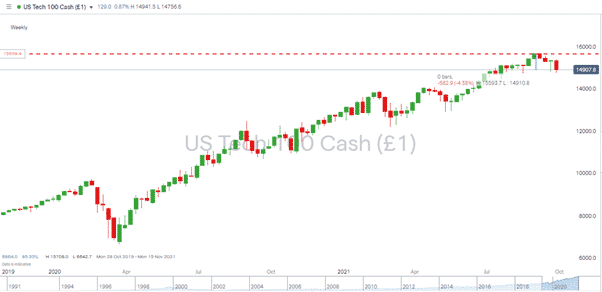

September is turning into a bad month for the markets. With two trading days to go before month-end, the Nasdaq 100 is down 4.38% on the month. That isn’t as surprising as it might at first appear; the September Effect is something analysts are wary of. But the losses incurred are forcing investors to look for an explanation. It’s just important they don’t choose the wrong one.

Nasdaq 100 – Weekly Price Chart

Source: IG

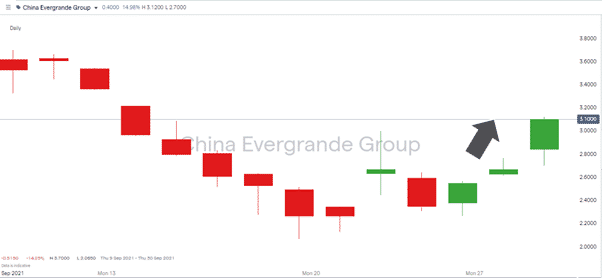

It’s Not About Evergrande

A lot of attention has turned to Evergrande. The Chinese property giant is being touted as 2021’s equivalent of the 2008 subprime mortgage fiasco. It’s easy to pin a market move to a big story, and the firm is obviously in trouble, but technical and fundamental factors point to it not being the driver of the recent price slide in other markets.

China Evergrande Group Daily Price Chart

Source: IG

For starters – During Monday’s 2% sell off in the Nasdaq 100, Evergrande rose in price by 10%. Unless it’s the contrarian indicator of all time, this just doesn’t stack up.

There are also reasons to look past Evergrande as the cause for the sell-off from a fundamental perspective. International involvement in China’s domestic market is limited. For years, global banks have been throwing their hands in the air about Beijing’s reluctance to let them invest in firms such as Evergrande. They’re now thankful for the restrictions being in place, but it does mean investors sifting through the recent carnage need to look elsewhere for the cause of the pile-up.

Inflation Concerns

For two decades, the US Federal Reserve has been the primary driver of markets, and it is the potential for a policy change by the FOMC which is causing concern. Talk of an interest rate hike and the tapering of QE is causing serious market jitters. It’s coming when there is still uncertainty about the state of the recovery from COVID, which is bad enough. But looking at a longer time scale, the weaning of markets off their cheap-cash drip is a task that no Fed Chair has wanted to take, dating back to the days of Alan Greenspan.

Greenspan’s willingness to support asset prices at the expense of supporting speculative behaviour even got its own name – the Greenspan put. That dates back to 1987, and despite the change of Fed Chair, the put has remained the number one policy tool.

Things could get very nasty very quickly if the Fed removes the prop supporting the markets. The near 5% sell-off in the world’s favourite equity index in September is what happens when big players contemplate the idea.

The odds are that the crash doesn’t happen, now at least. Reading what the market is saying is the key. Higher volatility looks set to dominate the markets for a time with trading opportunities to the up and downside.

Crowdsourcing information about scam brokers can help others avoid falling into the traps set by disreputable brokers, and you can share your experiences here. If you want to know more about this particular topic or have been scammed by a fraudulent broker, you can also contact us at [email protected]

Related Articles

- Forex vs Crypto: What’s Better For Beginner Traders?

- Three Great Technical Analysis Tools for Forex Trading

- What Does Binance Being Kicked Out of Belgium Mean for Crypto Prices?

- Crypto Traders and Coin Prices Face New Challenge as Binance Gives up its FCA Licence

- Interpol Declares Investment Scams “Serious and Imminent Threat”

- Annual UK Fraud Audit Reveals Scam Hot-Spots

Forex vs Crypto: What’s Better For Beginner Traders?

Three Great Technical Analysis Tools for Forex Trading

Safest Forex Brokers 2025

| Broker | Info | Best In | Customer Satisfaction Score | ||

|---|---|---|---|---|---|

| #1 |

|

Global Forex Broker |

BEST SPREADS

Visit broker

|

||

| #2 |

|

Globally regulated broker |

BEST CUSTOMER SUPPORT

Visit broker

|

||

| #3 |

|

Global CFD Provider |

Best Trading App

Visit broker

|

||

| #4 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #5 |

|

Global CFD & FX Broker (*Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more) |

ALL-INCLUSIVE TRADING PLATFORM

Visit broker

|

||

| #6 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #7 |

|

CFD and Cryptocurrency Broker |

CFD and Cryptocurrency

Visit broker

|

||

|

|

|||||

Forex Fraud Certified Brokers

Stay up to date with the latest Forex scam alerts

Sign up to receive our up-to-date broker reviews, new fraud warnings and special offers direct to your inbox