Featured Forex Broker

This secure framework acts as a base for some of lowest cost trading in the market with trade execution backed up by some very impressive behind the scenes infrastructure designed to offer the best access to the financial markets. Read the full review of Tickmill

Expert’s Viewpoint

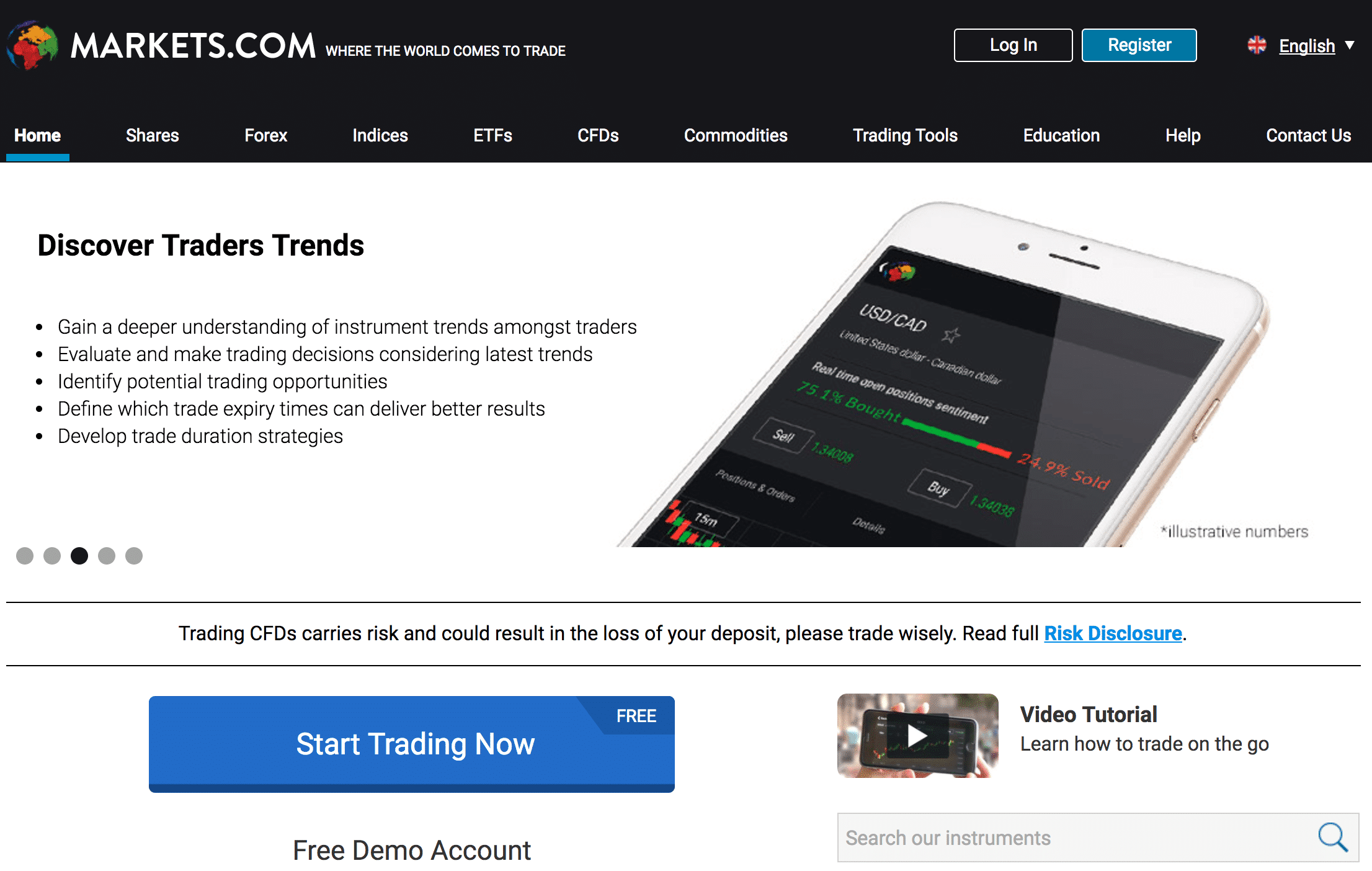

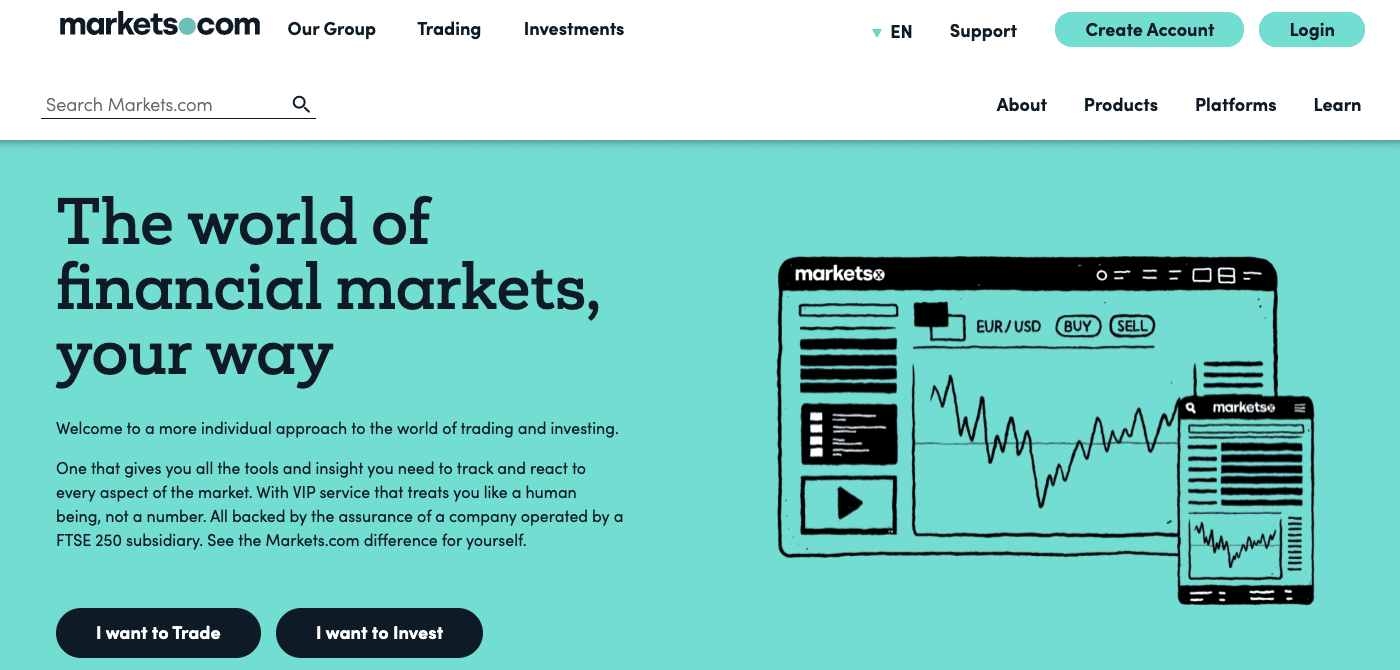

Owned and operated by SafeCap Investments Ltd, Markets.com is a fully regulated investment and trading services. Originally founded in 2008, Markets.com was founded with a vision to offer seamless trading and investment services across a range of financial markets and instrument types.

In terms of customer safety and protection, Markets.com is a fully licensed and regulated trading and investment services firm. They are registered in Cyprus, and fall under the regulatory oversight of CySEC. Additionally, they are also licensed to operate by the FSB in South Africa. As part of this, customer funds will be kept in segregated accounts, away from the working capital of the main business.

When it comes to customer protection Markets.com have put in place a comprehensive series of technological safeguards, which includes physical and technical safety solutions. Importantly, Markets.com have implemented rigorous firewall protection and SSL technology which ensures the safety of user data.

Trading is delivered through a number of different platforms, which includes Marketsx, Marketsi, MT4, MT5, and a mobile trading app. Marketsx is a multi-asset trading platform that offers advanced trading features delivered in an easy to use format. Additionally, users will also get access to expert market analysis and VIP customer service. The Marketsi platform takes a more individual approach to investing, and is geared towards long, medium, and short-term traders. Use the investment strategy builder to map out a personalised trading strategy, which uses industry-leading tech to build a strategy suited to your investment styles and risk profile.

In addition to Marketsx and Marketsi, users of the Markets.com platform will also be given access to both the MetaTrader 4 and MetaTrader 5 platform. Whilst the Marketsi and Marketsx platforms are aimed primarily at new and intermediate traders, the MT4 and MT5 platforms are the best options for more advanced traders given the high levels of customisability they provide users with.

If you run into any issues when using the Markets.com platform, customer support is available through a live chat function on a 24/5 basis. Additionally, direct phone support is provided 24 hours a day between 10pm on Sunday and 9pm on Friday (GMT). In addition, there is also a comprehensive knowledge centre, which includes FAQs and troubleshooting guides that will be able to help you work through most common account issues on your own. Generally speaking, response times were low, and user feedback online seems to be positive for the most part.

With all that said, Markets.com provides a well-rounded, relatively seamless trading experience that offers plenty of value for money features wise. Although aimed at the novice trader market, there is still plenty here that will appeal to intermediate and advanced traders. With a relatively low initial deposit requirement and an easy account set up process, Markets.com is definitely worth trying out to see how it compares with the competition.

Markets.com is operated by Safecap Investments Limited (“Safecap”), a regulated investment services firm authorised by the Cyprus Securities and Exchange Commission (“CySEC”) under license no. 092/08 and by the Financial Services Board (“FSB”) in South Africa as a Financial Services Provider under license no. 43906. The holding company SafeCap Investments was founded in 2006, and assumed its present form and title in 2009, with regulatory approval for forex operations being granted in 2008.

As of August 1st 2018 Leverage changes for EU traders:

- 1:30 for major currency pairs

- 1:20 for non-major currency pairs, gold and major indices

- 1:10 for commodities other than gold and non-major equity indices

- 1:5 for shares and other reference values not specifically covered elsewhere

- 1:2 for cryptocurrencies

Account Types

Markets.com offers a minimum initial deposit requirement of $100.

Default leverage of 1:50. TCs apply. is available to clients of Markets.com. There are also various additional options for corporate clients. Please note that increasing leverage also increases risk.

Trading Software

Clients of Markets.com can now trade on their proprietary Markets.com platform.

Deposits and Withdrawals

Markets.com is highly flexible with respect to account deposits. The firm accepts credit or debit card transfers via Visa, MasterCard and Diners’ Club, along with wire transfers for both deposits and withdrawals, and is also open to various local transfer options, upon discussion between the client and the firm.

The broker charges no fees during the deposit/withdrawal process and commits to reimbursing the client for any charges incurred to the financial intermediary (i.e. the bank) in deposits that exceed the $2,500.

The withdrawal process is initiated following the submission of a withdrawal request form by the client. Withdrawals are processed within 3 days for all methods.

Customer Support

In line with the general trends in retail forex brokerage, Markets.com offers an excellent support service with employees responding to calls 24 hours a day 5 days a week in multiple languages. With various email addresses to different departments and a live chat makes contacting Markets.com relatively simple in comparison to the market standard.

Safety

Markets.com rises above the industry standard in ensuring the safety of client account details. In addition to various advanced physical and technical safeguards, the broker implements rigorous firewalls, and the SSL (secure socket layer) technology to ensure the safety of information transmission.

Markets.com is operated by Safecap Investments Limited (“Safecap”), a regulated investment services firm authorized by the Cyprus Securities and Exchange Commission (“CySEC”) under license no. 092/08 and by the Financial Services Board (“FSB”) in South Africa as a Financial Services Provider under license no. 43906. The firm submits regular reports to this institution in order to establish its compliance with various regulatory rules and the state of its finances.

Conclusion

On the whole, Markets.com leaves an impression of being a solid, reliable broker with no outstanding features beyond competence in what it does. The website of the broker is also highly informational as well as educational; if you’re interested in the firm, we recommend that you examine it for yourself.

The firm is beginner friendly and offers a low initial deposit at $100 which is very reasonable in comparison to other brokers of today.

On the safety front, the firm stands out as a broker regulated by two separate and credible EU authorities.

In sum, Markets.com is a good option for any type of trader, whether beginner or seasoned due to its solid concept, excellent customer service, regulation and general image of competence.

Read all the forex broker reviews

Please be advised that certain products and/or multiplier levels may not be available for traders from EEA countries due to legal restrictions.

Safest Forex Brokers 2025

-

-

-

-

-

4.8-

-

-

-

-

4.9-

-

-

-

-

5-

-

-

-

-

4.9-

-

-

-

-

4.9-

-

-

-

-

5-

-

-

-

-

5Forex Fraud Certified Brokers

Stay up to date with the latest Forex scam alerts

Sign up to receive our up-to-date broker reviews, new fraud warnings and special offers direct to your inbox

Stay up to date with the latest Forex scam alerts

Stay up to date with the latest Forex scam alerts

Sign up to receive our up-to-date broker reviews, new fraud warnings and special offers direct to your inbox

Stay up to date with the latest Forex scam alerts