Rating Overview

| Overall rating | ⭐⭐⭐⭐ |

| Regulation | ⭐⭐⭐⭐⭐ |

| Fees | ⭐⭐⭐⭐ |

| Range of Markets | ⭐⭐⭐⭐⭐ |

| Platforms | ⭐⭐⭐⭐ |

Expert Summary

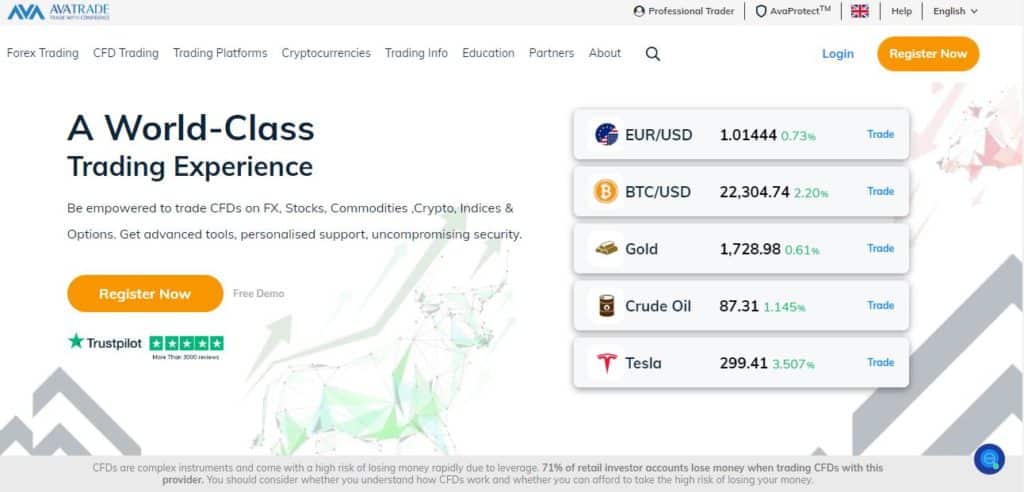

AvaTrade is a well-regulated broker with a global client base. Its international outlook is also reflected in the markets it offers. With AvaTrade there is something for everyone.

Headquartered in Dublin, the firm has nine regional offices spread across the world’s time zones. Other reassuring factors are that the firm has been trading since 2006 and currently supports more than 200,000 clients. Monthly trading volumes can be as high as $60bn.

The Central Bank of Ireland regulates AVA Trade EU Ltd, while the other subsidiaries trade under licenses from regulators in Australia, Japan, South Africa, and Abu Dhabi. Operational safety is also considered, and the innovative AvaProtect is a ground-breaking risk management product.

Instruments supported include forex, forex-options, stocks, commodities, indices, cryptocurrencies, bonds, and ETF’s. Leverage terms can extend to 1:400 and the total number of markets available is 250.

The broker’s efforts to meet all needs extends to it offering an extensive choice of top-class trading platforms. MetaTrader’s industry favourites, MT4 and MT5 are included. The broker’s proprietary dashboards DupliTrade and AvaTradeGO are useful additions while DupliTrade and ZuluTrade offer copy and social trading to complete the package. Trading infrastructure functionality includes various APIs.

AvaTrade is one of the most credible brokers in the industry. The firm is the subsidiary of a holding company with about $17 billion in market cap. It offers clients a variety of ways to transfer funds into their accounts and the 24/5 customer support service is professional and multilingual.

In terms of educational material, the broker provides several resources for both beginner and professional traders, including eBooks, trading videos, professional trading strategies and blogs.

**AvaTrade does NOT accept Clients from the USA**

Unique Features of Trading with AvaTrade

One strength of AvaTrade is the free use of forex trading APIs which support advanced automated strategies. These have a list-price running into hundreds of dollars but are provided free of charge to AvaTrade clients.

The AvaProtect risk management tool allows clients to protect a specific trade against losses of up to $1m over a chosen time frame.

Free Demo Account

No Deposit Required

Compare Ava Capital Markets Ltd with other approved brokers

|  |  |  | |

| Regulation | ASIC, MiFID, FSA, FSCA | FCA (FRN 509909), ASIC, FMA, and FSCA | FCA, CySEC, ASIC, Seychelles FSAS, | FCA, CySEC, DFSA, BaFIN, SCB, CMA & ASIC |

| Customer Support | email, phone, live chat | email, whatsapp, live chat | email, phone, live chat | |

| Trading Platforms | MT4, MT5, Mobile App | desktop and mobile via brokers own platform | desktop and mobile via brokers own platform | MT4, MT5, cTrader, TradingView |

| Minimum Deposit | $100 | 100GBP/AUD/EUR/USD | $50 (varying by Country) | $200 |

| Leverage | 400:1 | 1:30 | From 1:2 to 1:30 | 1:30 |

| Total Markets | 1260 | 2800+ | 2368 | 1200 |

| Total Currency Pairs | 55 | 65 CFD Forex pairs | 49 | 62 |

| Total Cryptocurrencies | 17 | 19 | 37 | 18 |

AvaTrade Platform Software

AvaTrader is a powerful, user-friendly platform that allows for single-click trading on all assets from a single screen. All the available platforms are fully customisable and come with their own blend of additional trade support tools.

MetaTrader 4 is the most popular retail trading platform in the world. It is robust, packed full of powerful software indicators, and has razor-sharp charting tools. It accommodates traders of all levels of experience and has a special place in the trading community as the go-to platform for automated trading.

Auto trading platforms, such as Mirror Trader and Zulutrade, are the leading auto trading interfaces in the industry. The auto-trading software allows you to duplicate the trades of skilled online traders, at any time, even while away from your computer.

AvaTrade Deposits and Withdrawals

The minimum deposit at AvaTrade is $100. Payments by credit and bank cards are processed almost immediately. The broker also accepts payments via wire transfers, PayPal, Neteller, Moneybookers, and WebMoney. With the Ava Debit Card feature of AvaTrade, clients can withdraw funds with no paperwork delaying the process; otherwise, it can take up to five days for the money to be transferred.

Beginner Trader Support

AvaTrade makes the explicit claim that the firm aims to create a user-centred forex trading experience for its clients.

AvaTrade’s journey towards meeting this aim starts with providing extensive support to new traders. The intuitive, simple interface, coupled with expert support staff available 24-hours a day, five days a week, in over 12 languages ensures that the questions posed by newcomers are answered swiftly. During our testing, issues raised with the support team were resolved in an acceptably short time.

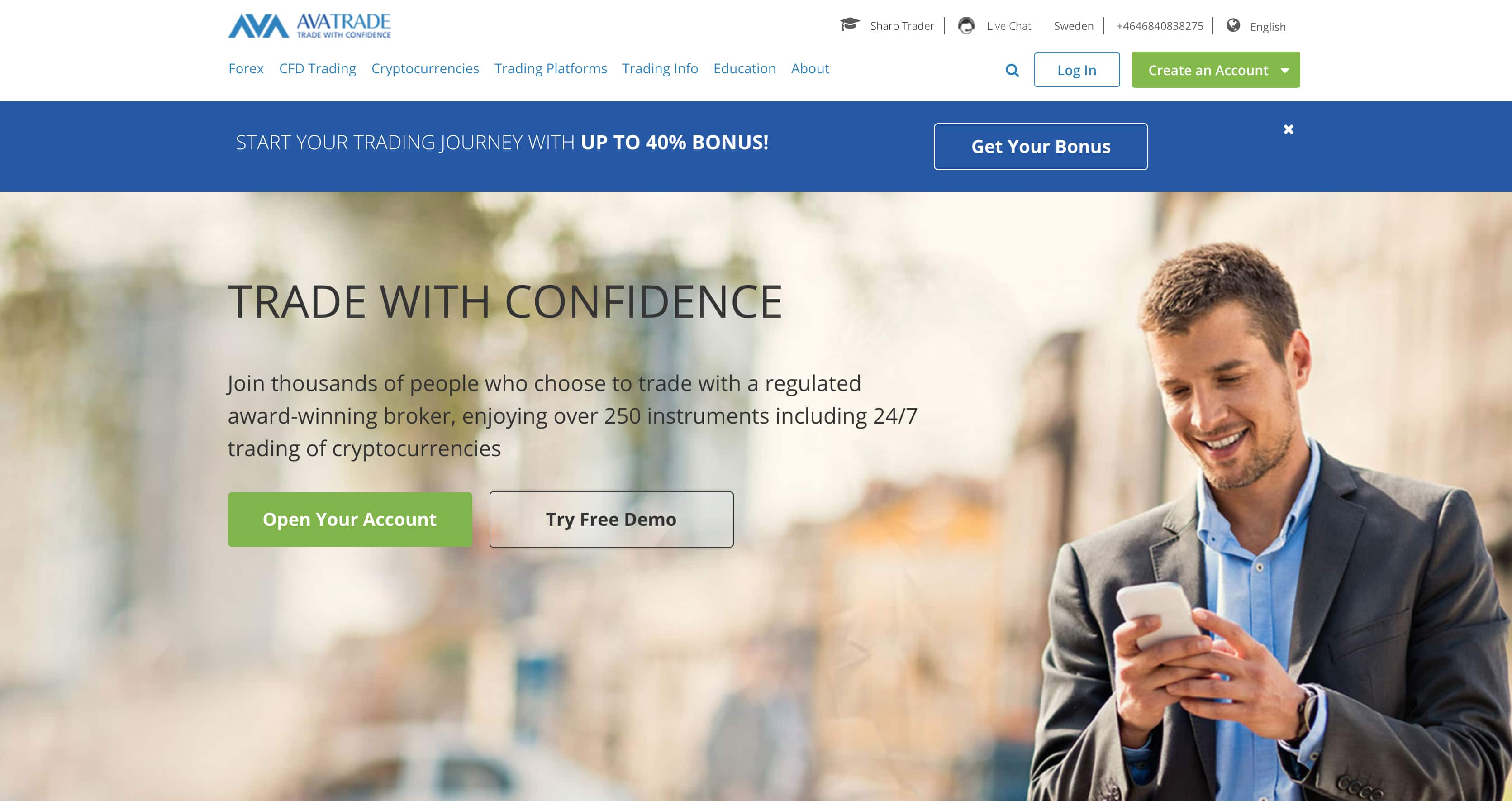

40% Sign Up Bonus

Limited Time OnlyIs AvaTrade Safe to Use?

As a broker registered in Ireland, AvaTrade is subject to extensive and stringent EU regulations over its financial activities. Its parent company also has a $17bn market capitalisation.

Apart from subscribing to the highest industry standards in basic data encryption and server security, the firm employs a core cadre of IT experts to remain up-to-date with developments in information technology. That is to ensure that advanced security enhancements available to the market are applied as soon as possible to the broker’s system and trading software.

Other Services:

The Sharp Trader Education centre is a one-stop portal that caters to both the beginner and the professional trader. There you can find an assortment of tools and learning materials to suit your trading needs. They include:

- Analysis and Signals

- Market Reviews

- Free FX Signals

- Technical Analysis

- Economic Calendar

Introductory and free live webinars are available for those who are new to Forex trading. The webinars include guided tutorials with real-time market updates.

AvaOptions is for serious traders that seek to trade on Real FX Options. The platform offers OTC Vanilla options, with spot trading and options from one interface on over 30 currency pairs.

AvaTrade also provides Mobile Trading that is compatible with Android and iOS.

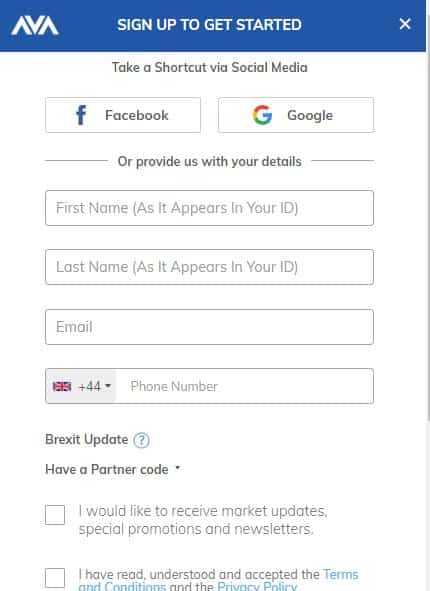

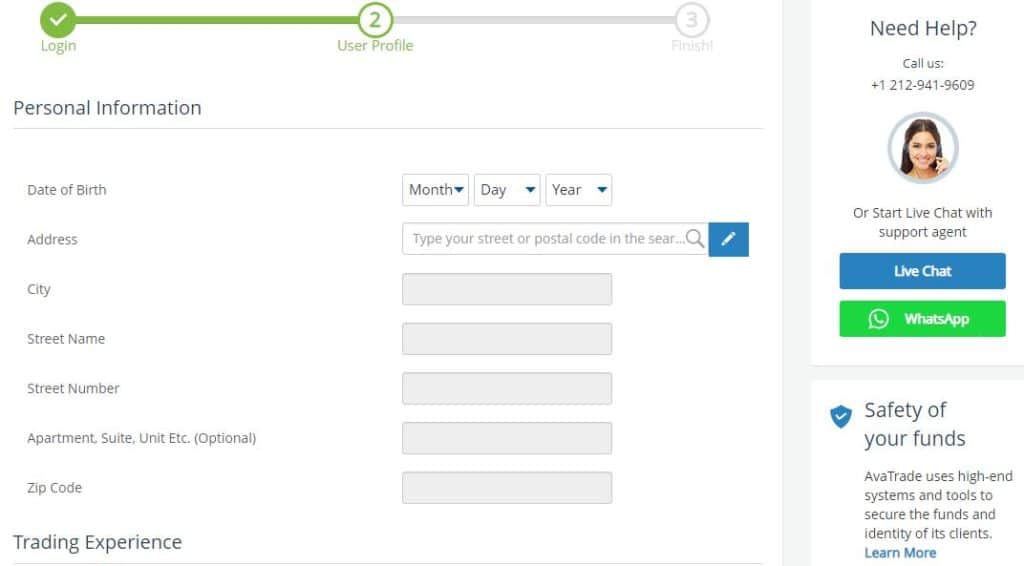

Opening an Account

The process of setting up a new account with AvaTrade is relatively straightforward. New clients start by completing a questionnaire which covers topics such as trading experience and offers important reminders about the risks involved with trading the markets.

This type of questionnaire is standard for a broker regulated by a Tier-1 financial authority and reflects the firm’s commitment to comply with KYC (Know Your Client) obligations. There are also questions designed to allow the broker to establish any new user’s financial health so that the broker can set up a trading profile which considers the firm’s duty of care to its clients.

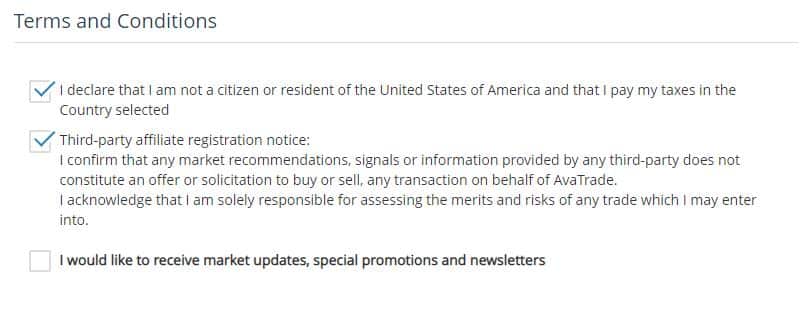

There are also some risk disclaimers to read and accept, such as one that ensures US citizens do not accidentally set up an account with a broker not currently accepting clients from that country.

One crucial choice for new clients is which of the four AvaTrade platforms to set up as their default trading dashboard. The well-regarded MetaTrader and AvaOptions platforms are both available.

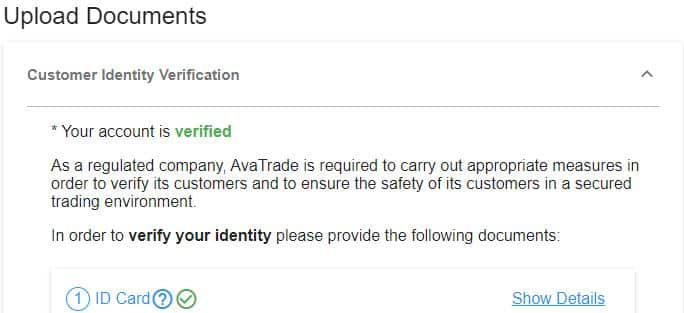

After completing the form-filling new clients are required to verify their details by uploading two pieces of documentation, such as a copy of a driver’s licence and a utility bill. During this stage of the testing process, we received an unprompted call from someone on the AvaTrade customer support team who helpfully offered to help work through the different steps and who could also verbally confirm that the account was verified.

The call with the AvaTrade member of staff developed into an informative Q&A session on what the platform offers traders and how to access educational materials. The onboarding process took less than one hour, mainly due to the opportunity to discuss how to get the most out of the platform with the AvaTrade contact. A new client with all their forms already in place could be expected to complete the account opening process in less than 30 minutes.

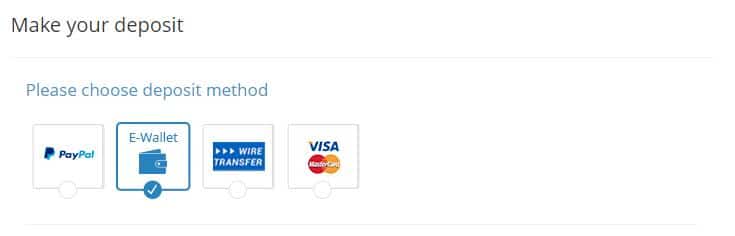

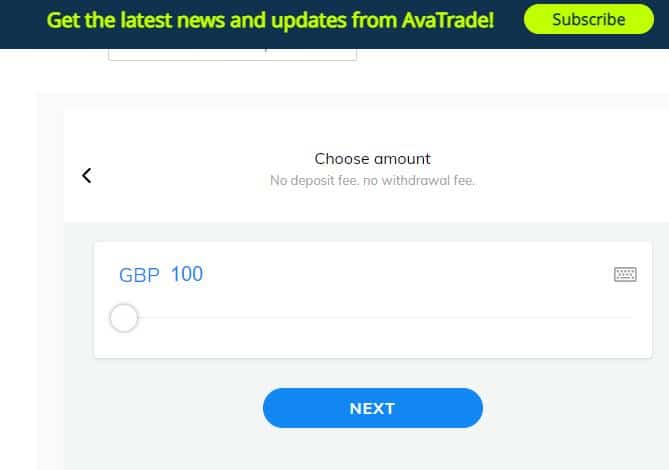

Making a Deposit

Making a deposit requires little more than clicking on the ‘Fund Your Account’ button and selecting what payment agent you want to use.

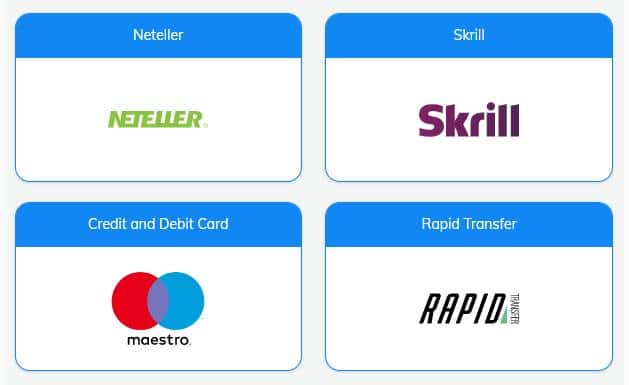

Debit and credit card payments result in funds being credited immediately. Bank transfers take longer to process, and those looking to use e-wallets can choose from using Neteller, Skrill, Rapid Transfer and PayPal.

The minimum deposit for wire transfers is $500, €500, £500 or ¥50,000, but for most of the other forms of payment, the minimum balance requirement is $100, €100, £100 or ¥10,000. One nice-to-have feature of the AvaTrade platform is that the different payment methods have a pop-up message giving notice on whether transaction fees will be applied to deposits and withdrawals.

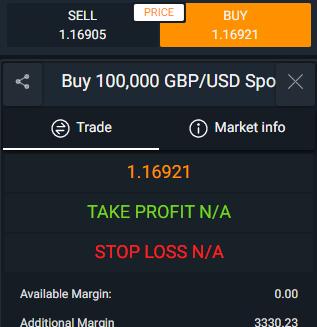

Placing a Trade

Moving onto the actual trading dashboard did require backtracking through the ‘My Account’ section, where it was possible to click on the AvaOptions trading platform icon and enter login details.

The intuitive functionality of the trading dashboard made navigating the chosen market easy (GBPUSD). All of the technical indicators required to analyse the market were close at hand but didn’t distract from the trading experience, and the trading interface on the right-hand side of the screen was well thought out.

The different fields relating to stop-loss, and take-profit orders, could be selected and adjusted easily. One novel feature of the trading GUI is that position size is set using a sliding bar by default, which would be helpful for those trading using a mobile app. There is also an option to revert to using the keyboard to input the trade nominal, which might be the natural preference for traders using desktop devices.

Contacting Customer Support

The initial call made by the AvaTrade support team in Dublin helped with onboarding and suggested the customer services team were professional, client focussed and knowledgeable.

To ensure our review covered all aspects of the AvaTrade service, our testers initiated their own queries with the support desk. They raised three questions intended to be beginner, intermediate and advanced level in nature.

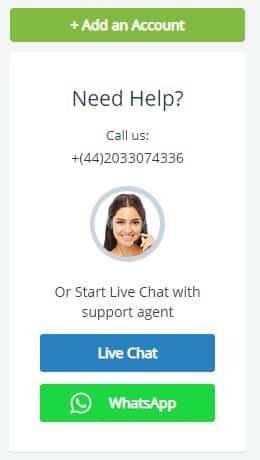

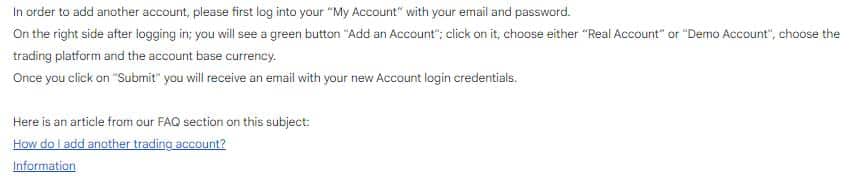

During the enquiry made by phone to 0203 3074336, it took less than three minutes to work through security checks and establish how to set up additional accounts which used the MetaTrader platforms and, indeed, additional AvaOptions accounts as well. That’s an impressive enough response time, but the representative followed up by suggesting they would send an email with the relevant instructions, which could be kept as a record. That hit our inbox within 30 seconds.

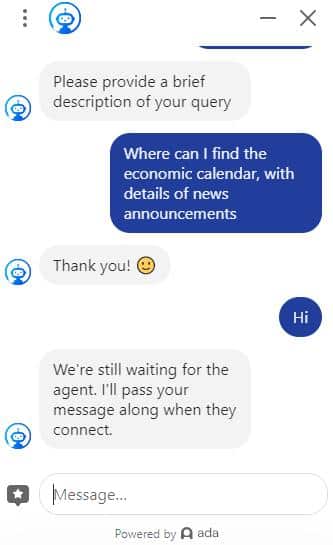

We also tested the LiveChat function and sending our own email questions. The LiveChat experience first involves a Chatbot which offers a range of FAQ-style responses, but we did get through to a human member of the team after passing a security check. During our testing, the response times on the LiveChat service were longer than those of queries placed by phone. It took more than 10 minutes to be put through to a representative who could explain how to access the AvaTrade economic calendar to keep up to date with upcoming news events. During testing, we also experienced moments when the connection to the LiveChat broke down, though reconnecting was easy to do, and there was no need to start the query from the beginning.

Asking a question by email allowed us to make a more detailed request, but there wasn’t an ‘email us’ button on the trading platform, so we had to go back to the AvaTrade home page to enter the details of our request.

The response to our request for more information on options trading strategies came back within less than two hours. We had asked for clarification on whether options traded at AvaTrade are American rather than European in format so that they can be exercised any time before expiry date. The support team came back with an answer that met our needs and gave links to additional research materials.

The AvaTrade customer support staff did an excellent job of dealing with our queries; however, the LiveChat response time was disappointing. A positive feature was that the staff avoided the common trap of turning the call into a hard sell and even suggested beginner traders start trading using small amounts of capital which is sensible advice.

AvaTrade Review Conclusion

AvaTrade is an award-winning broker. It’s well regulated, financially strong and has a substantial number of clients across the world. It offers a range of trading platforms that cover all types of trading strategies.

The broad appeal and undoubted credibility of AvaTrade is also a disadvantage. There is a sense that AvaTrade doesn’t quite have enough of a specialist niche. The fact that the number of tradeable markets is limited to 250 won’t be a problem for many but will be a concern for some.

There is a hint that the broker is addressing the need for it to move out of being too ‘middle of the road’. An obvious example of a new-found appetite for development is the innovative AvaProtect product. It will attract the attention of many looking to enhance their risk management and it adds a bit of colour to the otherwise solid offering.

5 Star Trusted Broker

Forexfraud CertifiedEurope* CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 79% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Please be advised that certain products and/or multiplier levels may not be available for traders from EEA countries due to legal restrictions.

Safest Forex Brokers 2025

-

-

-

-

-

4.8-

-

-

-

-

4.9-

-

-

-

-

5-

-

-

-

-

4.9-

-

-

-

-

4.9-

-

-

-

-

5-

-

-

-

-

5Forex Fraud Certified Brokers

Stay up to date with the latest Forex scam alerts

Sign up to receive our up-to-date broker reviews, new fraud warnings and special offers direct to your inbox

Stay up to date with the latest Forex scam alerts

Stay up to date with the latest Forex scam alerts

Sign up to receive our up-to-date broker reviews, new fraud warnings and special offers direct to your inbox

Stay up to date with the latest Forex scam alerts