Forex trading robots have a well established place as one of the most popular software product types designed for the personal forex market. Many of these robots are priced under $150, and they often run as so-called Expert Advisors within popular forex trading platforms like MetaTrader4. See an example of an Expert Advisor trading robot. Unfortunately, many people who purchase these products subsequently express strong disappointment that the automated forex trading software they bought just does not perform as they were led to believe it would by its vendor. Such feelings have even led some disgruntled people to cry fraud when it comes to these increasingly popular automated forex trading programs. Read about Trade Chimp, another popular example.

How Vendors Sell Their Forex Trading Robots

At a minimum, the vendors of many of these automated trading products can certainly be said to be painting their packages in the most positive light possible by hyping up the profitability of their products.

They often show tantalizing pictures of stacks of money and present glowing testimonials from happy trading robot users apparently well on their way to financial freedom. They also usually make amazing claims about the software’s historical trading profits while also emphasizing its incredible ease of use.

Nevertheless, the forex trading robot vendors will usually just display back-tested trading results on their websites that were performed over a certain selected period during which the trading robot experienced a winning streak of profitable trades.

Given their often considerably poorer subsequent performance, many formerly-hopeful trading robot purchasers get left wondering whether the robots were actually written or had their adjustable parameters optimized to profit from just this particular segment of historical forex rate data.

Forex Trading Robot Vendors Play the Disclaimer Game

Forex trading robot vendors also tend to hide behind a standard sort of disclaimer that might read something like this:

“Our results are not indicative of future performance or success. We are not implying that these results can be generally expected or achieved by anyone. There is a substantial risk of loss associated with trading Forex. Past performances do not necessarily indicate future results!”- From FAP Turbo’s Disclaimer

Or this:

“All results shown on this website are hypothetical, back-tested results. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. In fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. Hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk in actual trading.” – From Forex MegaDroid’s Disclaimer

Furthermore, one forex trading robot vendor’s website even goes on to say this:

All information on this website is for educational purposes only and is not intended to provide financial advice. Any statements about profits or income, expressed or implied, does not represent a guarantee. Your actual trading may result in losses as no trading system is guaranteed. You accept full responsibilities for your actions, trades, profit or loss, and agree to hold the Forex Megadroid team and any authorized distributors of this information harmless in any and all ways.” – From Forex MegaDroid’s Disclaimer. Read more about Forex MegaDroid here.

The basic idea here seems to be that as long as a forex trading robot vendor puts a disclaimer at the bottom of their web page, or in some other out of the way place like a hypertext or image link, then they seem to think that this act will absolve them from any forex fraud liability if their over-hyped automated trading product ends up being a major loser for those who buy it.

Many forex trading robot websites also duly quote the Commodities Futures Trading Commission or CFTC Commission Rule 4.41(b)(1)(I) which states that:

“Hypothetical or simulated performance results have certain inherent limitations. Unlike an actual performance record, simulated results do not represent actual trading. Also, since the trades have not actually been executed, the results may have under-or-over compensated for the impact, if any, of certain market factors, such as lack of liquidity. Simulated trading programs in general are also subject to the fact that they are designed with the benefit of hindsight. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown.”

This CFTC rule pretty much sums up the almost worthless nature of back-tested trading results when it comes to assessing the potential value of a forex trading robot’s future performance.

Just Give Unhappy Robot Customers a Refund to Shut Them Up

To avoid any hassles with disappointed and possibly irate customers who may have lost money trading with their product, the robots’ vendors generally just provide refunds as the simplest way of covering up how misleading their hyped-up advertizing can be.

This practice also helps prevent such unhappy customers from panning the vendor’s “cash cow” forex trading robot software in online discussion forums dedicated to the subject.

If the trading robot was originally purchased via Clickbank, this tends to be a relatively good thing since many of the problems associated with getting a refund from individual online vendors can then usually be avoided.

In general, Clickbank will return all funds to a trading robot purchaser who legitimately requests one within 60 days or eight weeks of having bought their product via Clickbank.

Accordingly, while it is not recommended for readers to purchase a forex trading robot, if you still want to go ahead and do so, then make sure you make any robot purchases via Clickbank. Also, be certain to test the product thoroughly within its risk-free trial period.

This will help you avoid problems in obtaining a refund of your money if you end up being disappointed with its trading results, just like so many other forex trading robot dupes have been before you.

Steer Clear of Forex Trading Robots

Basically, if forex automatic trading robots costing under a couple hundred dollars really worked as well as their vendors’ often claim, then ask yourself why would major banks still pay their human forex dealers hundreds of thousands of dollars a year to trade forex?

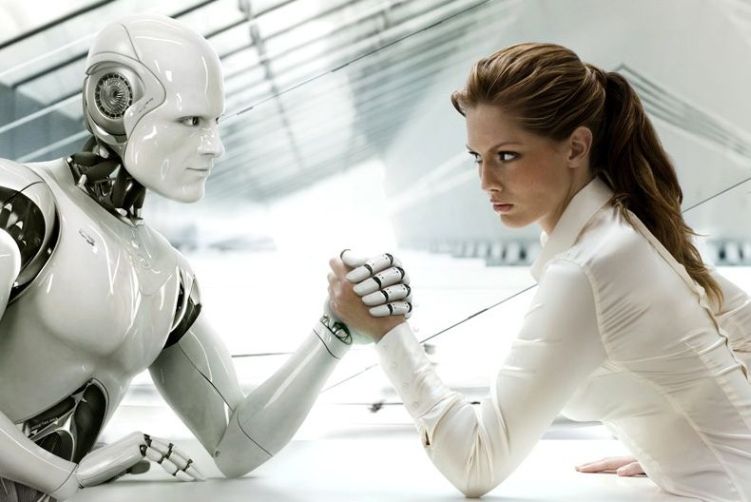

The fact remains that the vast majority of these automated forex trading software products usually do not deliver as their vendors’ misleadingly seem to promise, and disciplined human forex traders often significantly outperform such robots in terms of profitability.

Furthermore, the purchasers of such software often join the ranks of the many would-be forex traders who continue to fall into such potential forex fraud traps as they naively seek the easy money and financial freedom that these forex robot products do not actually provide.

Accordingly, if you wish to avoid being scammed by forex robot vendors and their outlandish profit claims, just say “No” to forex robots and instead take the time to learn to trade forex well yourself.

Learn about TrueFX, a signal generator service which is most possibly a scam.

And here is another one, Forex Automoney.

Read more about trading software scams on this page.

Learn more about what to look out for to avoid scams.

Related Articles

- Forex vs Crypto: What’s Better For Beginner Traders?

- Three Great Technical Analysis Tools for Forex Trading

- What Does Binance Being Kicked Out of Belgium Mean for Crypto Prices?

- Crypto Traders and Coin Prices Face New Challenge as Binance Gives up its FCA Licence

- Interpol Declares Investment Scams “Serious and Imminent Threat”

- Annual UK Fraud Audit Reveals Scam Hot-Spots

Forex vs Crypto: What’s Better For Beginner Traders?

Three Great Technical Analysis Tools for Forex Trading

Safest Forex Brokers 2025

| Broker | Info | Best In | Customer Satisfaction Score | ||

|---|---|---|---|---|---|

| #1 |

|

Global Forex Broker |

BEST SPREADS

Visit broker

|

||

| #2 |

|

Globally regulated broker |

BEST CUSTOMER SUPPORT

Visit broker

|

||

| #3 |

|

Global CFD Provider |

Best Trading App

Visit broker

|

||

| #4 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #5 |

|

Global CFD & FX Broker (*Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more) |

ALL-INCLUSIVE TRADING PLATFORM

Visit broker

|

||

| #6 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #7 |

|

CFD and Cryptocurrency Broker |

CFD and Cryptocurrency

Visit broker

|

||

|

|

|||||

Forex Fraud Certified Brokers

Stay up to date with the latest Forex scam alerts

Sign up to receive our up-to-date broker reviews, new fraud warnings and special offers direct to your inbox