Bitcoin, the most popular cryptocurrency across the planet, has surged dramatically during mid-July, reversing its downward trend and powering past $41,000. Many analysts have been surprised by BTC’s latest pricing behaviour, having decreed that the leading crypto was headed for the nether regions, especially after it broke support at $30,000. Now, two weeks later, Bitcoin enthusiasts are rejoicing again at the resilience of their favourite investment vehicle.

Source: eToro

The daily chart above depicts the extraordinary recovery of Bitcoin over the past 10 months, rising at nearly a 45-degree angle, blowing past $20,000, and then setting a new All-Time High (ATH) in the process. While champagne corks were popping around the crypto-verse, however, April brought rain showers. From its peak of $63,730, the rarefied air dissipated, as the King of Cryptos fell precipitously. It gave back more than 50% of its retracement, yet analysts warned that an 80% giveback was the verdict during 2018’s fall.

What is driving the Bitcoin resurgence?

Bitcoin has recently recorded a record 10-day winning streak, as evidenced by the long string of green candlesticks in the chart. It soon bumped into resistance above $42,000 and backed off, presumably to catch its breath while profits were being taken. The last time such a winning streak was put together was way back in 2012. These types of runs are rare, even for Bitcoin, but the biggest surprise has been the absence of selling pressure.

Order-book data is not reflecting many, if any, obstacles in the near term either. A few analysts are already claiming that there is another 10% to 15% of appreciation ahead. What is driving this surge? Fundamentally, inflation is on the rise, even though Chairman Jerome Powell of the US Fed tried to downplay recent increases as purely transitory. Even as risky as a BTC holding might be, it is still viewed favourably as a good hedge against price inflation. Many investors have learned this lesson many times over during Bitcoin’s short history.

As the wise investors read the inflation tealeaves, they began to buy. Entities that track movements in BTC account balances began noting that not only were the large accounts – the so-called ‘Whales’ – piling on Bitcoin, but also smaller accounts – the ‘fish’ – were accumulating the crypto.

According to Nick Chong, one of the authors of the Ecoinometrics newsletter: “After a couple of weeks of data showing that most address buckets are accumulating coins, Bitcoin is finally bouncing back from the $30k level.” Similar reports from other firms such as Whalemap have confirmed that, metaphorically speaking, there are ‘Moby Dicks everywhere’.

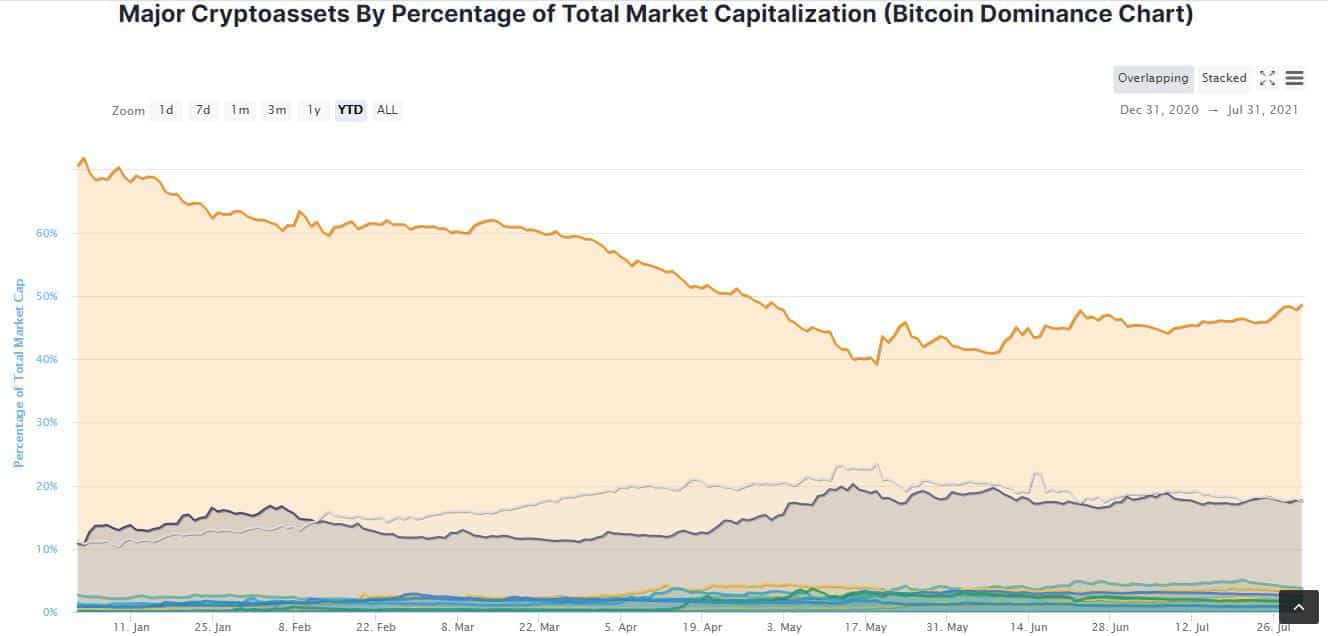

Investors have also been gradually shifting allegiance from alternative coin programs (altcoins) since May. Bitcoin had been on a capital losing battle since the start of the year, as its dominance in total crypto market share fell from 70% down to 40%. BTC dominance now sits at 47.5% with its eye focused on the 50% watermark, as depicted below in a chart from Coinmarketcap.com:

Concluding Remarks

Bitcoin waters are roiling with whales and small fish, but BTC’s current surge may have more room to run. Let caution be your guide.

Sources:

- https://cointelegraph.com/news/bitcoin-records-rare-10-day-winning-streak-as-btc-price-taps-42k-ceiling

- https://cointelegraph.com/news/bitcoin-accumulation-accelerates-among-whales-and-fish-with-btc-rallying-to-40k

- https://www.coinmarketcap.com

Related Articles

- Forex vs Crypto: What’s Better For Beginner Traders?

- Three Great Technical Analysis Tools for Forex Trading

- What Does Binance Being Kicked Out of Belgium Mean for Crypto Prices?

- Crypto Traders and Coin Prices Face New Challenge as Binance Gives up its FCA Licence

- Interpol Declares Investment Scams “Serious and Imminent Threat”

- Annual UK Fraud Audit Reveals Scam Hot-Spots

Forex vs Crypto: What’s Better For Beginner Traders?

Three Great Technical Analysis Tools for Forex Trading

Safest Forex Brokers 2025

| Broker | Info | Best In | Customer Satisfaction Score | ||

|---|---|---|---|---|---|

| #1 |

|

Global Forex Broker |

BEST SPREADS

Visit broker

|

||

| #2 |

|

Globally regulated broker |

BEST CUSTOMER SUPPORT

Visit broker

|

||

| #3 |

|

Global CFD Provider |

Best Trading App

Visit broker

|

||

| #4 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #5 |

|

Global CFD & FX Broker (*Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more) |

ALL-INCLUSIVE TRADING PLATFORM

Visit broker

|

||

| #6 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #7 |

|

CFD and Cryptocurrency Broker |

CFD and Cryptocurrency

Visit broker

|

||

|

|

|||||

Forex Fraud Certified Brokers

Stay up to date with the latest Forex scam alerts

Sign up to receive our up-to-date broker reviews, new fraud warnings and special offers direct to your inbox