The total consideration for the agreement is capped at $150 million (€127.6 million), with Playtech to make a series of payments.”

Both acquisitions represent a departure from previous M&A activities, but both units will be housed within the Financial Division of Playtech. To record the shift, the company has chosen to re-brand this division now as the “TradeTech Group”, which will now be able to “to offer a full turnkey solution to B2B clients across the industry.”

81% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Teddy Sagi is smiling broadly, too, after reordering his personal portfolio.

With his ego bruised a bit, Teddy Sagi continues to grin sheepishly in most photo ops. He remains in the Israeli Forbes Top 30 list of billionaires, and in London he is known as an eligible, if not the most eligible, billionaire bachelor in town. If you believe the tabloids, he has recently parted ways with a longtime flame, making the social scene jump to his every command.

Billionaires have a tough life, especially when their wealth is concentrated in a single company’s stock issue. In 2017, Sagi decided it was time to act. He reduced his ownership from 17.8% down to 6.3% by dumping 36.5 million shares at a discount in a private deal to institutional investors. He netted $429 million, but the poor soul may have to pay taxes, unless his gains are exempt. He remains the firm’s largest stockholder, but he can no longer appoint directors. There are ample reasons, however, for his contented smile depicted below:

Concluding Remarks

After regulators blocked Sagi in 2015, we noted: “Do not shed any tears for Teddy Sagi. He will continue to smile broadly. His gambling empire is outrageously profitable and hungry for more. It is only a matter of time before he and his team execute “Plan B”, whatever that might be.” Looks like “Plan B” is off and running!

81% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Related Articles

- Forex vs Crypto: What’s Better For Beginner Traders?

- Three Great Technical Analysis Tools for Forex Trading

- What Does Binance Being Kicked Out of Belgium Mean for Crypto Prices?

- Crypto Traders and Coin Prices Face New Challenge as Binance Gives up its FCA Licence

- Interpol Declares Investment Scams “Serious and Imminent Threat”

- Annual UK Fraud Audit Reveals Scam Hot-Spots

Forex vs Crypto: What’s Better For Beginner Traders?

Three Great Technical Analysis Tools for Forex Trading

Safest Forex Brokers 2025

| Broker | Info | Best In | Customer Satisfaction Score | ||

|---|---|---|---|---|---|

| #1 |

|

Global Forex Broker |

BEST SPREADS

Visit broker

|

||

| #2 |

|

Globally regulated broker |

BEST CUSTOMER SUPPORT

Visit broker

|

||

| #3 |

|

Global CFD Provider |

Best Trading App

Visit broker

|

||

| #4 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #5 |

|

Global CFD & FX Broker (*Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more) |

ALL-INCLUSIVE TRADING PLATFORM

Visit broker

|

||

| #6 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #7 |

|

CFD and Cryptocurrency Broker |

CFD and Cryptocurrency

Visit broker

|

||

|

|

|||||

Forex Fraud Certified Brokers

Stay up to date with the latest Forex scam alerts

Sign up to receive our up-to-date broker reviews, new fraud warnings and special offers direct to your inbox